Keeping a Cautious Eye on Natural Gas

In this piece, I highlighted that we are entering a typically difficult time for the energy sector. In a separate piece, Dean highlighted a potential warning sign for crude oil.

In this piece, we will drill a little deeper and look specifically at natural gas.

PRICE ACTION

The good news is that natural gas has been in a strong uptrend in the last 2 months. It's an obvious statement, but the most bullish thing it can do is to keep rallying. In fact, if NG can break out decisively above recent resistance near $3.40, the next upside target is in the range of $5. However, as you can see in the chart below:

- NG has had trouble in recent years sustaining a move above $3.40

- Stochastics readings above 75% have tended to mark the end of an up move

If price can break out decisively to the upside, traders can certainly give NG the bullish case the benefit of the doubt. Unfortunately, there are other reasons to be concerned.

SEASONALITY

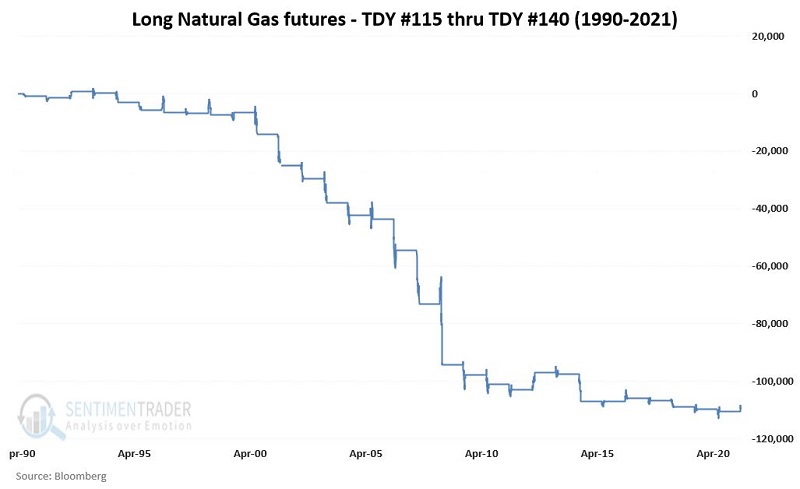

The chart below displays the annual seasonal trend for natural gas futures. A typical period of weakness extends from the close on Trading Day of the Year (TDY) 115 through TDY #140. So far this year, this period has shown a gain. But as you can see in the chart below, this is very atypical.

The chart below displays the hypothetical $ gain/loss achieved by holding a long position in natural gas futures only during this seasonally unfavorable period since 1990. The message is not that natural gas cannot rally during this period. The message is that it rarely does and that a bullish position in natural gas during this period clearly has to "swim upstream."

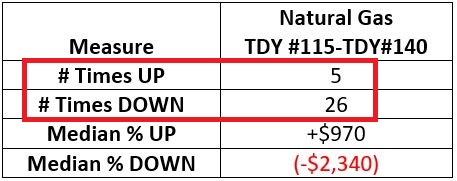

The bad news is fairly obvious. The table below displays the unhappy totals for natural gas during this period.

Since 1990 this period has shown a decline 84% of the time.

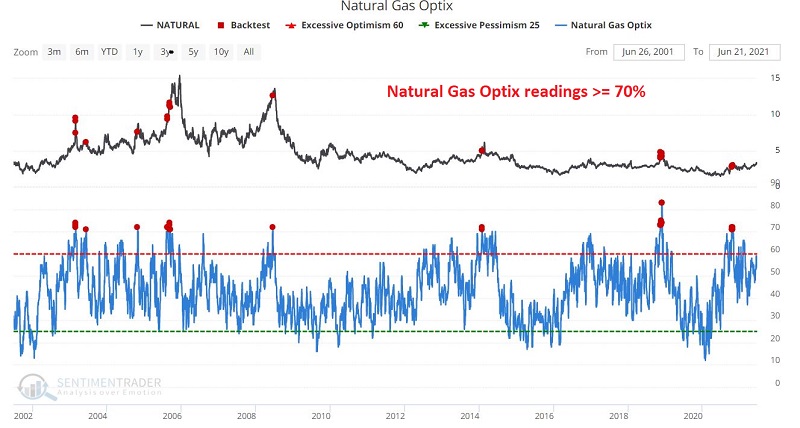

SENTIMENT

The most recent signal from natural gas Optix occurred in October 2020, when Optix exceeded 70%. Is that signal really still relevant 8 months later? History would seem to suggest so.

The chart below displays the instances when natural gas Optix exceeded 70% in the last 20 years.

The table below displays the summary of performance following 70%+ reading for natural gas Optix. As you can see:

- Price weakness is typical

- Returns tend to get worse the more time goes by

SUMMARY

Is natural gas doomed to fall in the months ahead? Not at all. As stated at the outset, if price can breakout above recent resistance, there is no reason that 2021 cannot be an "atypical" year for natural gas. But as I always like to point out…

Jay's Trading Maxim #32: Trading is a game of odds; therefore, one of the keys to long-term success is to put the odds as far in your favor as possible on a trade-by-trade basis.

- Can natural gas rally from here? Absolutely

- Are the odds in the bull's favor? That's for you to decide