Investors go all in as insiders fold

It hardly seems effective to outline yet more extremes in sentiment. We've noted them repeatedly since January and yet here we are at new highs.

Momentum has been everything, with massive thrusts across industries and even global indexes. And we're still not seeing any major risk warnings due to persistent internal weakness.

So at the risk of tilting at even more windmills, I'd like to at least touch on a few extremes because it's either something we've noted before or because it's just remarkable.

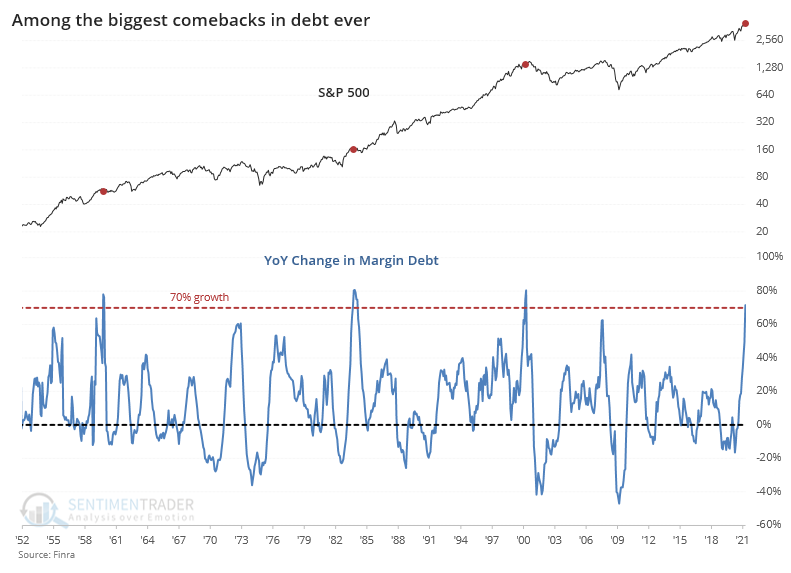

A month ago, we estimated that margin debt would rise enough in March to push its year-over-year change to 73%. It didn't quite pan out that way, as the growth ended up being "only" 72%.

This is the 2nd-highest rate of growth in 35 years, though as noted before, relative to the growth in the S&P 500, it's been hovering around 20%, which isn't as extreme as 2000 or 2007.

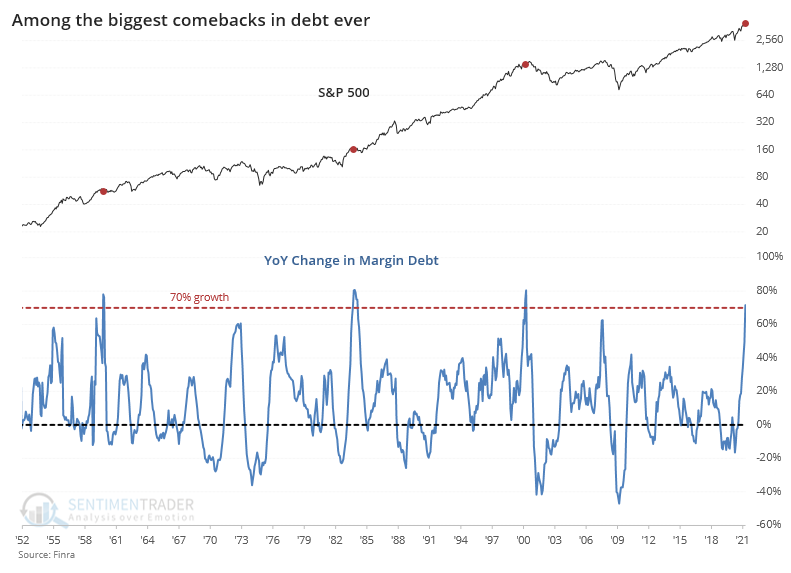

All of this optimism has pushed the Risk Appetite Index to one of its highest levels in several years over a 5-day period. This indicator measures market behavior like credit spreads, equity and foreign exchange volatility, gold prices, and sector relative performance (such as between defensive sectors like utilities and economically sensitive sectors like financials).

The last time the Risk Appetite Index reached this high of a level, it didn't precede anything nefarious for the S&P, similar to what we saw in 2017. Those reactions tend to be the exceptions.

