IPO market is nearing records

Stocks are popping, and companies are itching to take advantage. So are their bankers.

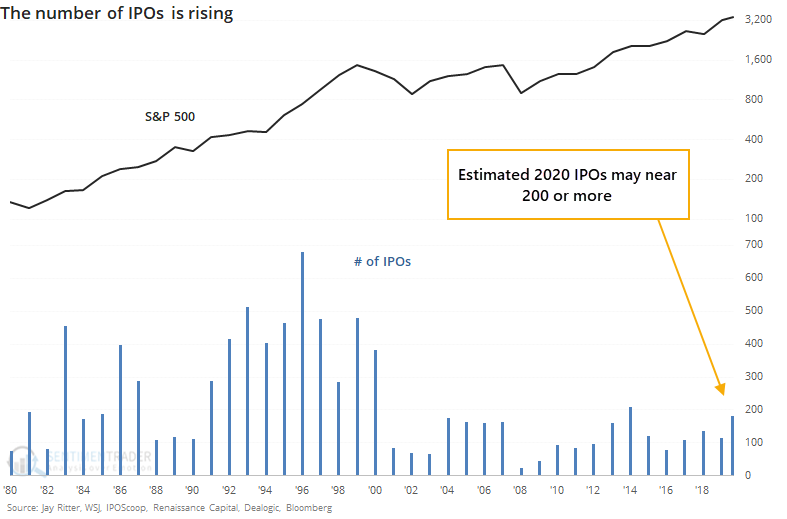

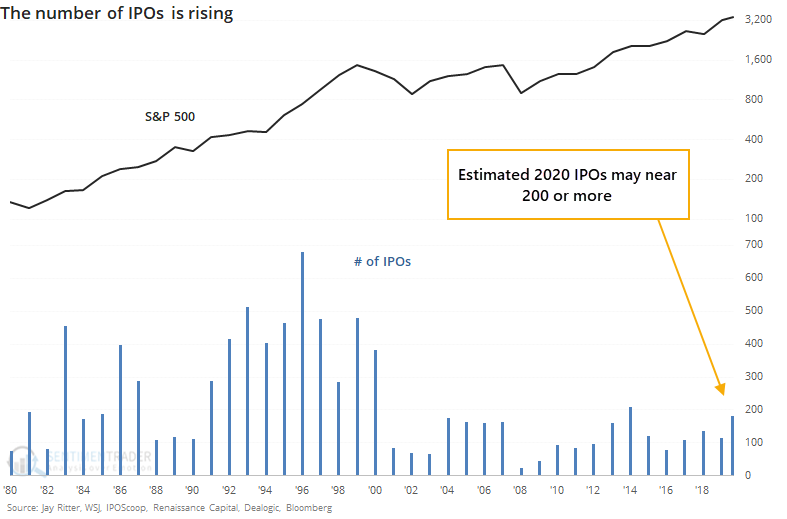

We've already seen that share issuance has spiked this year, and now Wall Street is seeing their opportunity to take full advantage as stocks continue to levitate. As the Wall Street Journal noted, we're on pace for a big uptick in IPOs brought to market, with a surge in the amount of money raised.

In terms of the raw number of new issues, it's still a far cry from the 1999-2000 heyday.

But when accounting for the total value of shares issued, we could set a new record.

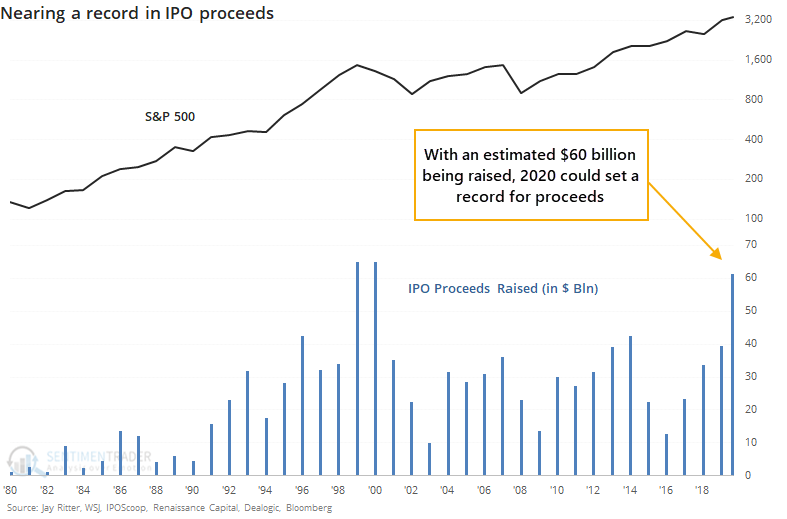

The IPOs have been warmly received. While this could change dramatically before year-end, through early August, the average IPO has popped more than 23%. There haven't been too many years with such eager new buyers.

