Investors have been clamoring for the strongest stocks

Investors have been piling into stocks, at least judging by the major indexes hitting continual new highs for this recovery.

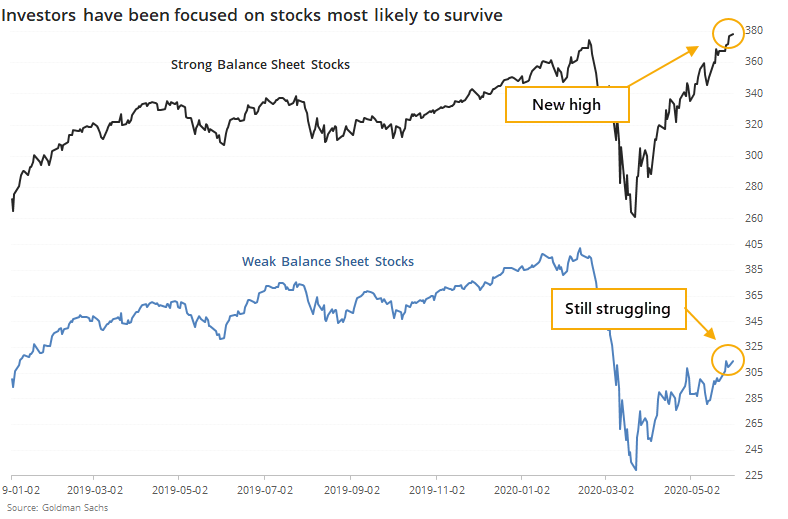

Not all stocks are created equal, and investors have seemingly been focused on those stocks most likely to survive the shakeout currently in progress. An index of stocks with strong balance sheets just hit a new high, fully recovering from the pandemic decline. Those with weak balance sheets are still struggling.

Per Goldman Sachs:

"Our Strong Balance Sheet basket identifies 50 S&P 500 companies across eight sectors with strong balance sheets. We use the Altman Z-score to measure balance sheet strength. The Z-score is a weighted sum of five financial ratios and was originally developed to forecast bankruptcies.

Our Weak Balance Sheet basket identifies 50 S&P 500 companies across eight sectors with weak balance sheets ... As the credit environment tightens, these firms will be less likely to have access to funds needed to invest in growth."

We can see the huge disparity between them below.

The data for these only go back to 2006, so history is limited. In those 14 years, there has never been a time when strong balance sheet stocks reached a 52-week high while weak ones were more than 10% below their own high. There was never a time when they hit a high and the S&P 500 was more than 5% below its high, either.

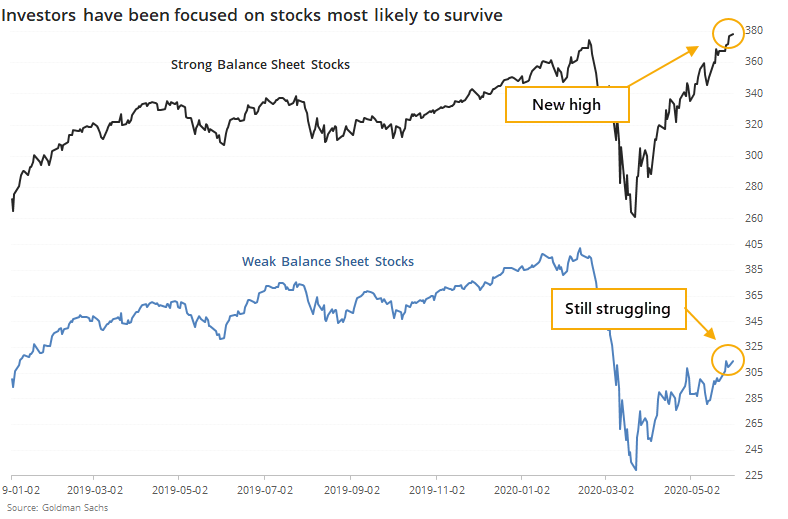

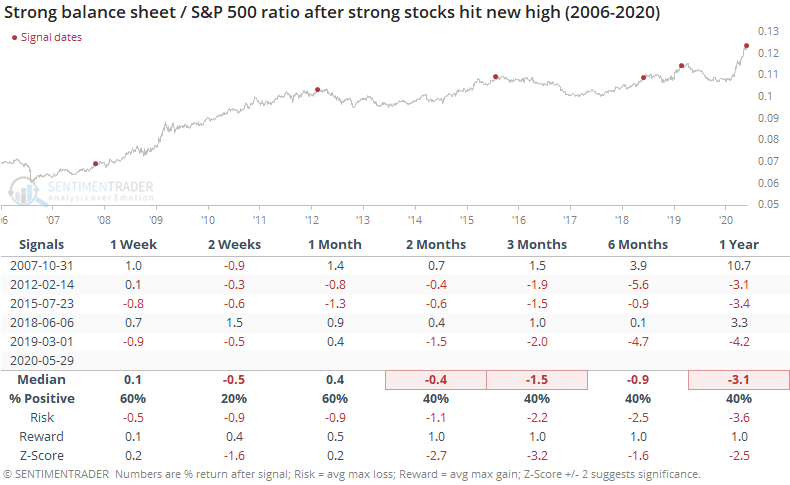

If we look for times when there was a smaller divergence, when both the S&P and weak balance sheet stocks were more than 1% off their highs while strong balance sheet stocks broke out to the upside, it hasn't necessarily been a great sign.

The S&P showed a negative return at some point over the next 1-3 months every time. Again, the sample size is tiny and history is limited, so we can't put too much weight on this, but it looks to be a modest short- to medium-term negative.

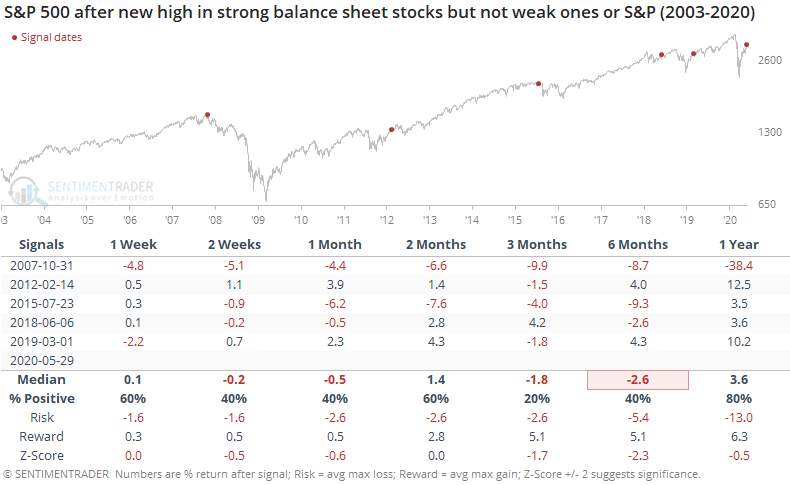

On a relative basis, strong balance sheet stocks had a mixed record relative to weak balance sheet stocks, but over the next 6 months, they underperformed (suggesting that investors shifted toward stocks with weaker balance sheets as stocks).

After leading as they have, strong balance sheet stocks had a mixed-to-poor record at continuing to outperform the broader market.

Across most time frames, strong balance sheet stocks showed only a slight outperformance at best against the S&P 500.

Overall, we're limited by a small sample and limited history, but the recent preference for stocks with strong balance sheets looks to be a minor negative for the broader market over the medium-term, but that's about it. By the time it has reached this stage, the strong balance sheet stocks have become stretched relative to their opposites, and the broader market, and had a tendency to underperform.