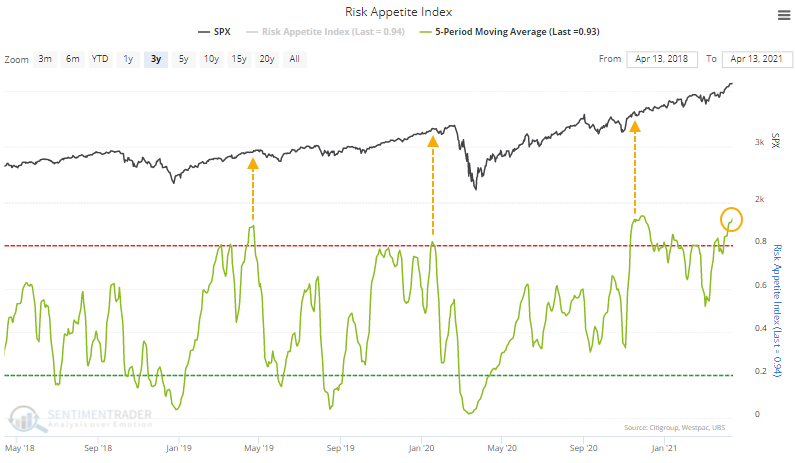

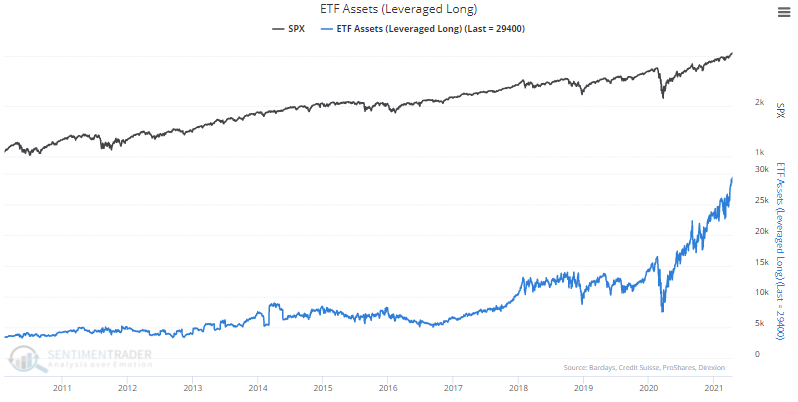

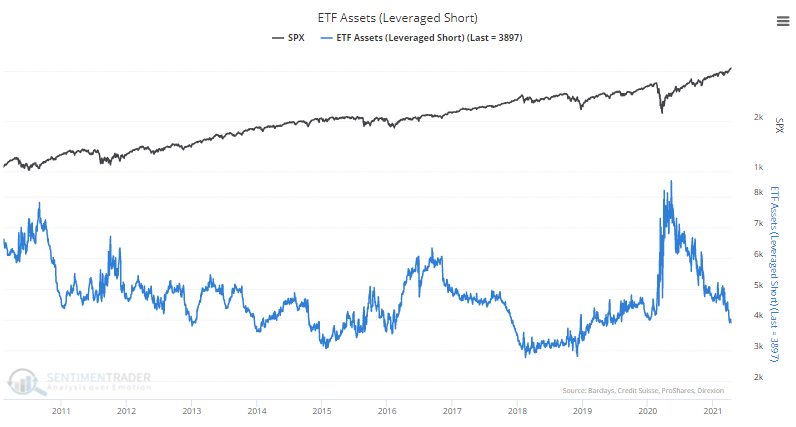

ETF traders are fully embracing this appetite for risk by pushing assets in leveraged long funds to record highs.

At the same time, they're abandoning leveraged inverse funds (this is a combination of fleeing assets and eroding values).

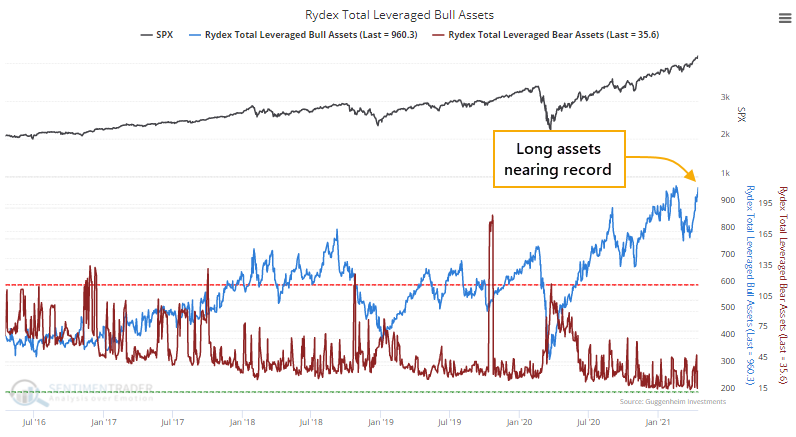

The same behavior can be seen among market timers using the Rydex family of mutual funds, with leveraged long index fund assets approaching a record high and leveraged inverse assets getting perilously close to zero.