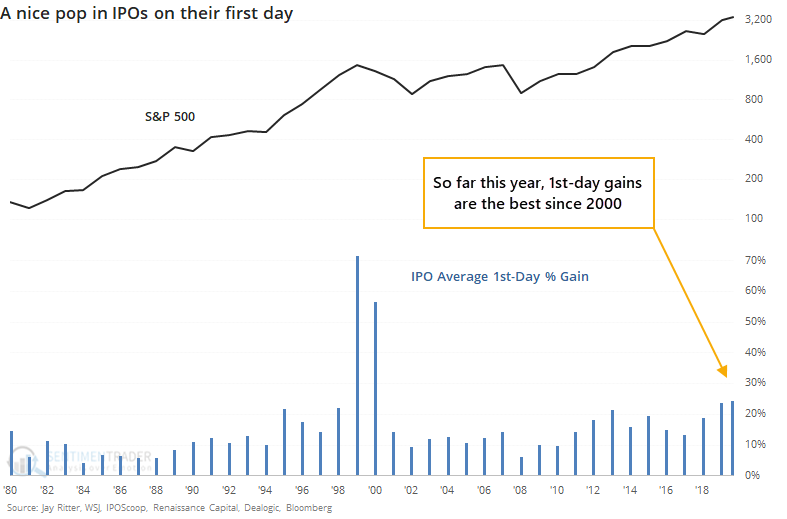

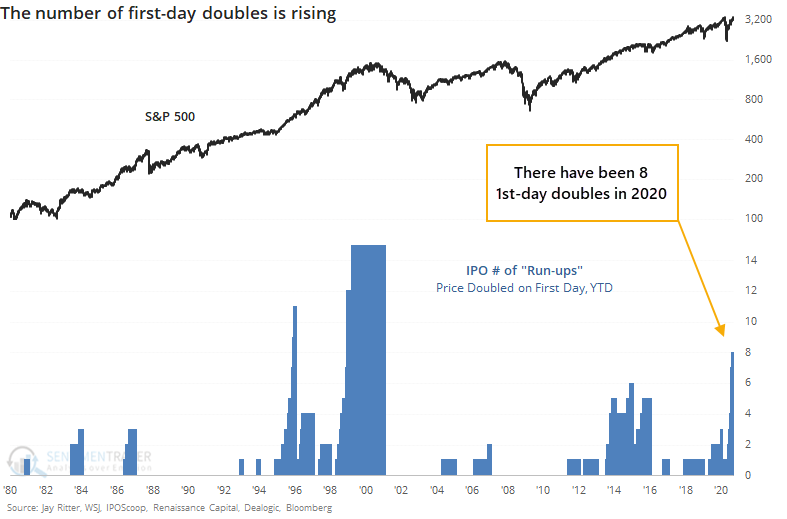

According to data from Jay Ritter, there have been 8 IPOs so far this year that doubled on their first day. If we look at the total number of "run-ups" year-to-date, this year is already in rare territory.

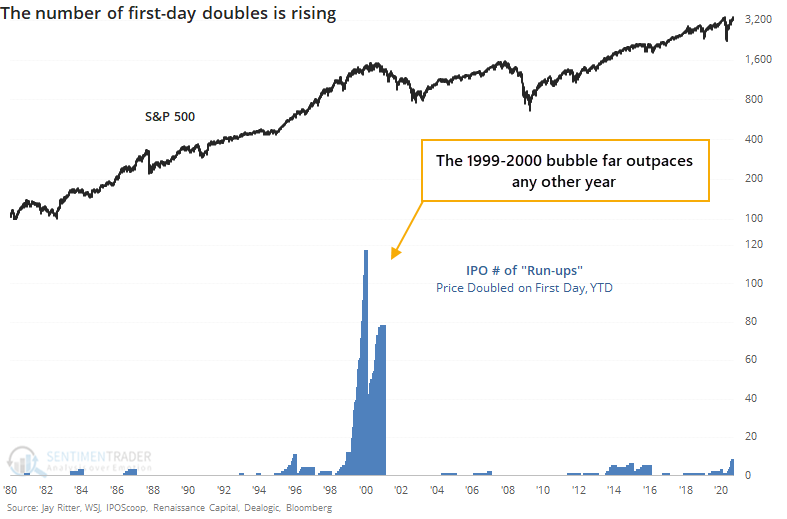

The chart looks a little off because of the 1999-2000 distortion. Anyone who lived through that craziness wouldn't be surprised by the full version of the chart.

Looking at all the different metrics, we're nowhere near the absurdity of the bubble years. The sheer number of new companies selling shares to the public, and the amount those stocks popped on their first days, may be a unique time in history that will never be equaled.

It is curious, at least, that outside of those two years, 2020 is on pace to exceed just about any other year. Not in terms of the number of new issues, but certainly in the amount raised, and possibly in how eager investors are to receive them. There is a modest-to-strong contrary nature to this data, and it's at least a slight long-term warning sign.