It's time to keep an eye on soybeans

Key points

- Due primarily to its unique planting cycle, soybeans are one of the most highly seasonal markets

- This market is entering a typically favorable seasonal period

- ETF ticker SOYB offers an alternative to trading riskier soybeans futures

Soybeans are entering a seasonally favorable period

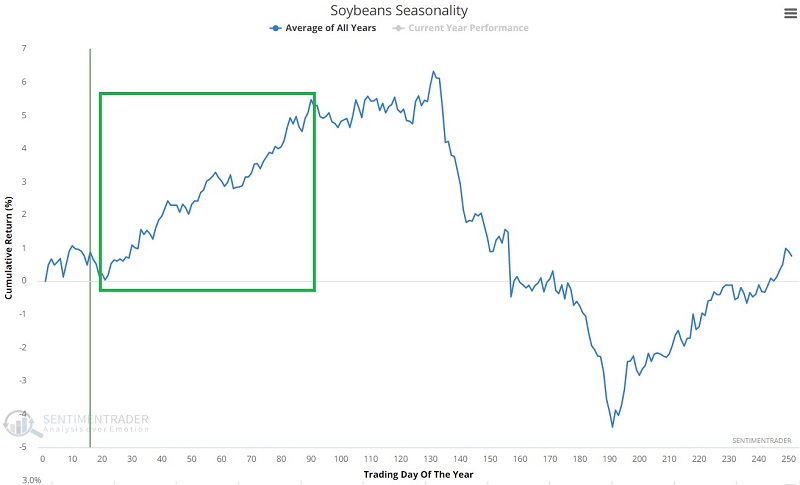

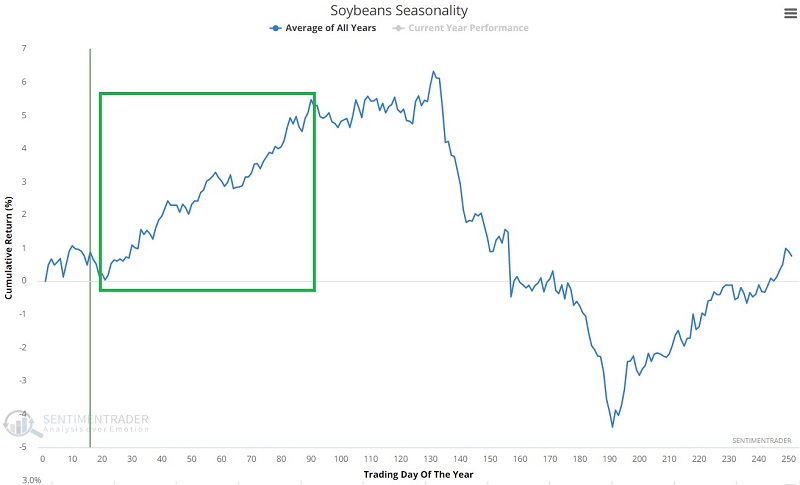

The chart below displays the annual seasonal trend for soybean futures.

The most important thing to note is that soybeans are re-entering a typically favorable seasonal period. The seasonally favorable period extends from the close of TDY #21 through the close of TDY #90.

For 2023, this period extends from the close on 2023-01-30 through 2023-05-02.

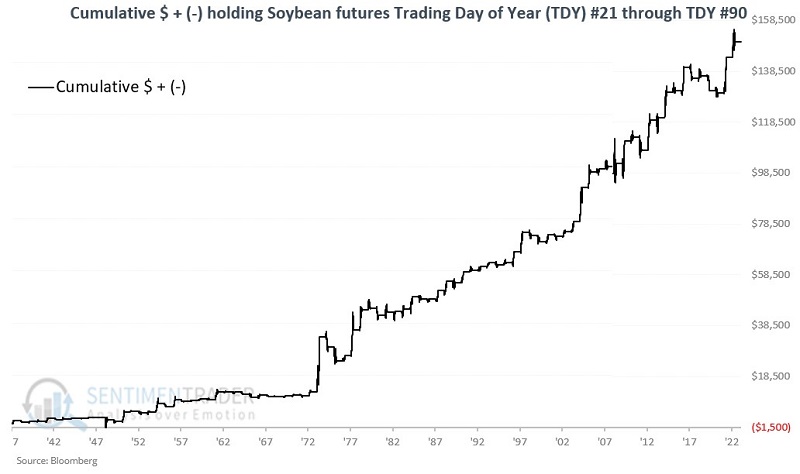

The chart below displays the cumulative hypothetical gain from holding long one soybeans futures contract only during TDY #21 through TDY #90 every year since 1937.

