Its time to keep a close eye on platinum

Key points

- Platinum is entering a very unfavorable seasonal period

- There are no guarantees that platinum will decline during this period in 2023

- Sentiment has also recently flashed a potential warning sign

- History strongly suggests avoiding a long position - and considering a short position - in the near-term time frame

Platinum is a highly cyclical market

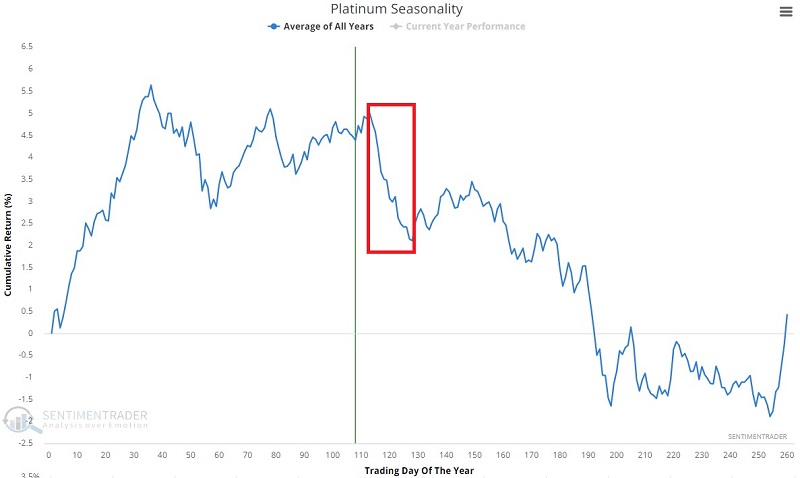

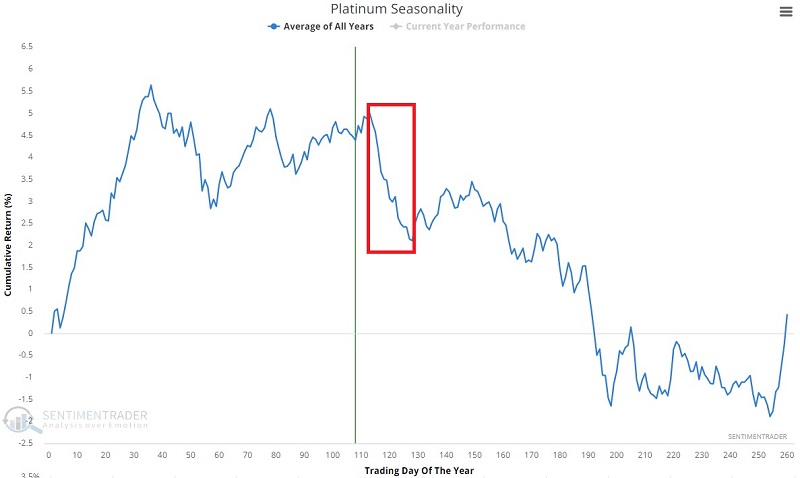

The chart below displays the annual seasonal trend for platinum futures. Highlighted is an unfavorable period that extends from the close of Trading Day of Year (TDY) #113 through TDY #128. For 2023, this period extends from the close on 2023-06-08 through 2023-06-29.

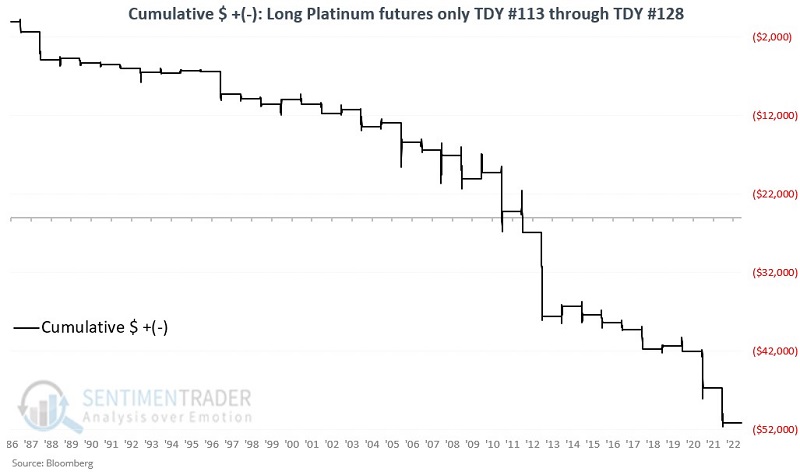

For testing purposes, we will use daily platinum futures data from Bloomberg, using a data series that tracks the spot futures month. The chart below displays the hypothetical cumulative $ +(-) from holding a long position in platinum futures only from the close of TDY #113 through TDY #128 every year since 1987.

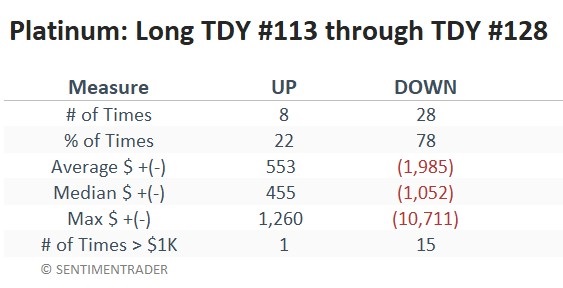

The table below displays a summary of platinum performance only during this period.

As always, seasonality is "climate, not weather." An annual seasonal chart is a look back at average performance, not a roadmap for the current year. Just because an annual seasonal trend chart declines sharply during a given period does not mean the market will do so this year. All that said, the equity curve chart and performance table above suggest that platinum has historically been particularly vulnerable during June.

One measure of sentiment is skewing unfavorable

The chart below highlights with a red dot each date when the 50-day moving average of Platinum Optix crossed above 50% while platinum futures were above their 150-day moving average.

While the results are not uniformly bearish, on many occasions, a nascent rally in platinum ran out of steam shortly after a signal. The most recent unfavorable signal occurred on 2023-05-22, lending more weight to the negative side of the ledger for platinum.

The table below summarizes platinum futures performance following the signal dates.

What the research tells us…

Note that platinum futures have shown a gain during the seasonal period in question 22% of the time in the past. So, it is a mistake to assume that platinum is doomed to fall in the weeks ahead. Nevertheless, the historical results are heavily skewed to the bearish side. Note that in 36 years, a gain above +$1,000 has occurred only once (3% of the time). A loss of -$1,000 or more has happened 15 times (42% of the time).

Trading is essentially a game of odds. The combination of a most unfavorable seasonal period and a warning from sentiment suggests that traders looking to put the odds on their side in this precious metal should either play the short side or stand aside through late June.