Investors continue to shy away from debt

Signs of speculation are pretty easy to spot across markets, but it's not like every single indicator is showing the same thing. Some are showing apathetic sentiment or even pessimism, like fund flows and isolated surveys.

One of those showing apathy is margin debt. The rising horde of retail traders has turned much more toward the options market to get its kicks than borrowing against rising stock balances.

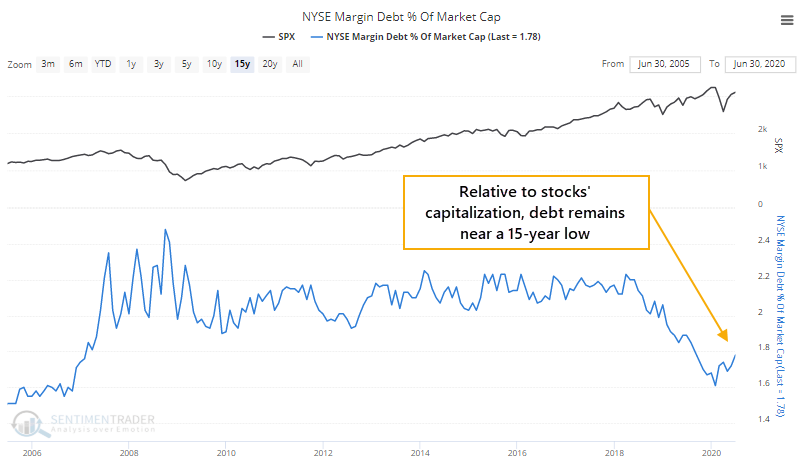

While investors have taken on more margin debt in recent months, as a percentage of the total capitalization of U.S. stocks, debt remains near a 15-year low.

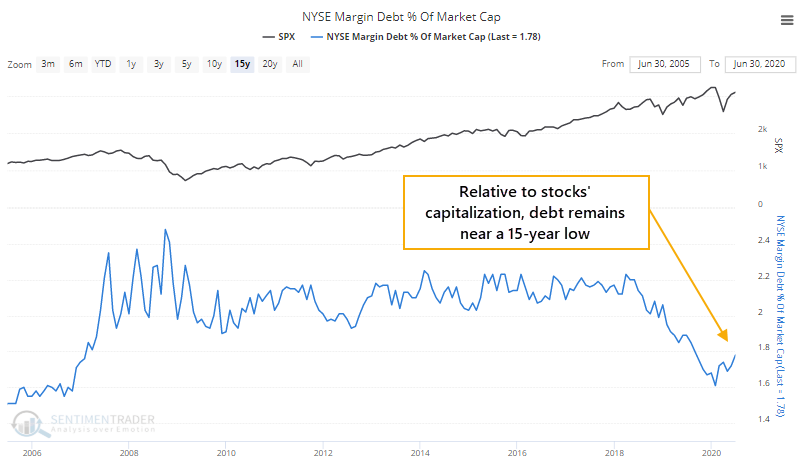

Over the past year, growth in margin debt has trailed growth in the S&P 500 by more than 7%. This is the polar opposite of bubble peaks in 2000 and 2007 when the growth rate of debt exceeded the growth in stock prices by more than 50%.

This has been a consistent theme for years. In 2000 and 2007, we saw tremendous, and sudden, growth in borrowings against stocks, but it's been entirely absent since then, at least relative to the growth in the market.

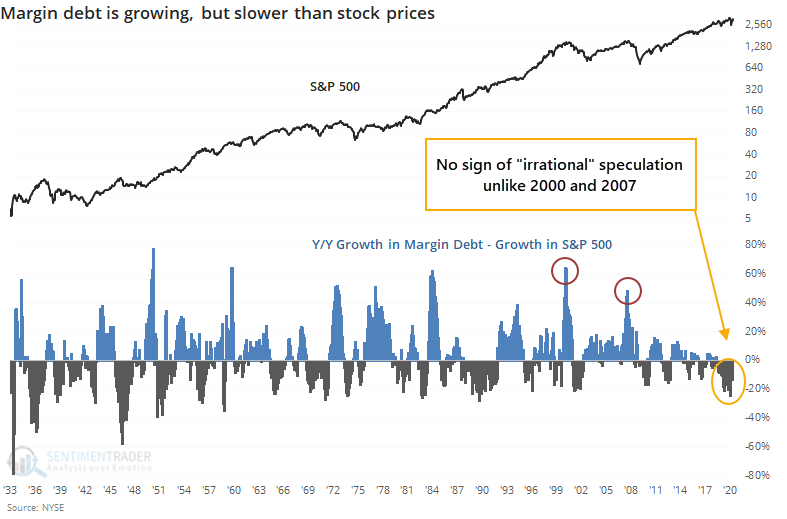

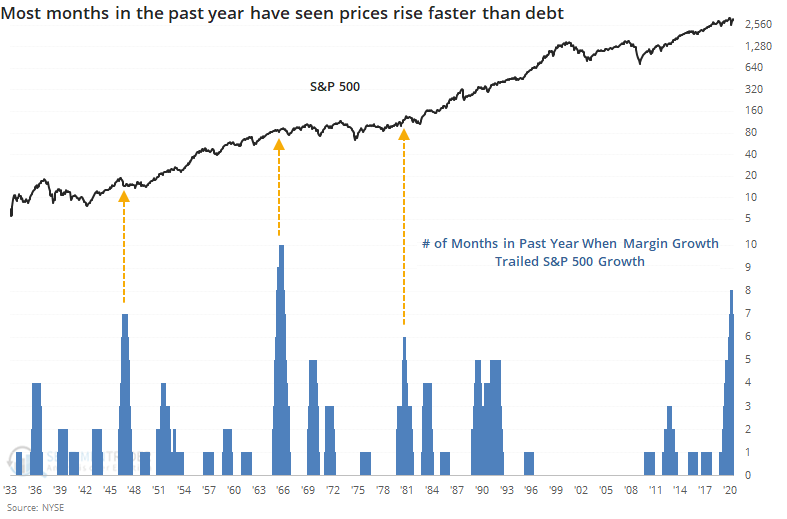

The year-over-year change in margin debt has trailed the change in the S&P 500 for 7 out of the past 12 months, ranking among the most apathetic periods since the 1930s.

While theoretically, it seems like this should be a long-term positive for stocks, other periods like this were not necessarily so. When there were extended periods of lagging margin debt in the 1940s, 60s, and 80s, stocks languished for months on end before finally taking off again.

As the manager of a direct brokerage margin department in the 1990s, on a daily basis, I saw firsthand the emotions that go into client decisions about debt borrowed against their stock holdings. On an aggregate basis, though, using this data has proved to be a challenge. The best uses of the data occur when there is a massive growth in debt, especially relative to growth in stocks. That hasn't been the case for over a decade. Currently, the apathy shown in this data might be considered a very slight positive, but even that is a stretch.