Investors Keep Hoarding Cash

NOTE: This will be the last Lite post for the next week.

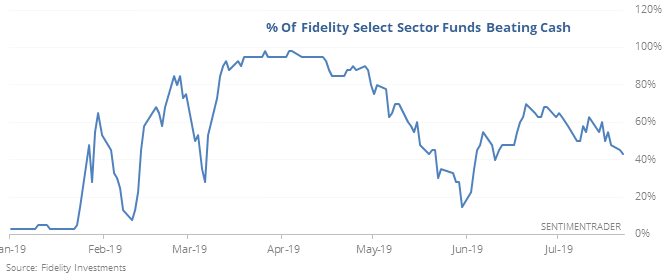

Lagging the market, and cash

The broader stock market has done well over the past month, but an abnormally large – and increasing – number of Fidelity Select sector funds are lagging even the return on cash.

It’s not “odd” funds like precious metals, either. It’s ones like Biotech, Computers, Chemicals and a handful of others. It’s not too unusual to see relatively few funds outperform cash when the S&P 500 is near its high, but it is unusual to see so few funds do so, and at an increasing pace, when indexes have rallied so hard. It typically led to gains in stocks, but with the big caveat that most of those ended up turning into losses.

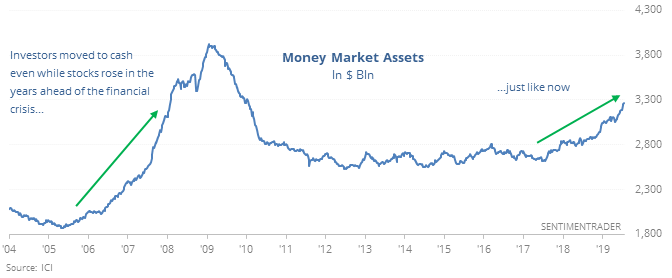

Stuffing the mattress

Despite a rising stock market and lower interest rates, investors keep shoveling money into money market funds.

This suggests highly defensive behavior and bullish implications from so-called "cash on the sidelines" argument. It hasn’t been that clear, though, with similar behavior preceding some major declines.

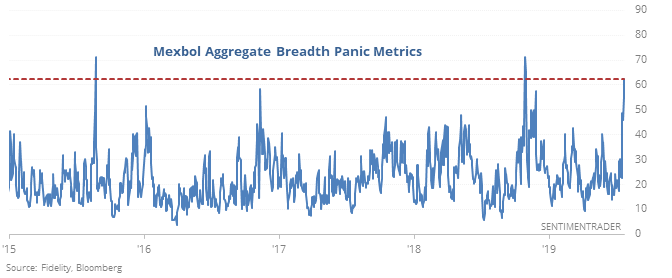

Pánico

Stocks in the Mexbol index have been hit hard, and it’s getting close to “puke” levels.

Few of them are trading above their averages, more are hitting new lows, and most of them are oversold and suffering quick, large losses. Over the past 17 years, this has been an indication of panic.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.