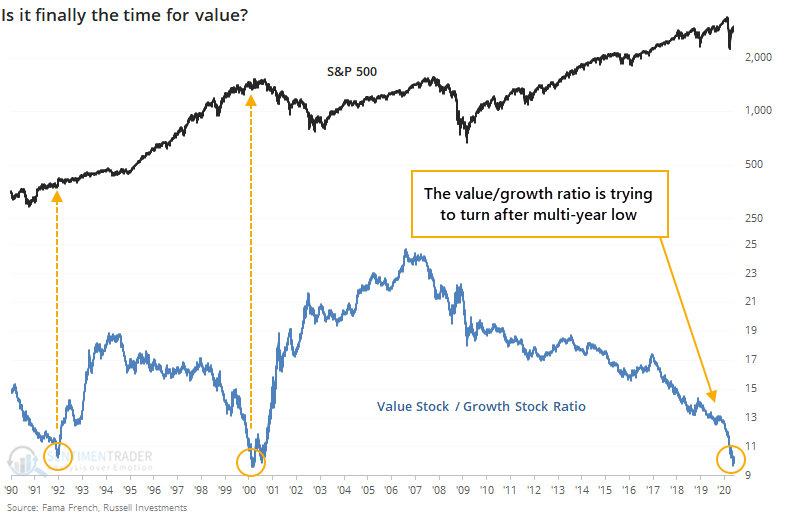

Is it finally the time for value?

After bearing the brunt of pessimism during the shutdown, value stocks are trying to stage a comeback. The Russell 3000 Value index surged more than 11% over the past two weeks while the Russell 3000 Growth index rallied less than 7%. That's nearly 5% in outperformance for value.

It could use it. The ratio between the two indexes recently fell to a multi-decade low and is trying once again to curl up.

The relationship between value and growth stocks to the broader market is inconsistent. Sometimes a turn in the ratio has preceded a peak in stocks, sometimes a bottom.

