Investors flood into precious metals, flee emerging markets

Investors have been loving precious metals. Emerging markets not so much.

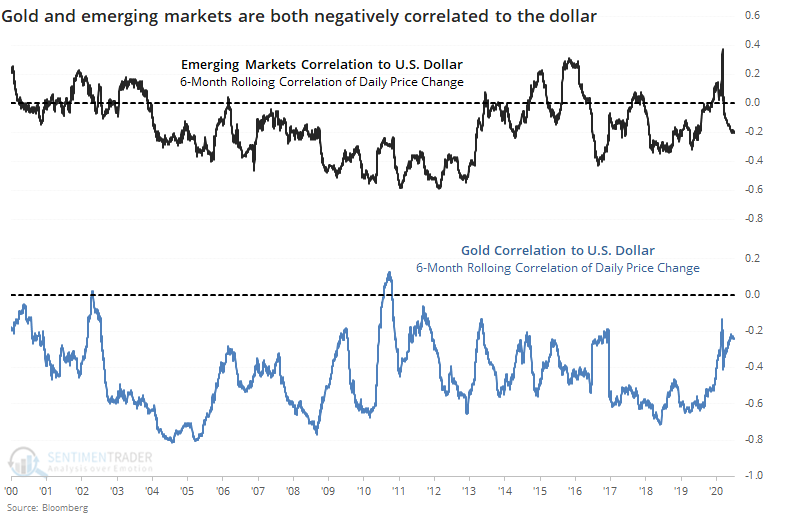

Both markets tend to move with the dollar, so it seems odd that investors would favor one so highly over the other. Over the past 30 years, both markets show a consistent negative correlation to the dollar. Generally, the correlations move together - if the dollar is influencing emerging markets, then it's usually influencing gold, too.

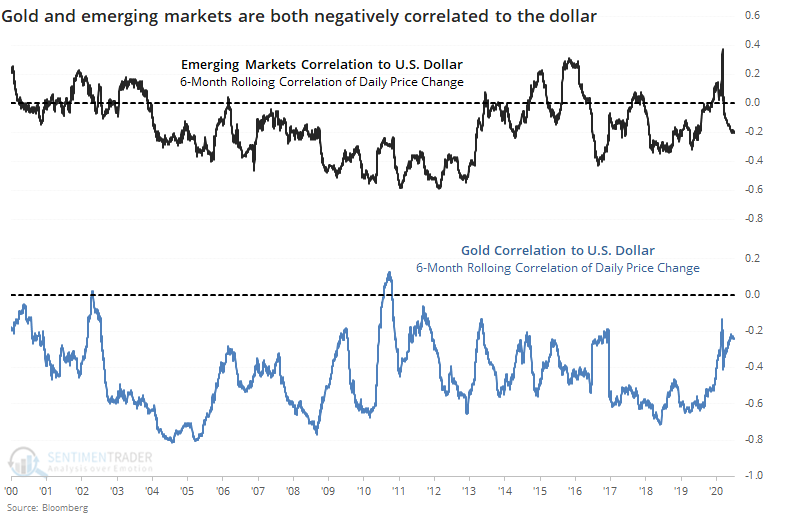

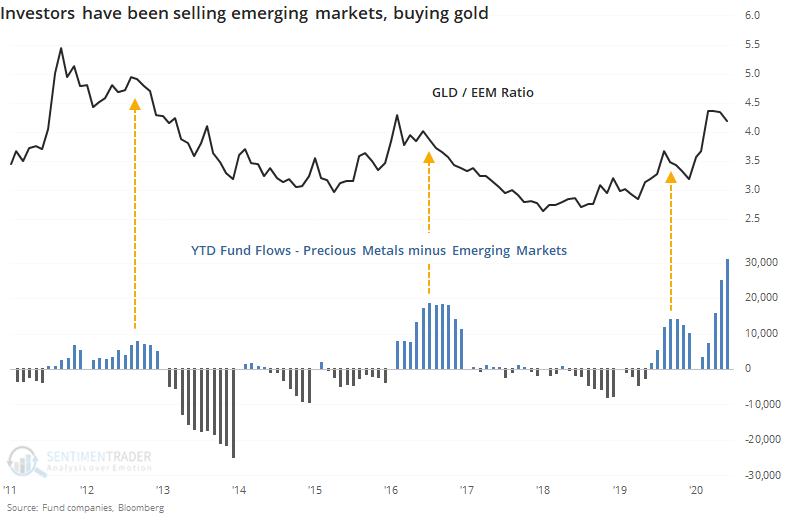

Even though both gold and emerging markets have been on a tear, so far this year, precious metals funds have taken in more than $25 billion, a decade-long high.

