It's getting late in real estate

Key Points

- Real estate has historically been a weak sector during September

- Using sector index data, we will look at the long-term history of real estate in September

- Using ETF data, we will also look at a specific period of seasonal weakness

Real estate in September

For testing purposes, our dataset uses monthly total return data for the Fama French database through 1990 and S&P 500 sector data starting in 1991.

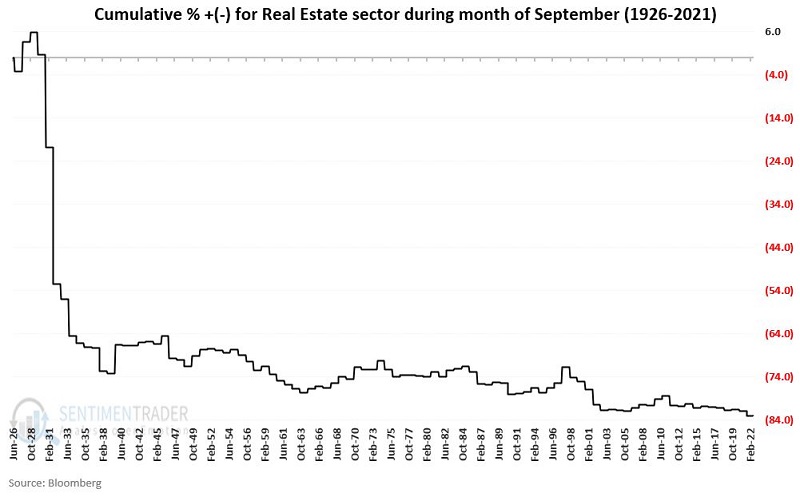

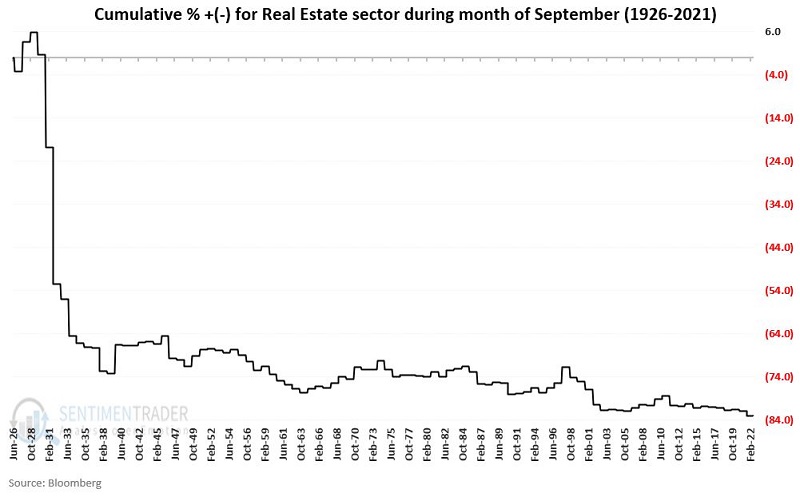

The chart below displays the cumulative total return for the real estate sector if held only during September starting in 1926 through 2021.

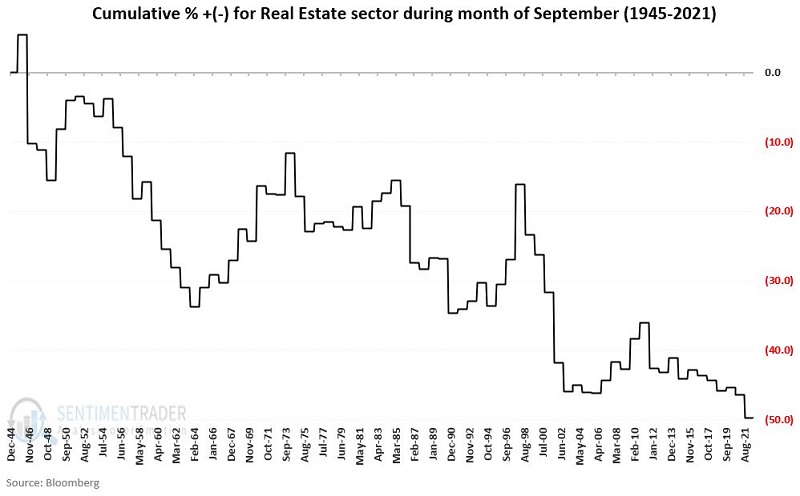

The massive collapse in the early 1930s dominated performance. So, to get a clearer picture, the chart below displays the cumulative total return for the real estate sector if held only during September during the post-WWII period starting in 1945.

