It's time to look at unleaded gas

Key Points

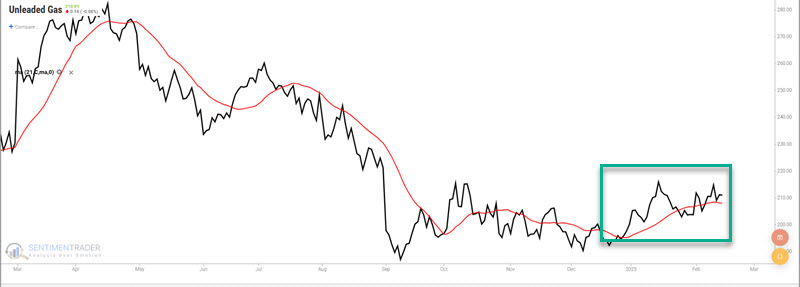

- Unleaded gas prices have perked up recently

- This vital commodity is entering a particularly favorable seasonal period

- Unleaded gas futures have recently moved into an uptrend, creating an agreement between seasonality and price action

Unleaded gas enters a favorable seasonal window

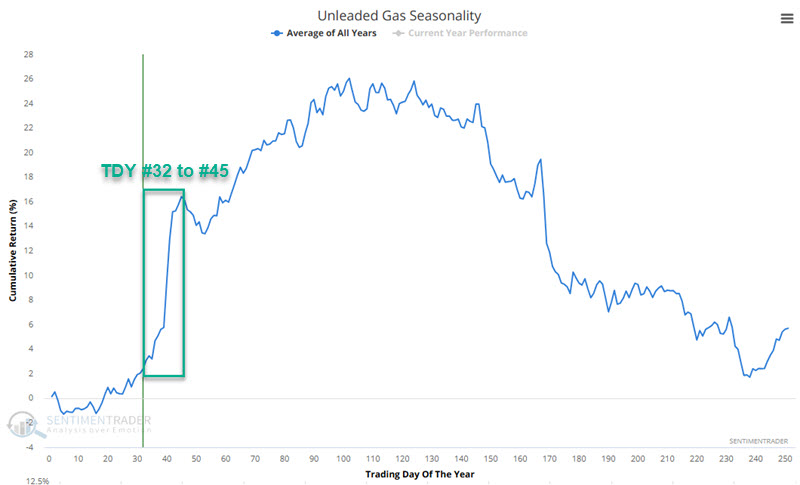

The chart below shows the annual seasonal trend for unleaded gas futures.

The green box highlights the period that extends from the close on Trading Day of the Year (TDY) #32 through TDY #45. For 2025, this period extends from the close on 2025-02-14 through 2025-03-05.

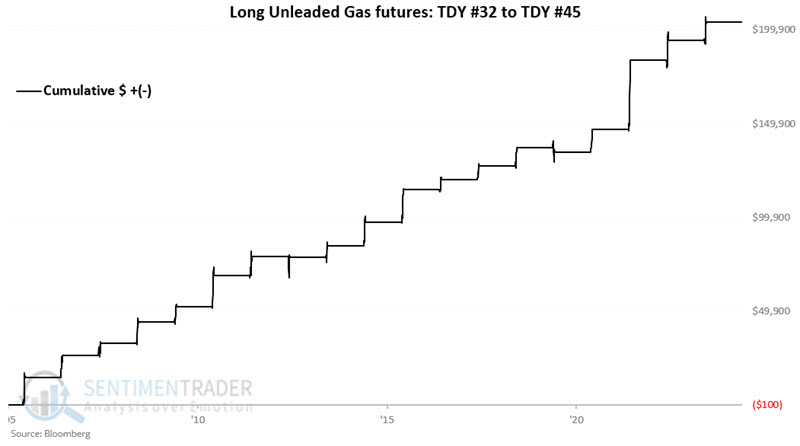

The chart below displays the hypothetical cumulative $ +(-) achieved by holding a long position in unleaded gas futures only during this period each year since 2006.

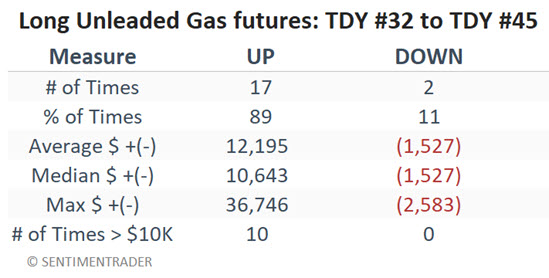

The table below summarizes unleaded gas futures performance during this period.

The chart and table above are compelling and suggest a high probability of higher unleaded gas prices shortly. However, as always, it is essential to remember that seasonality is merely an average of what has happened in the past and NOT a roadmap of what will happen in any given year. Also, unleaded gas futures can be highly volatile and generate significant moves in both directions.

Typically, I prefer to consider seasonal trends when seasonality and price agree. The chart below shows that unleaded gas futures have recently moved into an uptrend. If that remains the case, the seasonal trend strongly suggests giving the bullish case the benefit of the doubt in the weeks ahead.

An ETF alternative for non-futures traders

Trading in unleaded gas futures requires deep pockets (not to mention nerves of steel at times). Non-futures traders who wish to gain exposure to price fluctuation in unleaded gas can buy shares of the United States Gasoline Fund LP ETF (ticker UGA), just as they would buy shares of any stock.

What the research tells us...

The research suggests that unleaded gas futures "should" move higher in the weeks ahead. A typically reliable seasonal trend combined with an already burgeoning price uptrend would seem to bode well. It's too bad that the financial markets can never be fully trusted to do what we want/expect them to. While long exposure to unleaded gas (whether via futures contracts or ETF shares) seems like a good bet, individual traders are never relieved of their responsibility to allocate capital intelligently and to manage risk ruthlessly.