It's the most platinum time of the year

Key Points

- Platinum has demonstrated a tendency to rally early in the new year

- The advance typically begins a few days earlier, before the turn of the year

- ETFs offer non-futures traders the potential to participate in this trend

Platinum into the new year

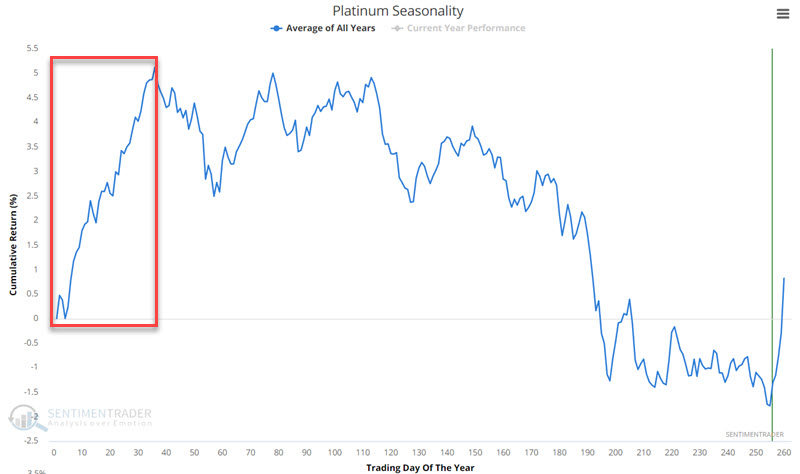

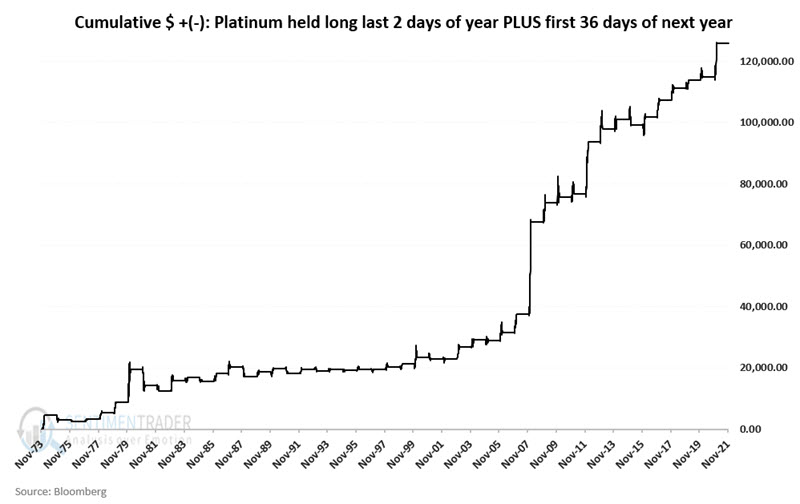

The chart below displays the annual seasonal trend for platinum futures.

Our seasonally favorable period for platinum includes:

- The last two trading days of the current year

- The first 36 trading days of the following year

For the current cycle, this period starts at the close on 12/29/2021 and extends through the close on 2/23/2022.

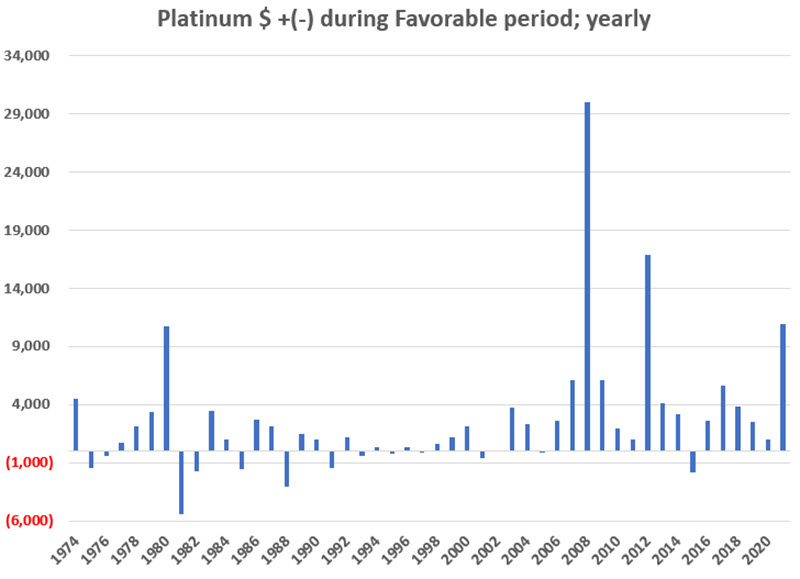

The chart below displays the annual $ return for platinum futures during this seasonally favorable period.

The chart below displays the cumulative $ return for platinum futures during this seasonally favorable period.

