It's time to keep an eye on real estate

Key points

- The real estate sector was hit hard in 2022 and has struggled to get off the deck so far in 2023

- Rising interest rates, high real estate prices, and concerns about several sub-sectors (notably commercial and single-family homes) have justifiably dampened enthusiasm

- If the sector is going to stage a rebound, the current seasonal window could be the time - and traders should be alert for an opportunity in this beaten-down and unloved sector

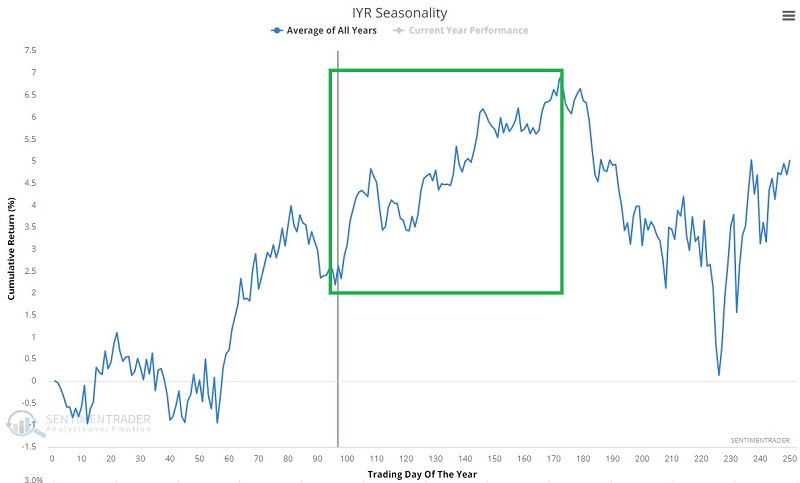

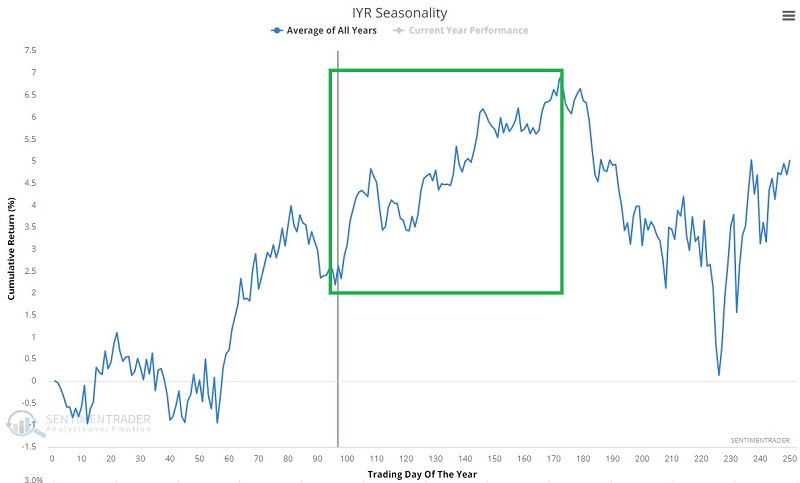

The annual seasonal trend for real estate

The chart below displays the annual seasonal trend for the iShares US Real Estate ETF (ticker IYR).

The current favorable period extends from the close of Trading Day of Year (TDY) #96 through TDY #172. For 2023, this period extends from the close on 2023-05-19 through 2023-09-11.

Traders should not assume that starting a favorable seasonal window automatically equals a "buy signal." The proper mindset is not "it's time to buy" but "it's time to keep an open mind and be prepared to buy." This is a crucial distinction given a) the continued weakness among real estate-related securities and b) that many investors have thrown in the towel on this sector. If the real estate sector is going to finally reverse a) and surprise b) - this time window would be an ideal time for that to happen. To illustrate, let's take a closer look at historical results.

