Investors get comfortable trading stocks on their own merits

It's a truism of markets, lasting decades if not centuries, that when investors panic, they sell everything together. When they're comfortable, they buy and sell securities on their individual merits.

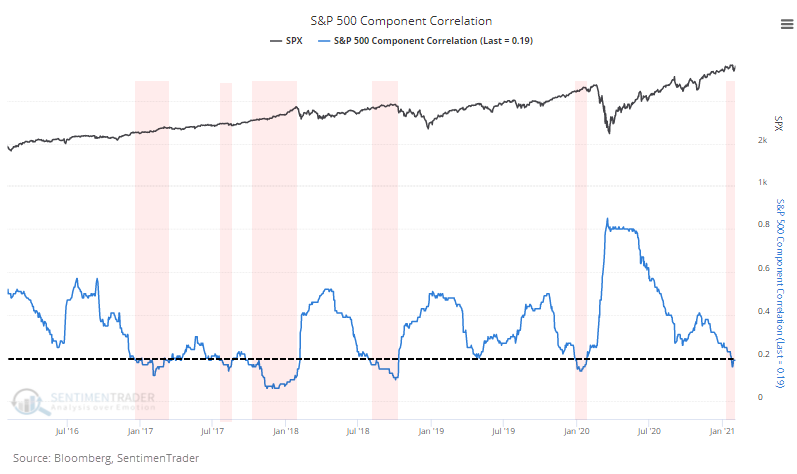

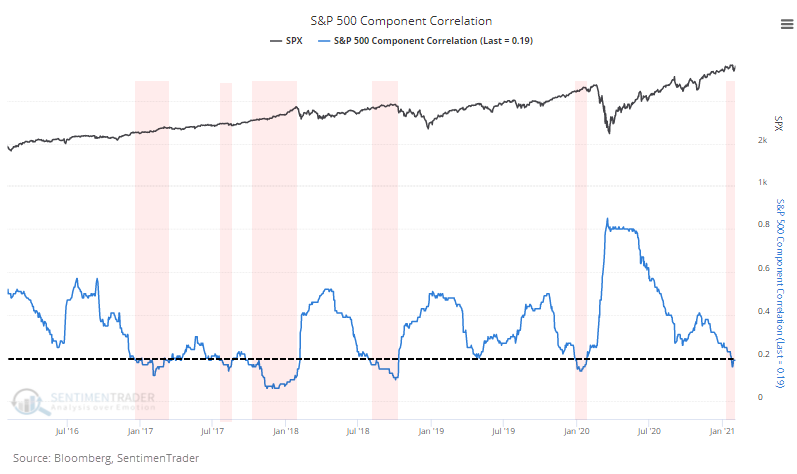

That's why we see correlations among stocks and other assets rise during times of anxiety and fall during periods of complacency. This is notable now because the correlation among stocks in the S&P 500 has plunged to the lowest level in over a year.

Correlations have gyrated in a wider range in recent years, so we can transform the data series above into a z-score. This compares the current reading to the average over the past year and adjusts for the standard deviation among those readings. This measure dropped below -1.5 in late January and has stayed right around that level.

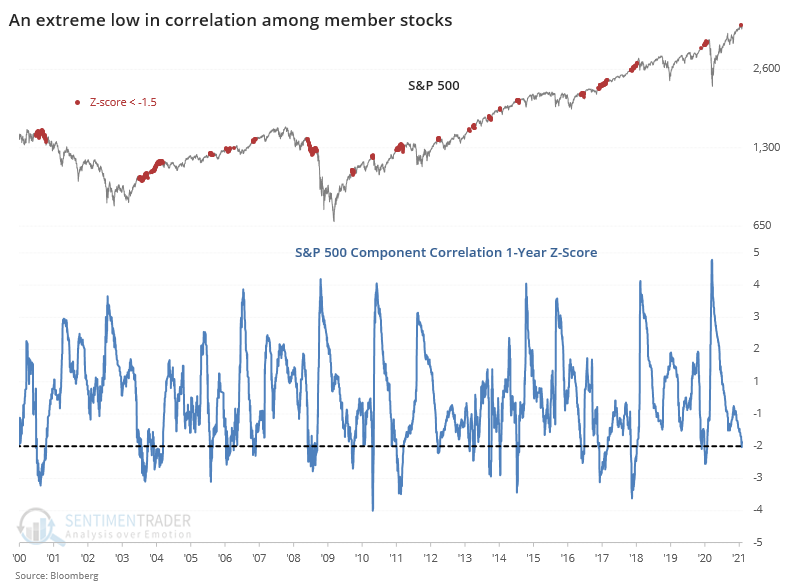

When the S&P 500 has been at or near a high and the correlation z-score drops below -1.5, the index has had some trouble holding its momentum.

Over the next 3-6 months, it sported a negative average return. During the next 6 months, its average risk (maximum decline) was -8.5% while its average reward (maximum advance) was only +5.9%. It was also significantly more likely to see a big drop versus a big rise within those 6 months. See this Knowledge Base article for more details about the terms in the table.