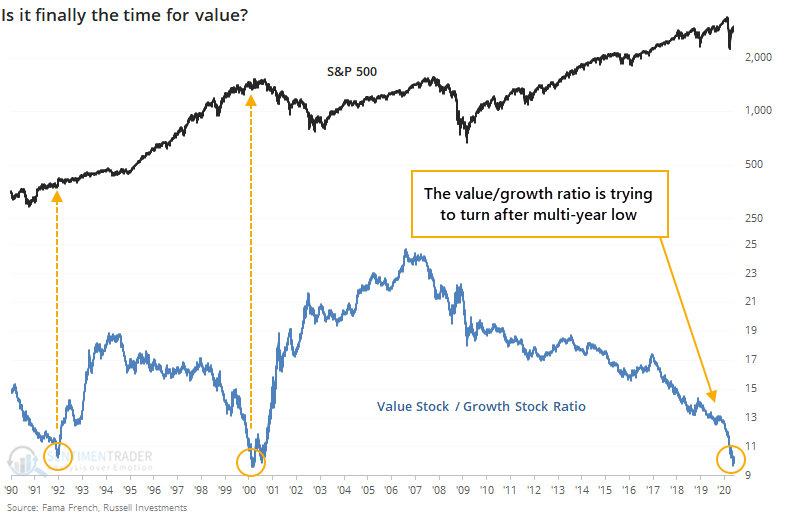

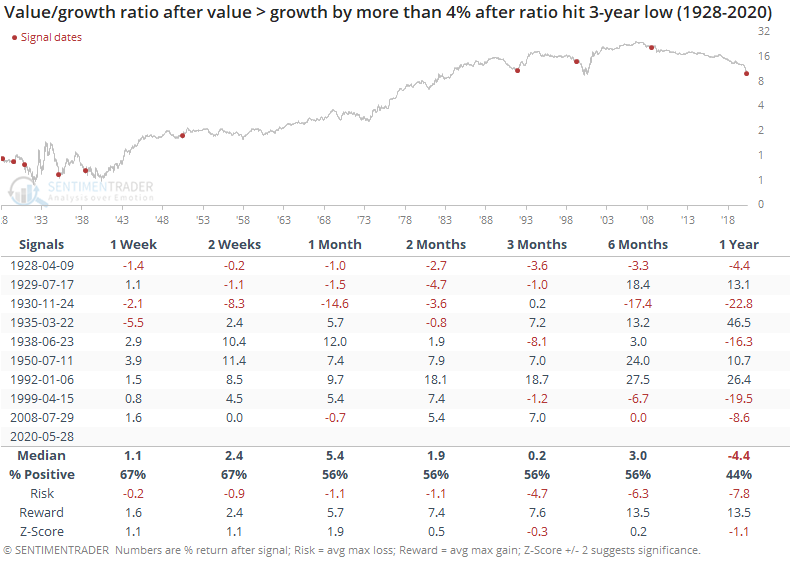

If we go back to 1928 and look for times when the ratio between value and growth hit at least a 3-year low, then value stocks outperformed growth by more than 4.5% over a 10-day period, it did lead to some good returns for value stocks.

In recent decades, there have been few precedents, but each time value stocks rallied shorter-term. It was woefully early in 2008, however.

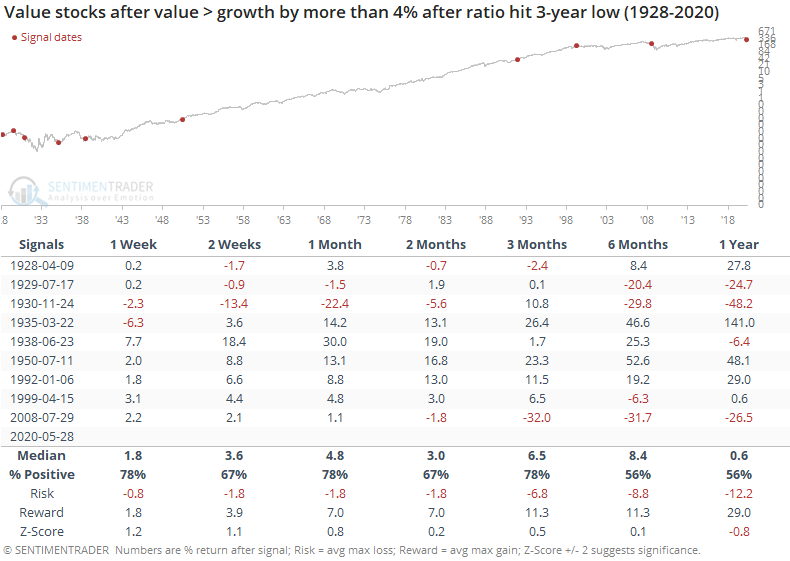

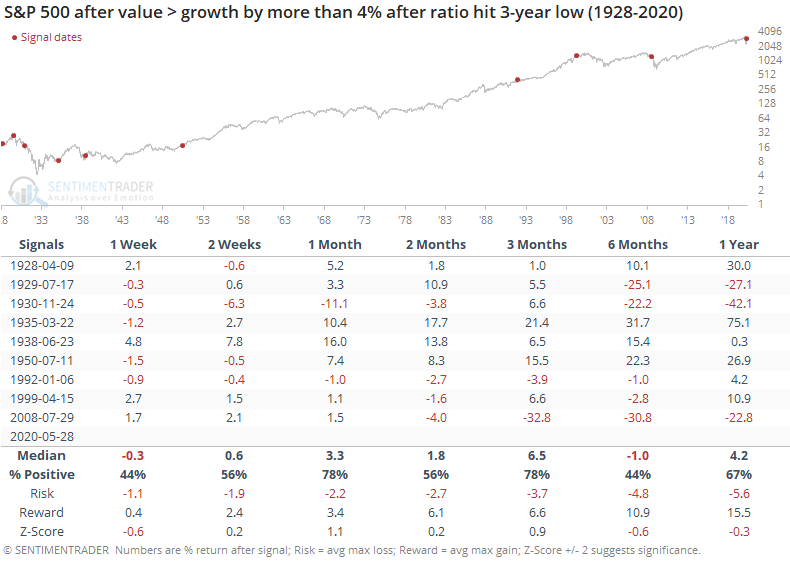

Growth performed less well, especially lately.

That means the ratio between them typically rose as value continued to outperform growth. It failed multiple times in the 1920s and 30s but since then has been much more successful.

For the S&P 500, the last three turns in this ratio were not that great of a sign over the medium-term.

If we place more weight on recent history (which we do) then the turn in value versus growth over the past couple of weeks should be a continued good sign for value relative to growth over a short- to medium-term time frame. It has not been a good sign for the broader market.