Investors were optimistic, now euphoric

If you're invested in one of the groups that has skyrocketed in the past couple of weeks, then it would only be human nature to feel a little giddy. Euphoric, even.

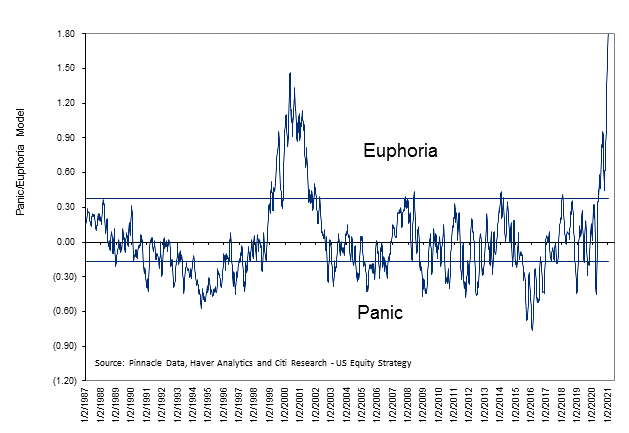

Based on a popular model, that's exactly how many investors are feeling at the moment, as the Citi Panic / Euphoria model has soared to a record high.

We created a proxy model using publicly available inputs, and it shows a fairly clear contrary nature - when it's high, the S&P's returns over the next year tend to be low; when the model is low, the S&P's returns are high.

Whenever this proxy was above 1, occurring about 14% of the time since 1988, the S&P 500 returned an annualized -3.7%, compared to an impressive +21.4% when it was below zero.

Even though this proxy isn't as extreme as the one shown above, it did just record the 3rd-highest reading in 30 years.

What else we're looking at

- Returns in the S&P 500 after the highest readings in the Panic Euphoria proxy model

- What happens after lesser extremes, too

- Forward returns in the U.S. dollar when it shows nascent signs of a short-covering rally

- A look at what happens in crude oil when rig counts jump higher

For immediate access to all the research with no obligation, sign up for a 30-day free trial

| Stat Box The yield on 10-year Treasury notes rose for the 6th consecutive day, tied for the 30th-longest streak since 1962. It would have to go twice as long, 12 straight days, to match the longest streak from April 1970. |

Sentiment from other perspectives

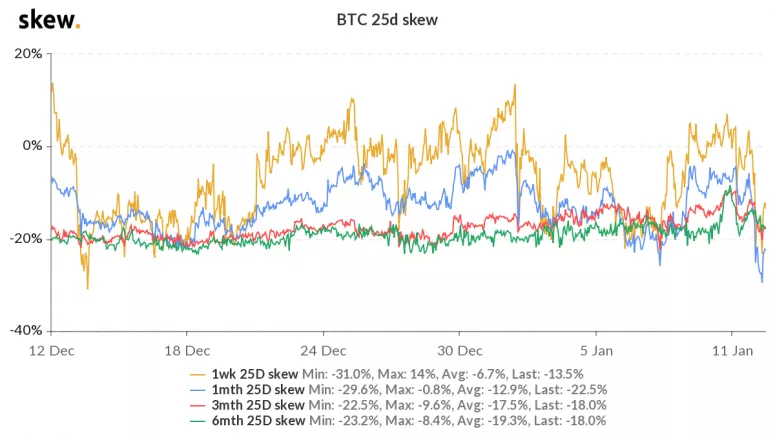

Despite recent losses, options traders are still embracing HODL, betting on the bitcoin rally to resume. Premiums on call options remain far ahead of puts, showing a preference for upside bets among traders. Source: Coindesk

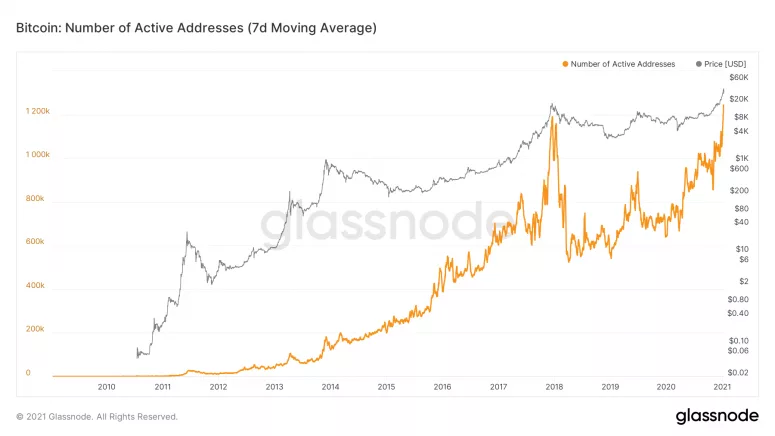

There are a lot more options traders buying those bitcoin calls, too. At least, it's likely, given the explosion in trading volume and number of accounts holding the coin. Source: Coindesk

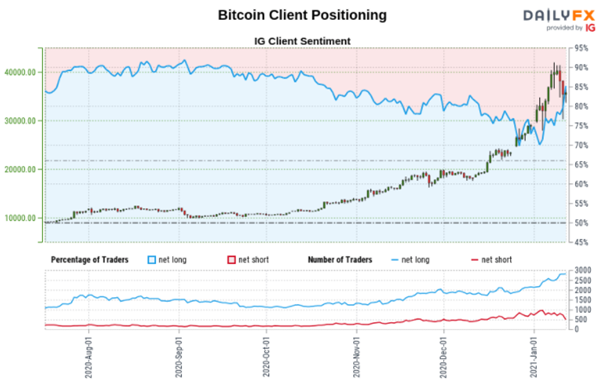

On one platform, the number of traders who are long jumped nearly 10% in the past week while shorts dropped by over 13%. Source: DailyFX