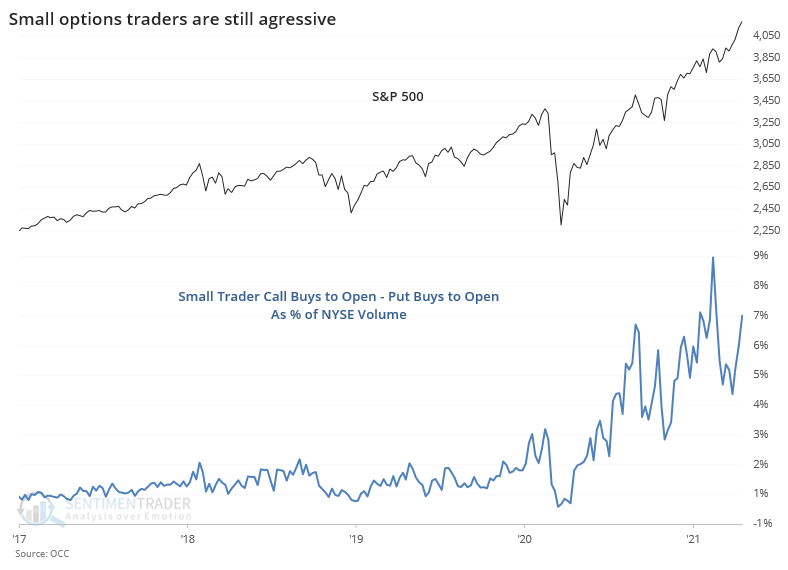

The smallest of options traders, those trading 10 contracts or fewer, have rebounded as a relative influence. The number of speculative call options bought to open, minus protective put options bought to open, is jumping again. This remains 2 to 3 times any other extreme in 20 years, prior to the last year. It's also higher than the euphoric spike from late August 2020 but is still below the highest point from early February of this year.

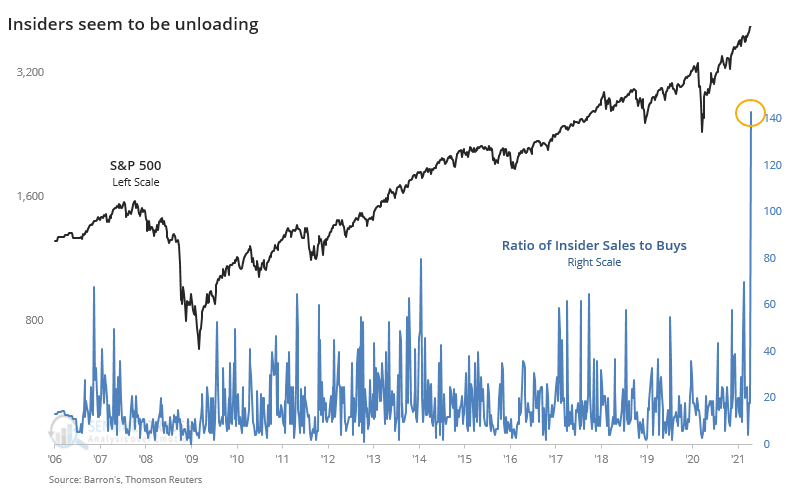

At the same time that investors are feeling so euphoric, corporate insiders appear to be selling. A weekly ratio of insider sales to buys as computed by Thomson Reuters skyrocketed to an astounding 143-to-1, the highest in the weekly readings as reported by Barron's in at least 16 years.

Maybe the latest week's reading is being skewed by particularly small volumes thanks to the quiet periods surrounding Q1 earnings announcements. It's so extreme that it almost seems like a data error, though other data seems to confirm low interest among insiders, even if not as extreme.

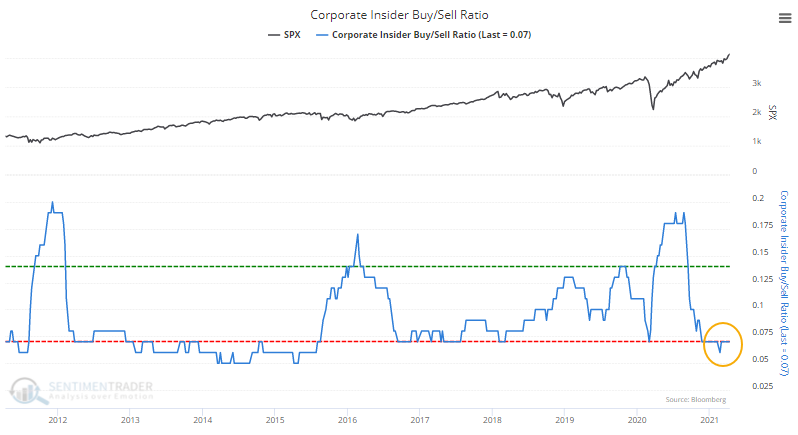

The Corporate Insider Buy/Sell Ratio remains near a decade low. While spikes in insider buying vs. selling is a much more consistent buy signal for stocks than a drop is as a sell signal, it would be better to see this at least in neutral territory.