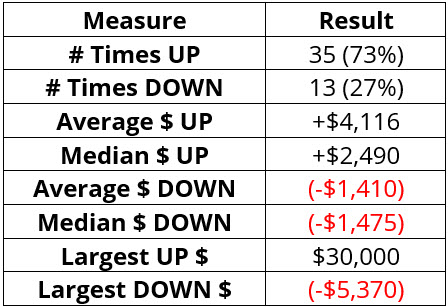

The table below displays the relevant performance numbers.

The one glaring problem is that most individuals will never trade platinum futures. So, let's consider an alternative.

PPLT ETF

PPLT (Aberdeen Standard Physical Platinum Shares ETF) is an ETF intended to track the price of platinum futures. Traders can buy and sell shares of PPLT just as they would shares of stock. While this approach lacks the leverage of futures trading, it makes a platinum investment more accessible to many individual traders.

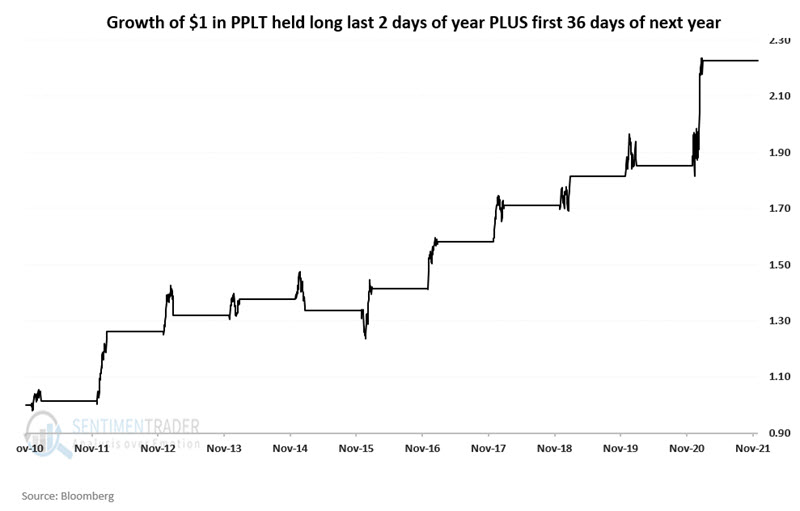

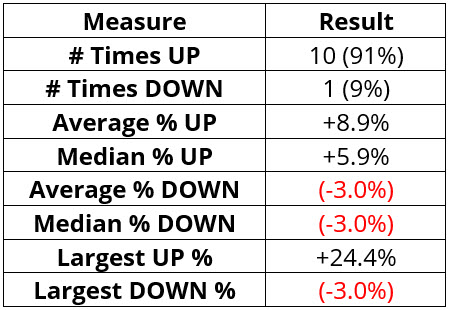

The chart below displays the growth of $1 invested in PPLT ONLY during our seasonally favorable period.

The table below displays PPLT results during our seasonally favorable period since the first period began in December 2010.

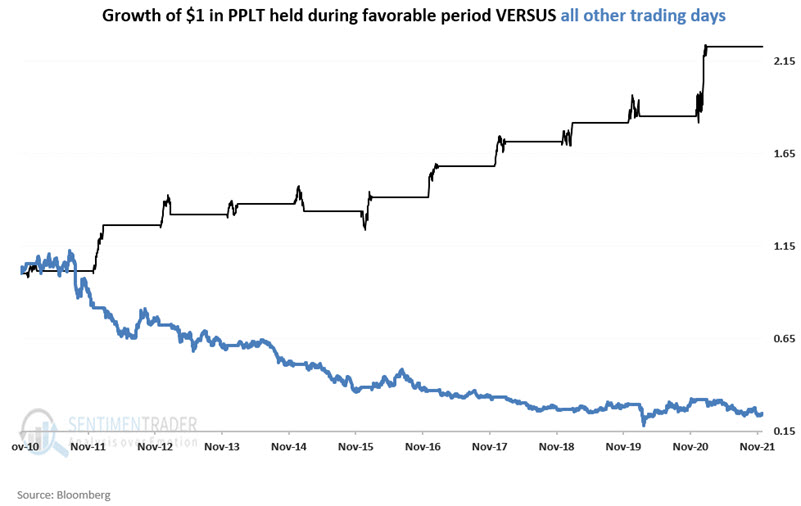

To fully appreciate platinum's performance during the seasonally favorable period, the chart below displays:

- The growth of $1 only during the seasonally favorable period

- Versus the growth of $1 during all other trading days

Since 11/30/ 2010, PPLT has:

- Gained +123% during seasonally favorable periods

- Lost -76% during all other trading days

What the research tells us…

Platinum tends to rally early in the year; however, results vary widely from year to year. While results have been consistently positive in the past, there is no guarantee that this degree of favorability will continue. Platinum futures offer the potential for significant gains but also large losses for the unprepared and/or under-capitalized trader. The PPLT ETF offers traders an unleveraged way to play the long side of platinum.