As with most viable seasonal trends, two things are apparent:

- There is no guarantee that beans will rally during this supposedly favorable period during any given year

- Nevertheless, the long-term favorable bias is unmistakable

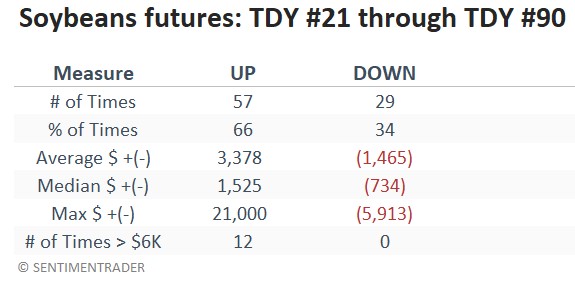

The table below summarizes performance results during this favorable seasonal period.

The good news is that historical results have seen soybeans rise during this period in two out of every three years. Also, the "big moves" tend to be on the upside (Note the twelve gains of +$6,000 or more, with no loss greater than -$5,913). The bad news is that there is no guarantee that future results will be similar. Likewise, the fact remains that trading soybean futures involve potentially unlimited risk.

Using an ETF as an alternative

The Teucrium Soybean Fund (SOYB) is an exchange-traded security that is designed to track in percentage terms the movements of soybeans futures prices. SOYB issues shares that may be bought and sold like shares of stock.

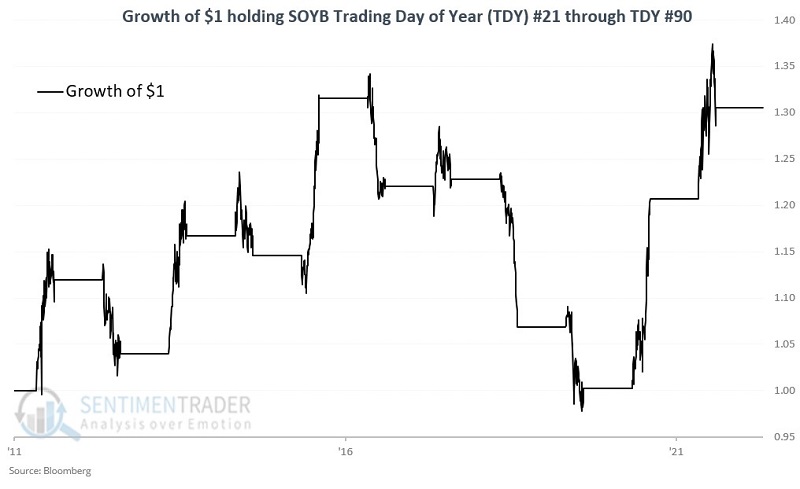

The futures contracts held by ticker SOYB are based on their own prescribed roll schedule. This means that the daily percentage fluctuation in SOYB may differ from those of the spot contract we used above to track soybeans futures directly. The chart below displays the growth of $1 invested in SOYB only during TDY #21 through TDY #90 for soybeans futures.

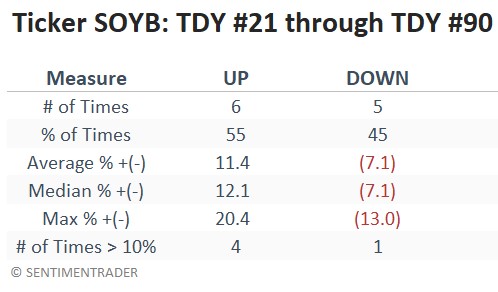

The table below summarizes performance results during this favorable seasonal period.

What the research tells us…

Soybeans are a highly seasonal market. It tends to show strength in the first half of the year and weakness during the second half. This market is now entering a period that has often seen soybean futures offer exceptional strength. That said, traders must recognize the exceptionally volatile nature of soybeans futures. Nonfutures traders who wish to play the long side of soybeans can look to ticker SOYB, with the caveat that the returns for the ETF during its relatively short history have not been as robust as those for the futures themselves.