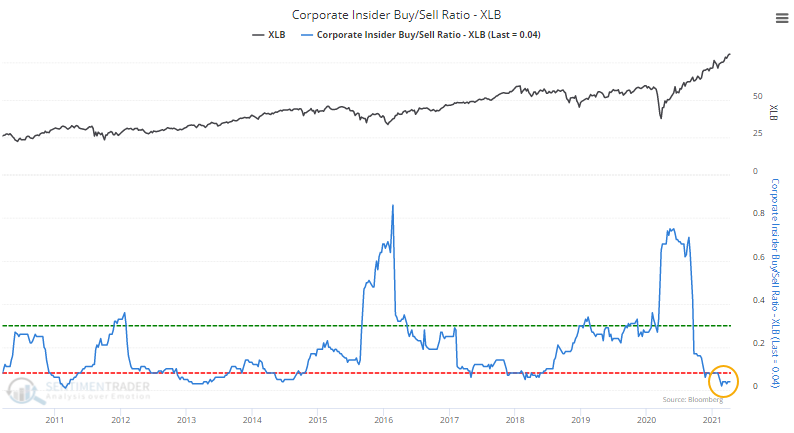

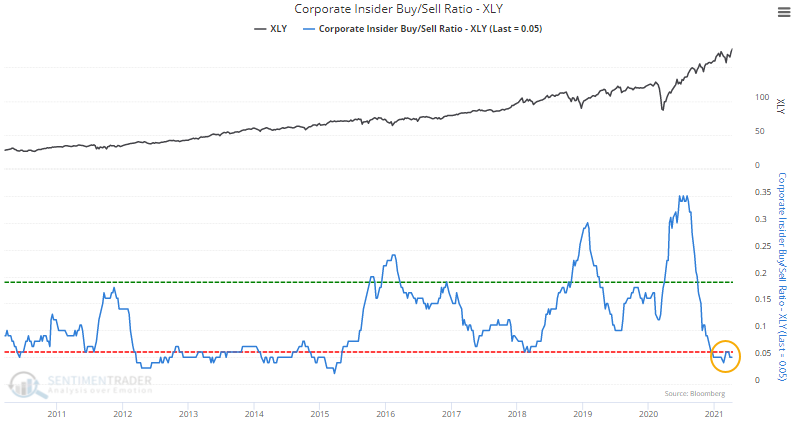

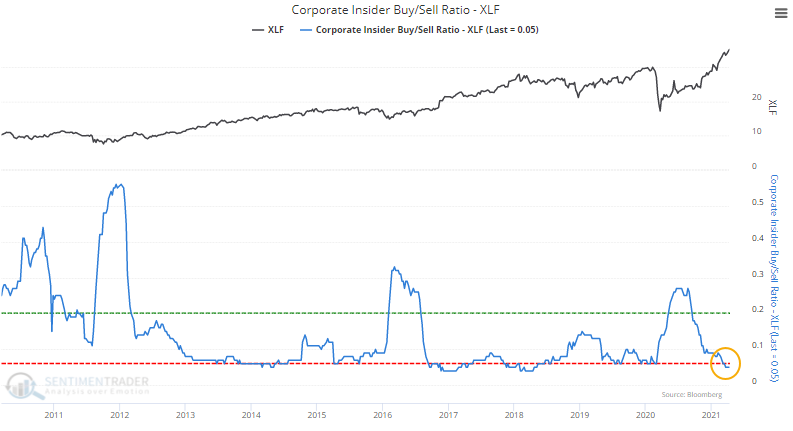

Among sectors, insiders have shown the least interest in adding to positions in Materials, Discretionary, and Financials.

We continue to see a type of tension that hasn't really happened before. Many of the measures related to thrusts, momentum, and breadth, are the types that only trigger during the initial phase of a multi-year bear market recovery. But most of the sentiment-related measures have generated signals that typically only trigger near the ends of multi-year bull markets.

A typical market response to lesser conflicts has been choppy conditions in major indexes, with further gains eventually given back. That's been the outlook for a while and seems like it's continuing.