Testing a favorable seasonal window

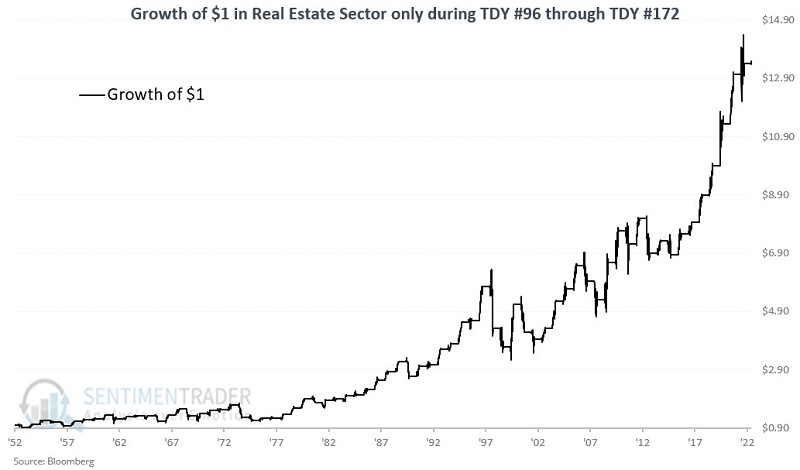

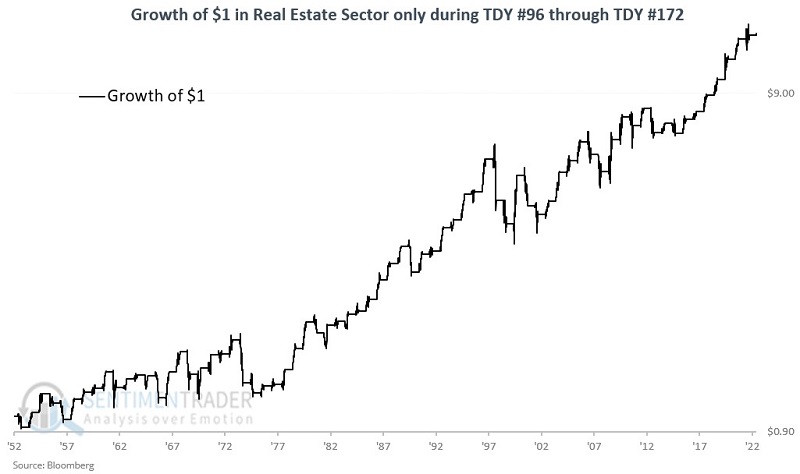

We will use the Fama French Index database real estate sector data from 1953 through 1991 and the S&P 500 real estate sector index after that for testing purposes.

The chart below displays the hypothetical cumulative $ +(-) from holding a long position in the real estate sector only from the close of TDY #96 through TDY #172 since 1953.

The chart below displays the same data as above but on a logarithmic scale.

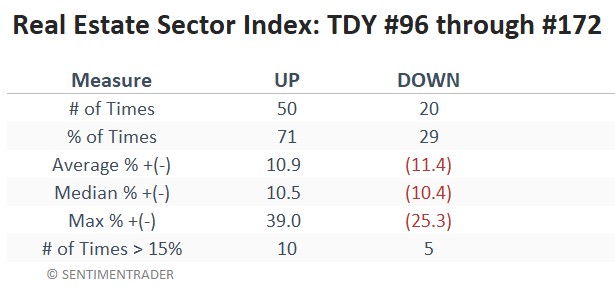

The table below summarizes real estate sector performance only during this period.

What the research tells us…

The results above highlight that late May into mid-September has been a favorable time of year for the real estate sector overall. However, this should not be construed as some automatic buy signal. Year-to-year results have witnessed a high degree of volatility and variability, and off years can be devastatingly brutal for real estate investors (-25.3% in 1974, -24.7% in 1998, and -18.7% in 2001, to name a few instances). The proper way (in one author's opinion) to use seasonality is as a tool to help us locate potential periods of opportunity.

If the real estate sector is going to get off the deck and finally stage a decent bounce, the months ahead would appear to be an ideal time for that to happen. Very aggressive traders bullish on real estate may consider this an excellent time to "take the plunge." Before diving in, all others would likely be best served by watching the real estate sector closely and looking for some signs of life - and some objective sign of a change in trend.