Investors Have Soured on Stocks AND Bonds

Over the past couple of weeks, volatility has spiked, and optimism has plunged. That's true for stocks, and it's true for bonds. That puts investors in an unusual and uncomfortable place.

The two asset classes are supposed to (mostly) offset each other's worst qualities while not being too much of a drag during the good times. That's the whole concept behind the 60/40 portfolio balancing behemoth.

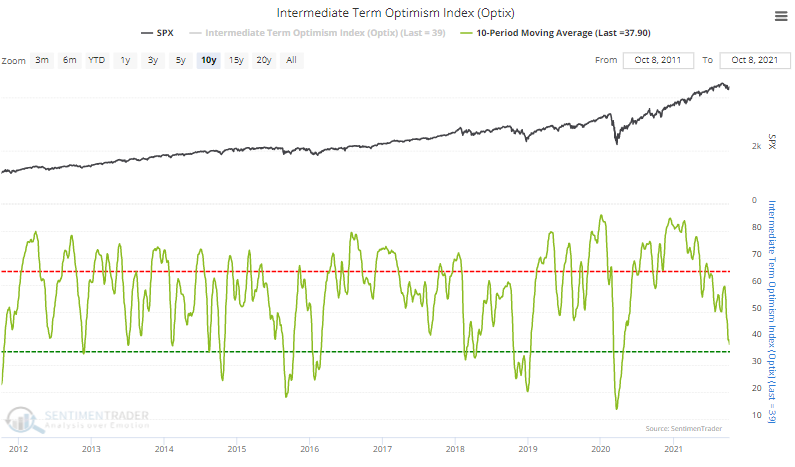

In recent days, sentiment has soured for stocks, and the 10-day average of the Medium-term Optimism Index is nearing a pessimistic extreme.

Curiously, investors have not sought the safety of the bond market. The 10-day average Bond Optimism Index has likewise dropped.

The average combined stock and bond optimism is now approaching 40% for one of the few times in the past 20 years. Typically, the markets balance each other, with investors moving to bonds when they're fearful of stocks and vice-versa. This is only the 2nd time in the past two years when optimism on both markets was so low.

What else we're looking at

- Full returns in a 60/40 balanced fund and risk parity index when both stock and bond optimism is low

- Returns in popular stock and bond ETFs after low optimism in both markets

- A look at the recent move in zinc and comparisons to past spikes

- A few reasons to focus on U.S. tech stocks

| Stat box The DBC commodity fund is working on its 8th consecutive positive week, nearing a record streak since its 2007 inception. |

Etcetera

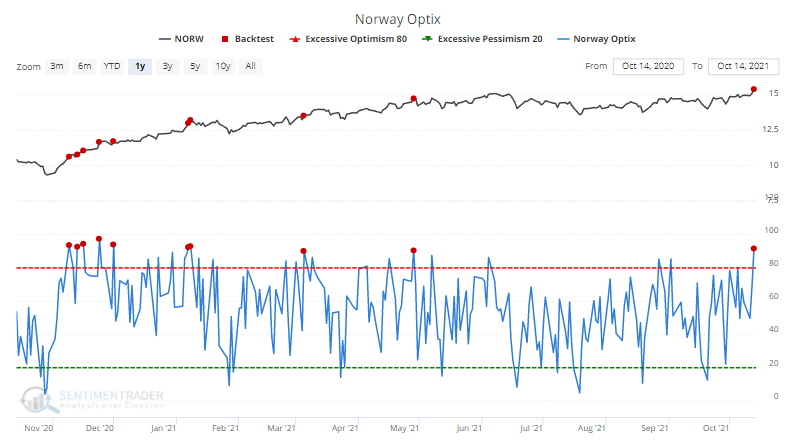

Norway way way up. Norweigian stocks have soared to new highs, and traders are looking for more. The single-day Optimism Index on the NORW fund moved above 90% for the first time since May.

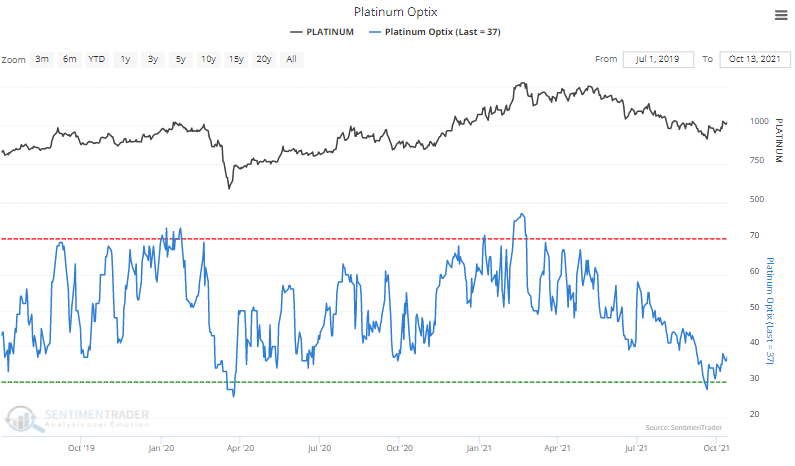

The other white metal. Commodity traders are feeling a bit more positive about platinum. The metal's Optimism Index dipped into extreme pessimism territory a couple of weeks ago for only the 2nd time in two years and has been rising modestly since then.

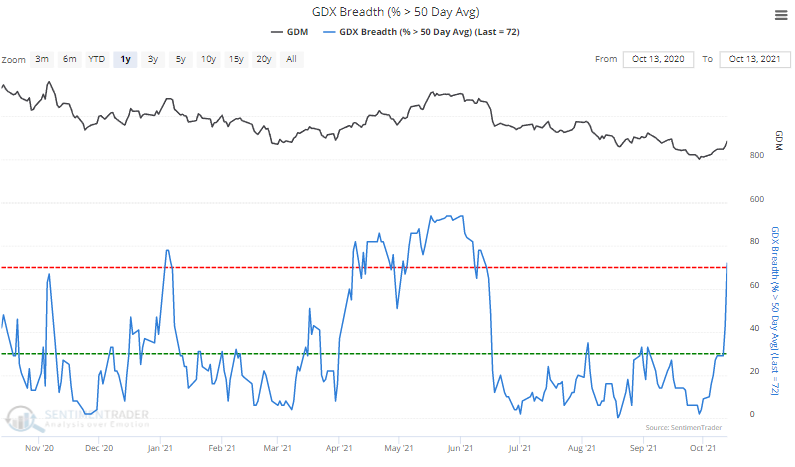

Major move in miners. More than 70% of gold mining stocks are now trading above their 50-day moving averages, the most since June.