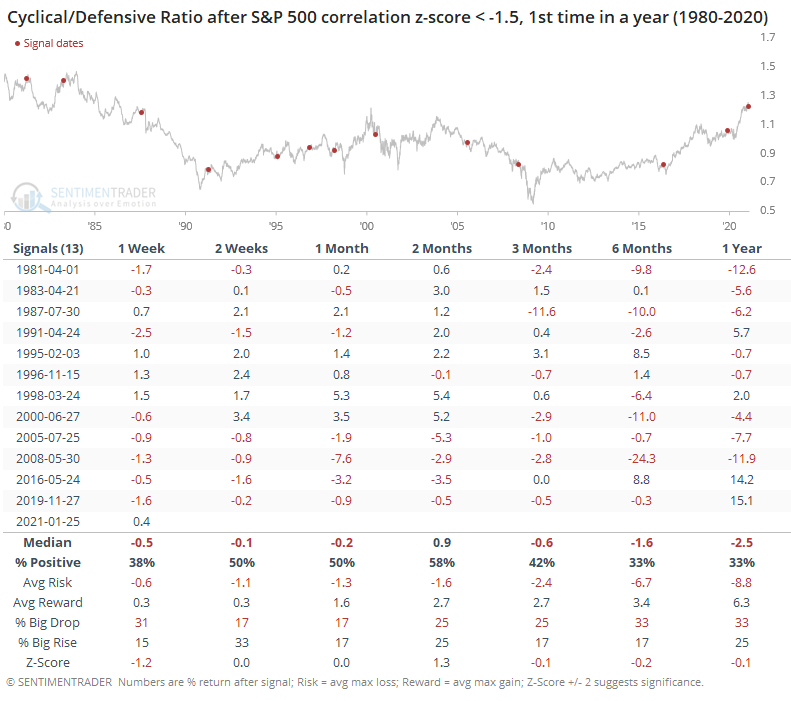

Looking at some factor ratios, cyclical stocks tended to underperform defensive ones after these signals.

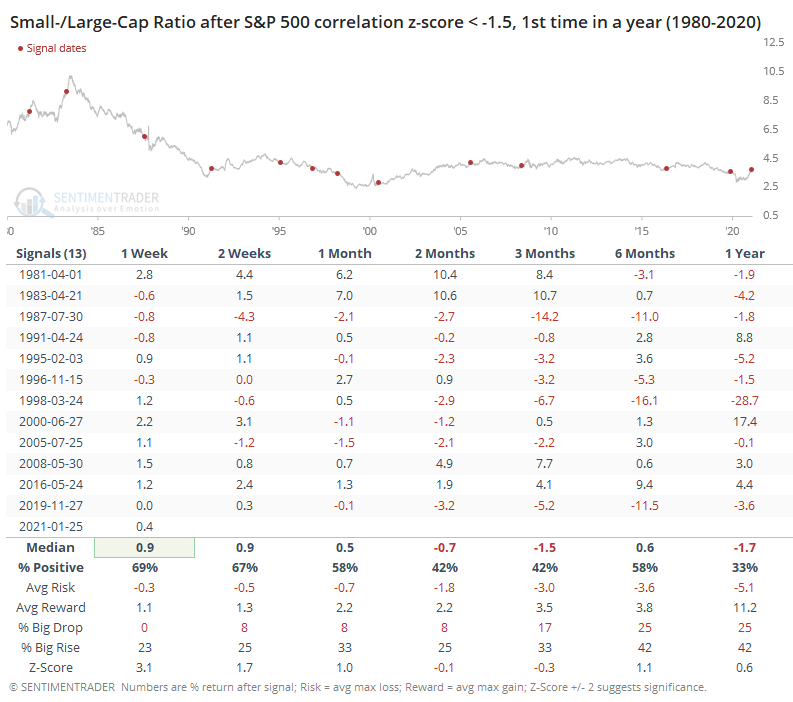

Small stocks underperformed large ones.

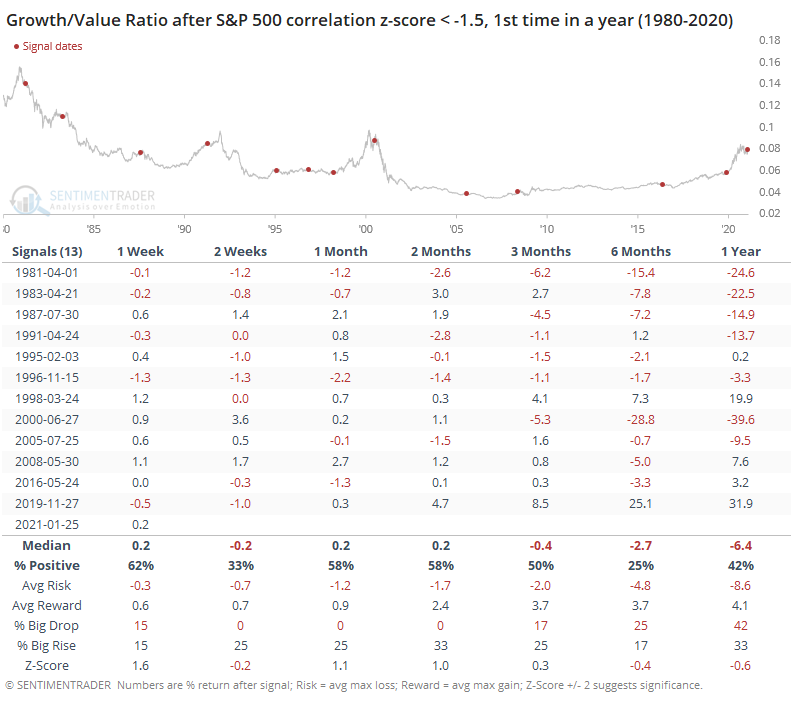

And growth underperformed value, though that last signal was a doozy of an exception.

There is no shortage of signals that most investors are somewhere on the spectrum between complacent and euphoric, perhaps even manic. This can go on for a while, but we've been seeing some cracks under the surface that bear watching. A hyper-speculative environment that's coupled with decaying internal momentum is a recipe for weeks or months of high risk.