Knee-Jerk Election Patterns

As investors sort through the large moves made across markets and sectors following the election, the knee-jerk reaction among traders was that there would be clear winners and losers based on a change in administration, and some of the moves were extreme.

Knee-jerk reactions are often misleading and once the dust settles, we see more rational and considered trading take place. Often, that means a complete reversal of the initial move.

Let's go back to 1928 and look at the presidential election day-after reactions across markets and sectors. We'll then look at returns going forward, and see if there is any correlation between the knee-jerk cowboys and longer-term investors.

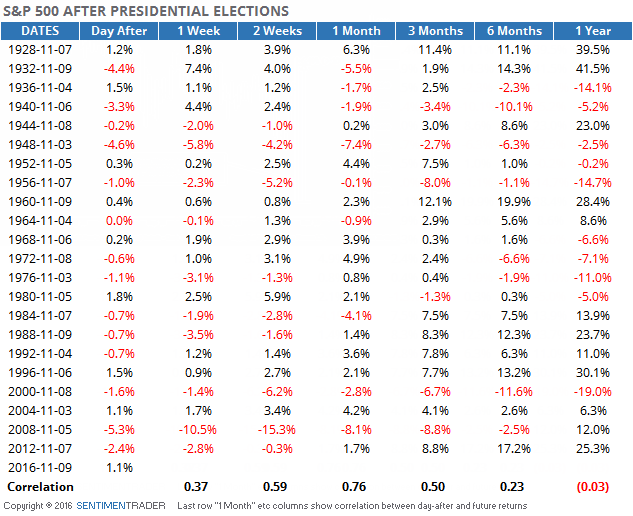

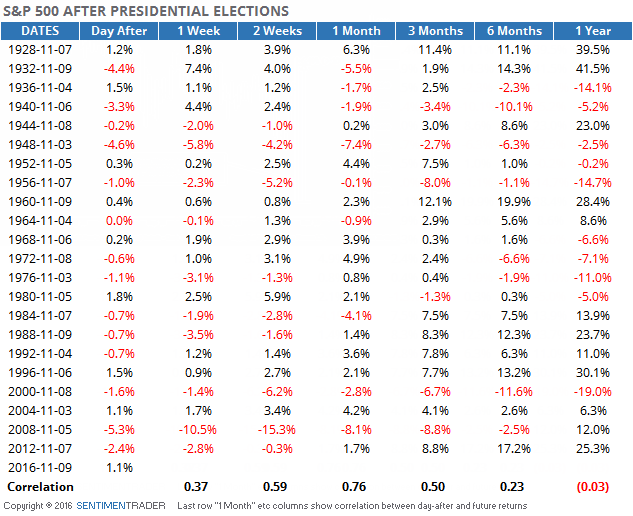

For example, here are the day-after returns in the S&P 500. The "1 Week" etc columns show how the S&P performed in the week(s) following the day after. We can see that in 2012, the S&P lost 2.4% the day after the results came in, and then lost another 2.8% in the week after that.

The last row shows us that there was a correlation of 0.76 between the knee-jerk post-election reaction and the S&P's return 1 month later. Correlations range from -1.00 (perfectly inverse) to +1.00 (perfect correlation), so a correlation of nearly 0.8 is impressive, and a good sign for stocks going forward. That was the peak of the correlation, however, and a year later there was actually a negative correlation between the day-after and one-year returns, but it was small enough that it suggests there was essentially no correlation.

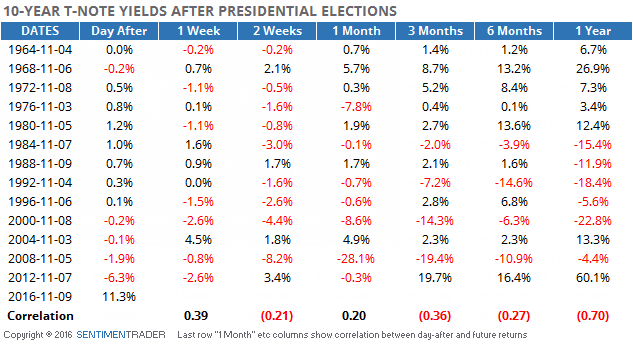

For bonds, there was a mostly negative correlation between how yields performed the day after to how they did going forward, especially longer-term.

