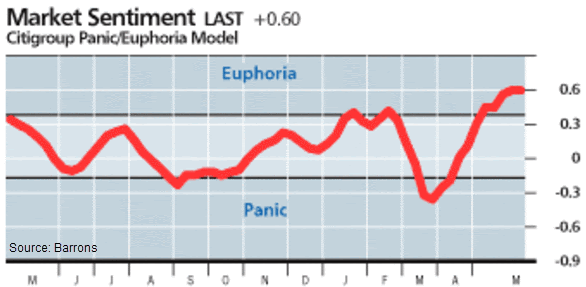

It looks like investors are becoming euphoric

Every once in a while, an indicator or model catches the investing public's attention. Reasons vary, but the gist of it is that we all want to find the holy grail, a simple and perfect guide that tells us what to do.

The indicator du jour is the Citigroup Panic / Euphoria Model published weekly in Barron's. It did a very good job of indicating euphoria in January and February, suggesting sentiment was overdone and stocks were due for below-average returns going forward. It flipped to panic in late March, another good call. Now it's back to euphoria, even more than at the beginning of the year.

When an indicator puts a couple of good signals together, it often gets praise as the "new thing." Once it inevitably fails, people move on to the next one. This particular model has been around for a long time, as have its detractors.

Based on publicly released data, the model's inputs are somewhat unusual. We've looked at all of them at some point, and few of them have any consistent record at being a contrary (or other) indicator of future stock returns. If we create a proxy model using the same inputs, it's currently a mixed bag, which means that the overall average is almost exactly zero, not showing any particular sense of panic or euphoria. It's unclear why the "official" model from Citigroup is showing euphoria.

Based on the published model, we should be concerned because it's showing that investors are euphoric about the potential for a further rally. It did a very good job of warning us early this year, which is a mark in its favor. While its recent record is very good, historically the model has been inconsistent after registering euphoric readings, and many components of the model don't agree.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- An in-depth look at Panic / Euphoria component indicators and a proxy model over the past 20 years

- SPY hit a 50-day high on a 50-day low in volume

- Silver has skyrocketed over the past 50 days

- The ratio of gold to silver has plunged nearly 25%

- High-yield (junk) bonds now have an overbought RSI