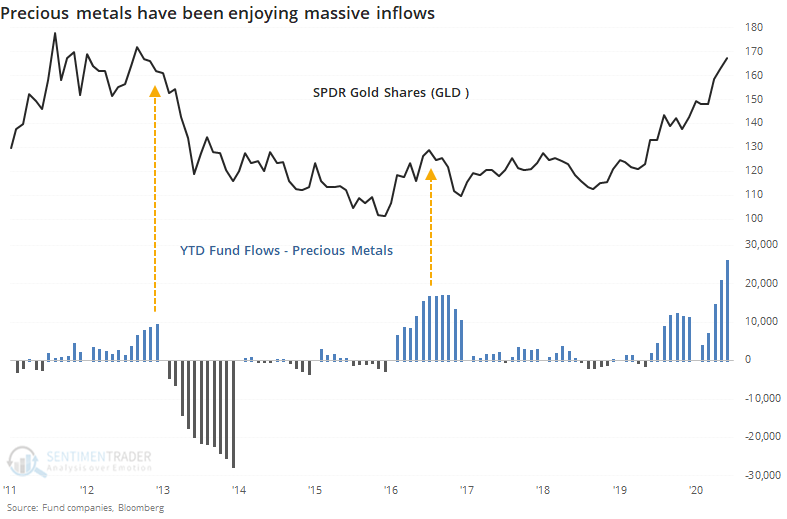

The flow into emerging markets is at a record low. Halfway through the year, the outflow from these funds has already surpassed the worst year-to-date flow from 2013.

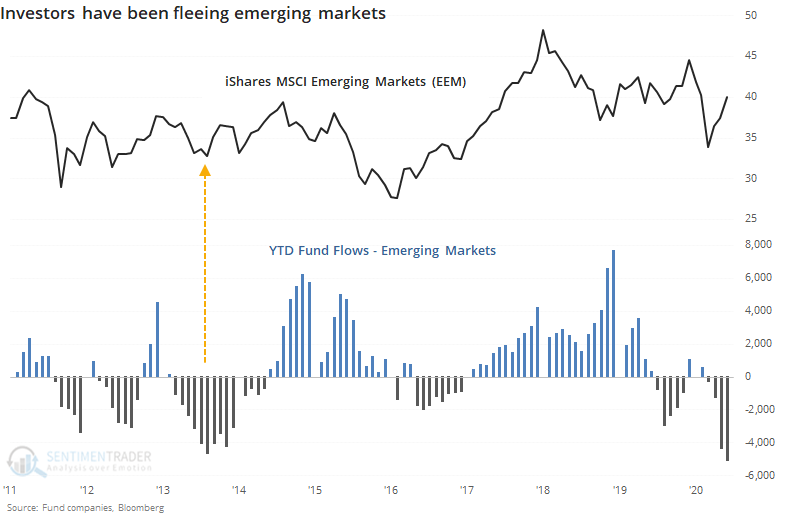

If we combine the flows and look at a ratio of GLD to EEM, then we see the following.

Because flows into precious metals fund swamp those in emerging markets, the spread is much more heavily influenced by the former. Still, we can see the spread has never been higher - investors have never plowed so much money into gold relative to emerging markets.

The big question is whether it matters. The other times there was a large spread between flows into the two markets, the ratio of GLD to EEM fell back in the months ahead. When there was a large flow out of metals and into emerging markets, then the ratio rebounded. While history is short and precedents are few, it's a modest suggestion that investors may have tipped too far toward metals when the dollar is likely to influence both to some degree.