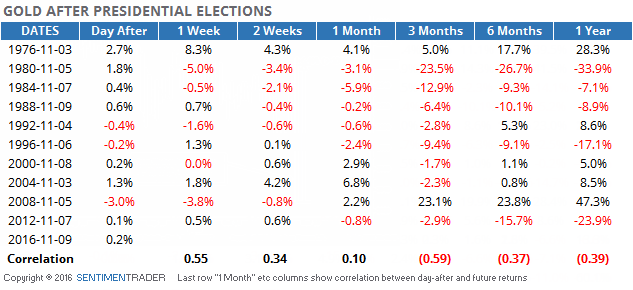

Gold tended to trade in the same direction as the knee-jerk reaction in the short-term, but reversed that in the weeks and months following, trading in an opposite direction more often than not.

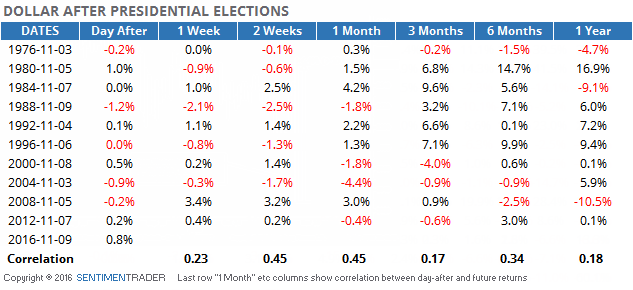

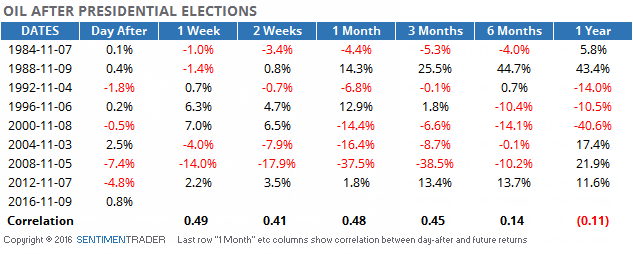

The U.S. dollar and oil, however, tended to have positive correlations between their knee-jerk reactions and future returns, at least over the next month.