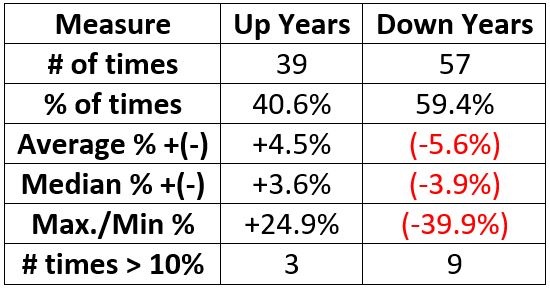

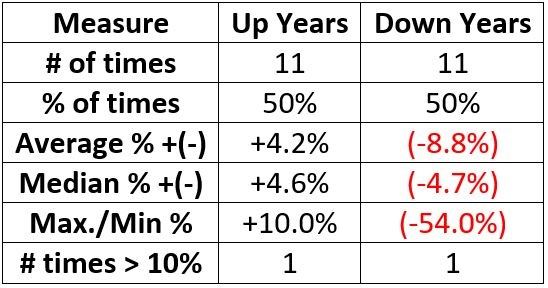

Despite the devastating September results from the 1930s, September has not been a banner month for real estate. The table below displays a summary of September real estate sector performance.

September 1st is just around the corner.

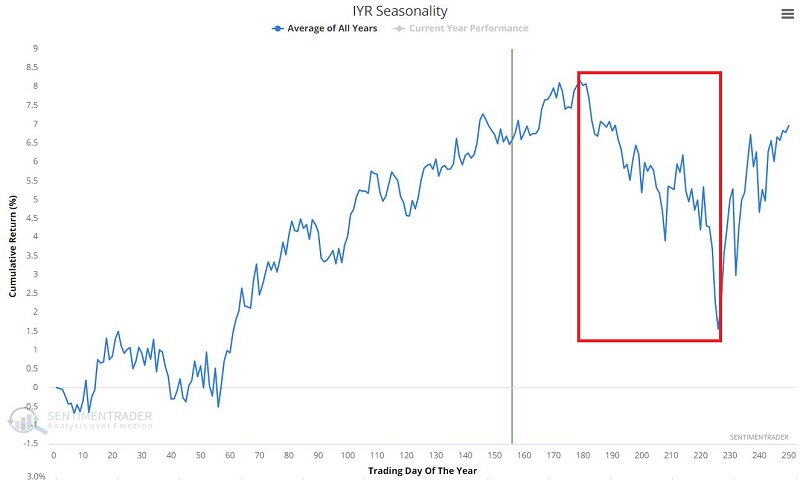

Trading Day of Year with IYR

The trouble in the real estate sector often does not begin until later in September and sometimes bleeds well into late fall. The chart below displays the annual seasonal trend for ticker IYR (iShares U.S. Real Estate ETF), which tracks the Dow Jones Real Estate Index. As you can see, there has been a tendency for weakness between trading Day of Year (TDY) #179 and TDY #226. For 2022 this period extends from the close on 2022-09-19 and the close on 2022-11-23.

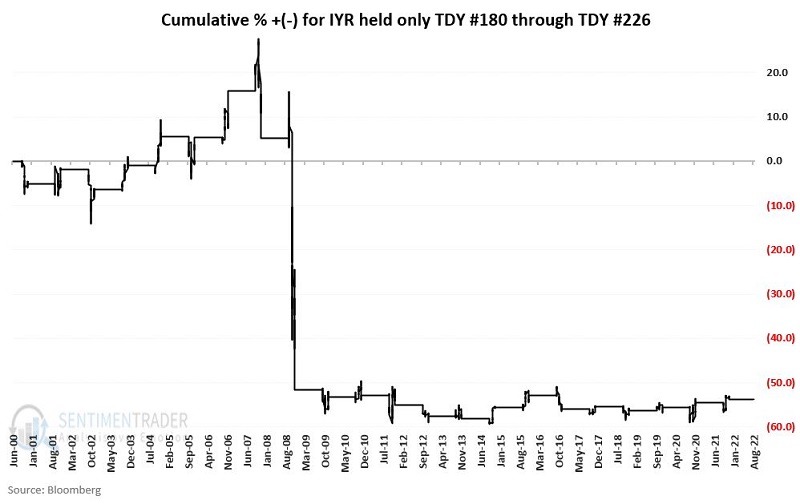

The chart below displays the cumulative return for ticker IYR if held only during TDY #180 through #226 every year since fund inception.

2007 and especially 2008 accounted for most of the net loss. Nevertheless, the more significant point is that not much of anything great happened during this period in other years.

The table below summarizes IYR performance during this seasonally unfavorable period since 2000.

What the research tells us…

The long-term odds of the real estate sector advancing in the next one to three months is basically a coin flip. However, the key point is that when this sector has shown weakness during the fourth quarter, it has tended to be severe. The good news is that a good buying opportunity often forms for real estate during the fourth quarter. Long-term results suggest that investors tread lightly in this sector during the fourth quarter but remain alert for a buying opportunity.