Investors decide that hedging is for losers

With stocks on a persistent rip higher, what's the point in hedging? Investors seem to be asking themselves that more and more.

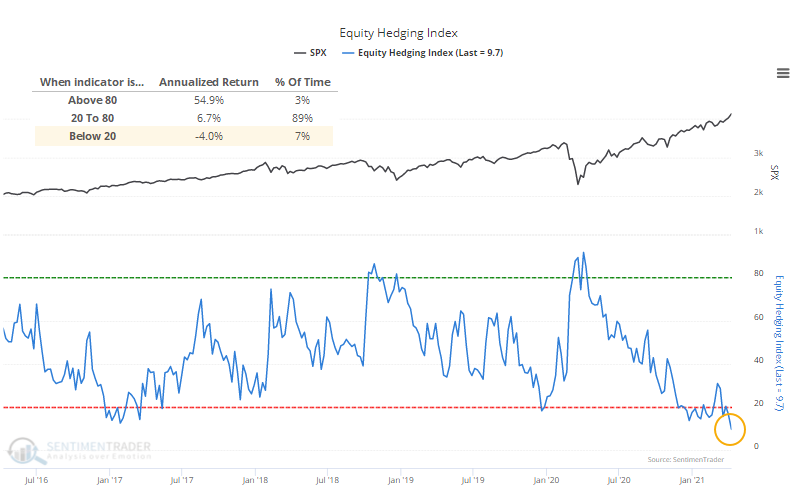

Last week, our Equity Hedging Index (EHI) dropped below 10 for one of the few times since we began calculating this nearly 20 years ago.

There are many ways in which an investor can hedge against a stock market decline. The EHI tracks 6 of the most common factors and compares the current level to its historical average. The more each indicator shows hedging activity, the higher the Equity Hedging Index will be.

This is a contrary indicator, meaning that the higher the Equity Hedging Index is, the more likely stocks will rally going forward; the lower the Equity Hedging Index, the less likely stocks will rally, which we can see from the annualized returns in the chart below.

In that entire history, there have been only 9 other weeks with an EHI as low as this according to our Backtest Engine. All of them preceded weak medium- to long-term returns.

Last week, we saw the highly unusual - perhaps unprecedented - situation of massively positive medium- to long-term breadth thrusts not just among individual stocks, but also industries, sectors, and global indexes. This is happening despite many warnings from extended sentiment readings like the Equity Hedging Index. We've never really seen such a large and protracted tension like this.

| Stat Box For the 1st time in its history, the SPY fund has closed above its open and had a higher intraday low than the prior day, for more than 10 consecutive days. This beats prior long streaks in 2013 and 2017. |

What else we're looking at

- Full returns after extremes in the Equity Hedging Index

- What the EHI looks like over a 20-week period

- A very obscure - and very long-term - buy signal in the S&P 500

- When to turn defensive using participation within the S&P