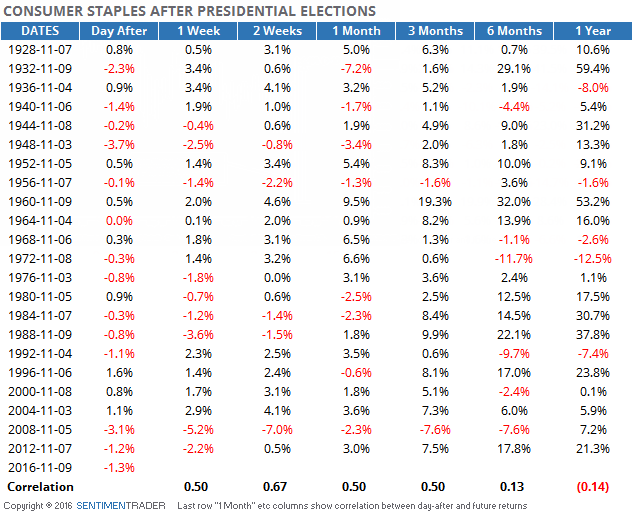

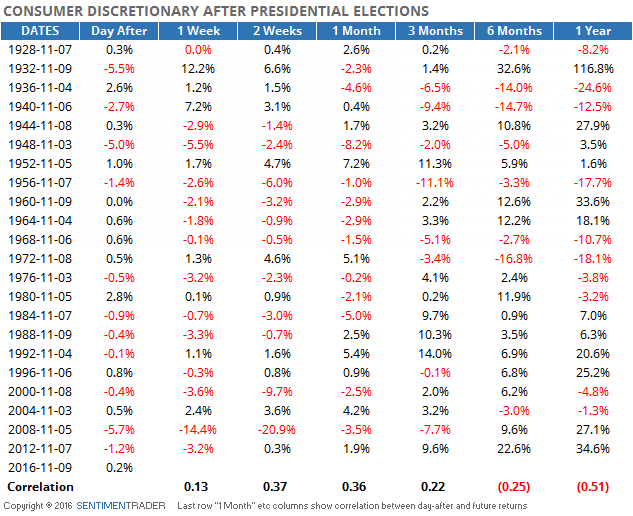

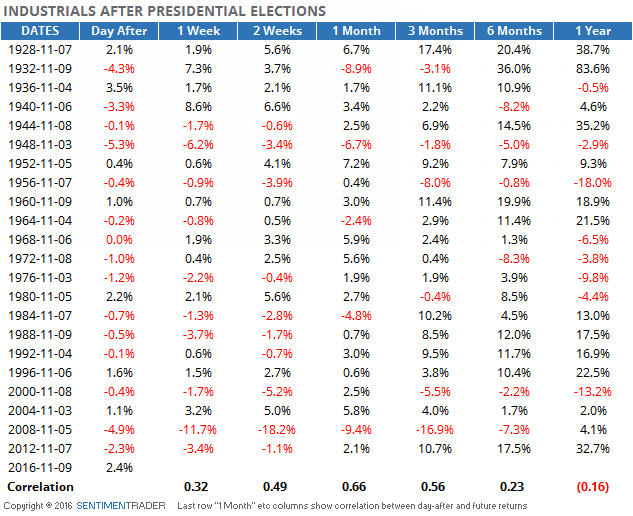

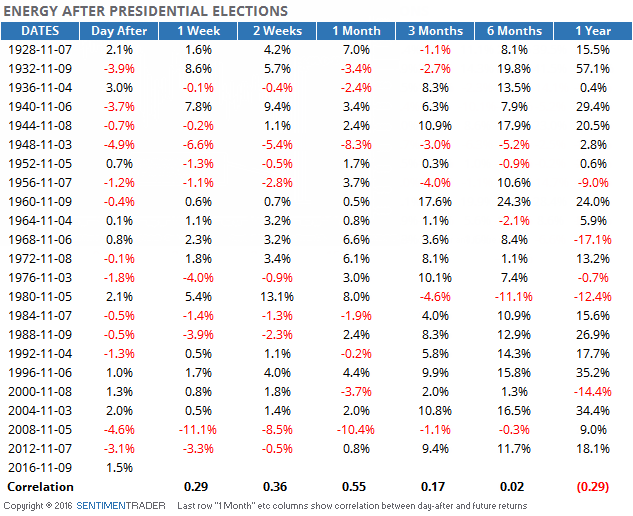

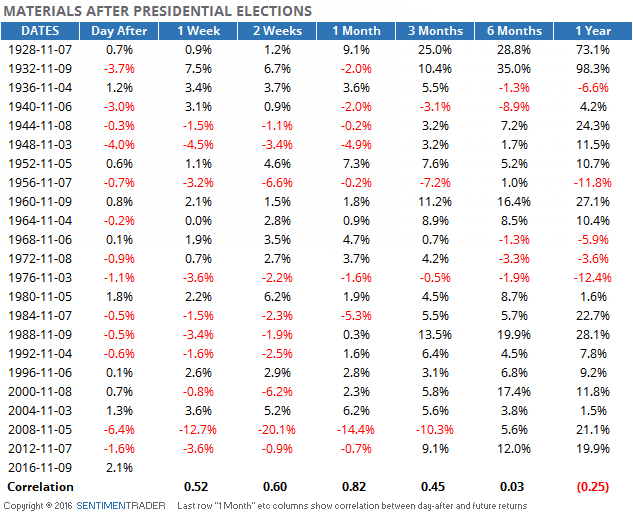

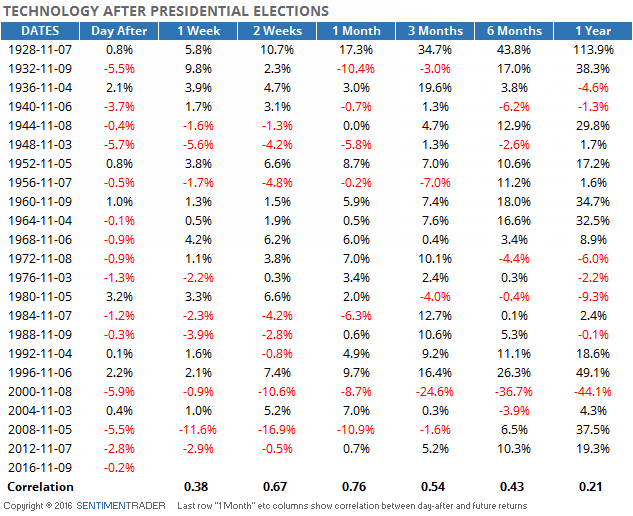

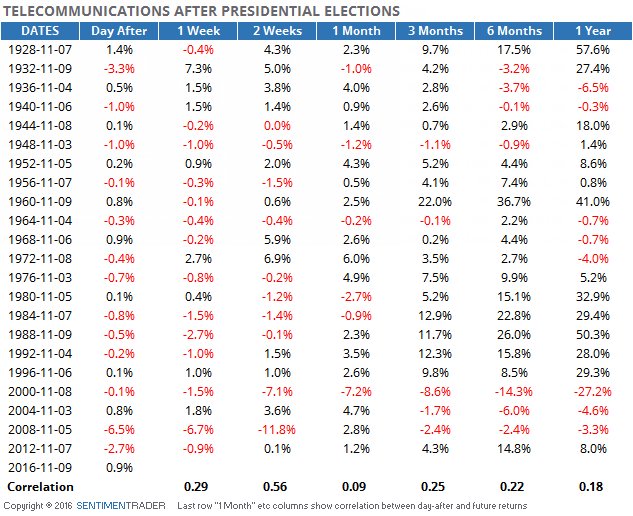

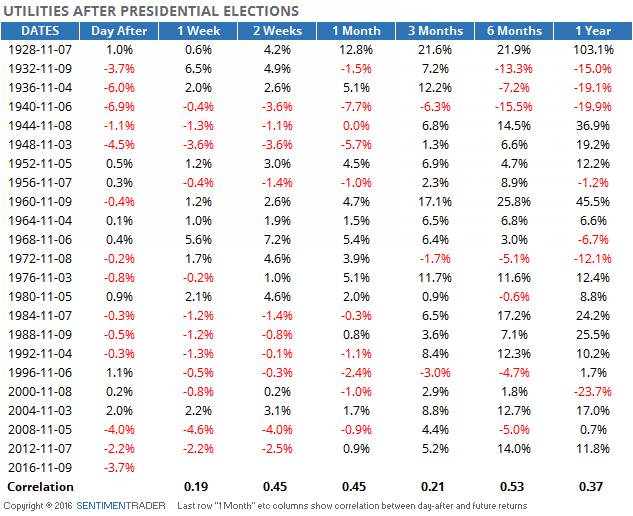

