Investors in Big Tech ignore rising real rates

Key points:

- The price/earnings multiple on the Nasdaq 100 is at or near its highest level in a year

- So is the real rate on 10-year Treasuries, an unusual situation as the two series have an inverse relationship

- Precedents are few, but similar behavior preceded further gains for Big Tech

Tech investors are shaking off rising rates

We've looked at a handful of macro-doom indicators over the past few months. So far, none have come to fruition, which is more the rule than the exception. But hey, if you can nail that one time it works...

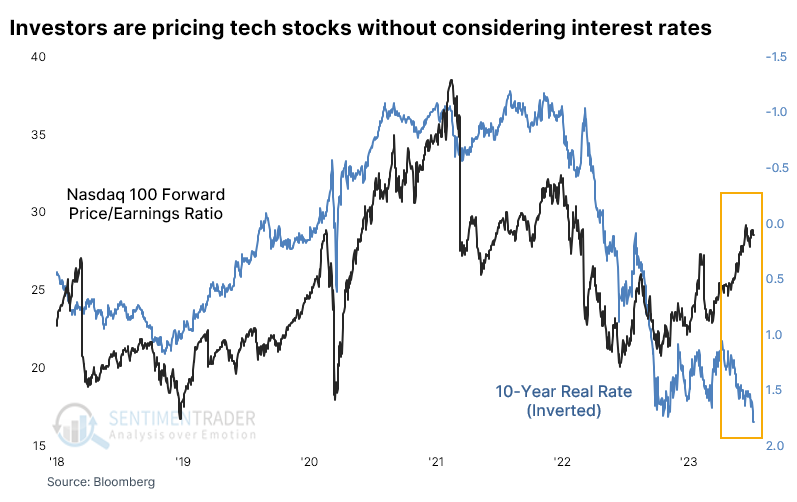

Thanks to a surge in big tech stocks, one of the increasingly popular charts floating around lately is their valuation, which has decoupled from the trend in the real rate on 10-year Treasury notes. Because most Technology stocks lose money, their valuations are often closely tied to real interest rates.

Even though real rates have jumped since April, tech valuations have grown. The chart below shows real rates inverted to better show the correlation between the two data series.

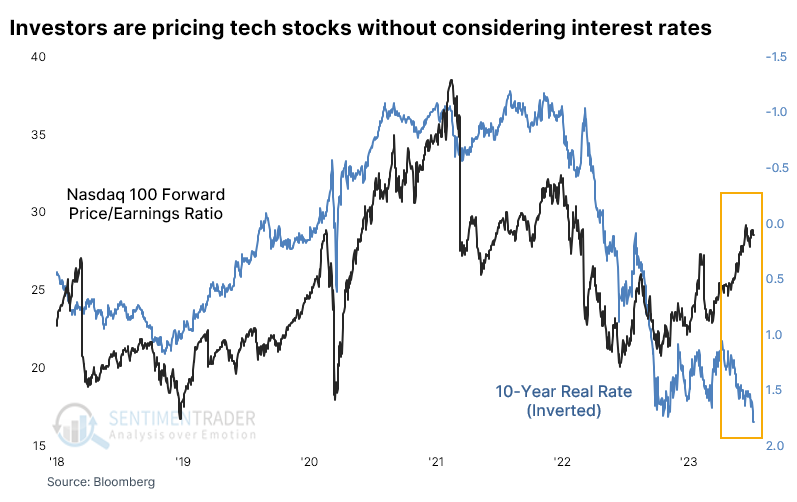

Over the past 20 years, the two series have had a negative correlation. It's not perfect by any stretch, but generally, when real rates rise, investors devalue the shares of money-losing companies. That's not happening now. The forward price/earnings ratio on Nasdaq 100 stocks and the real rate on 10-year Treasuries are both in the top 5% of their ranges over the past year.

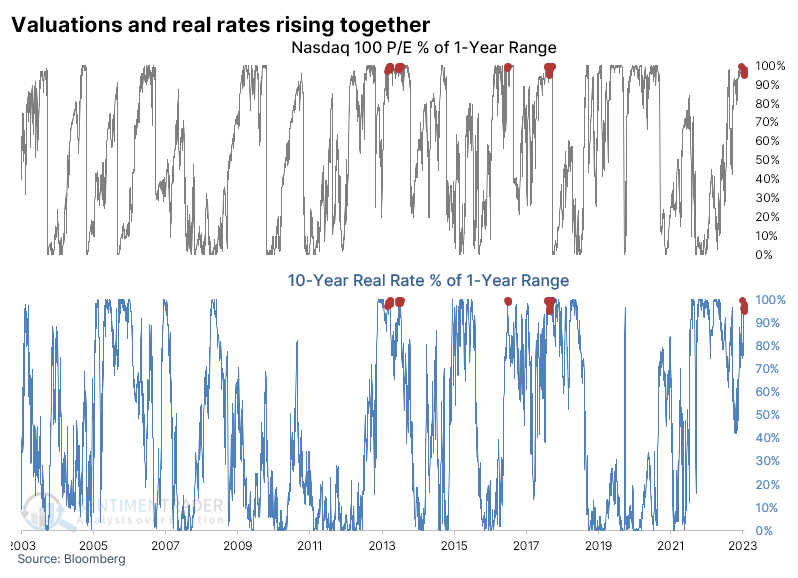

The red dots in the chart below show similar conditions. There aren't many.

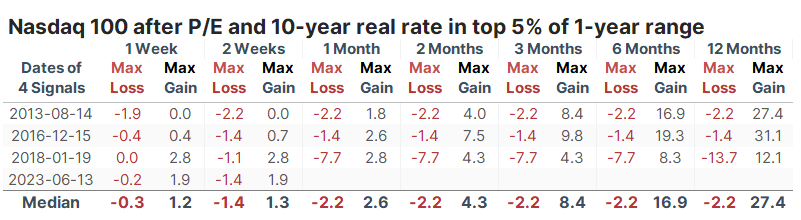

With a nod to the dangers of relying on minuscule sample sizes, the table below shows future returns in the Nasdaq 100 after the first of those red dots in a year. This first triggered a month ago, so we're already a ways in. And while short-term returns were iffy, medium- to long-term returns in the NDX were mostly good.

The table of maximum gains and losses across each time frame shows that none of the three precedents showed a loss greater than -7.7% at any point within the next six months, while all of them gained at least +8.3% during the same time frame.

What the research tells us...

There has been no shortage of reasons to sell over the past six months, and as stocks extend their gains, or at least don't lose them, the reasons will multiply. Valuations will get more stretched, and at some point, that will matter. It's important to fact-check whether the excuses are shared across social or traditional media. Most of the time, they simply parrot a viewpoint from someone with a vested interest. While we can't use a sample size of three to confirm any conclusion, we can say comfortably that selling big tech stocks simply because the valuation seems out of hand with interest rate trends would have caused an investor to lose out on gains every time.