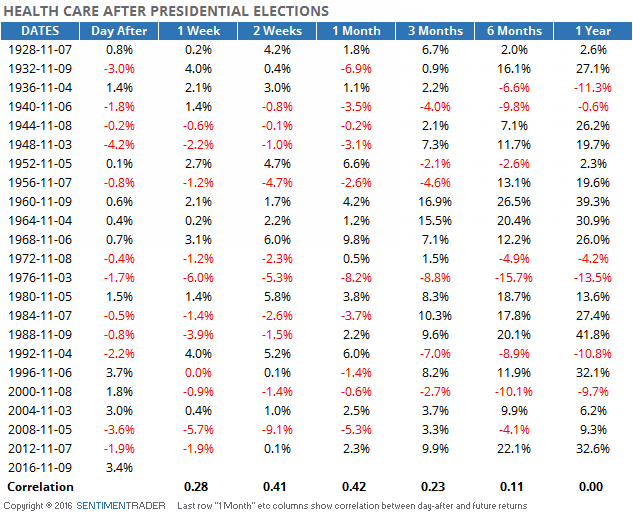

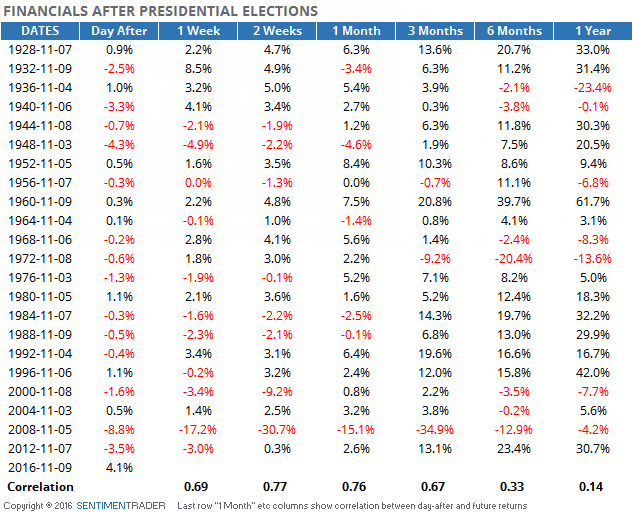

That tended to be the case with the major S&P 500 sectors, as well. They had strongly positive correlations between the initial post-election reaction and returns over the next month. That bodes well for financials, and not so much for utilities.