Investors Are Rotating Out of S&P Stocks Into Small Caps and Tech

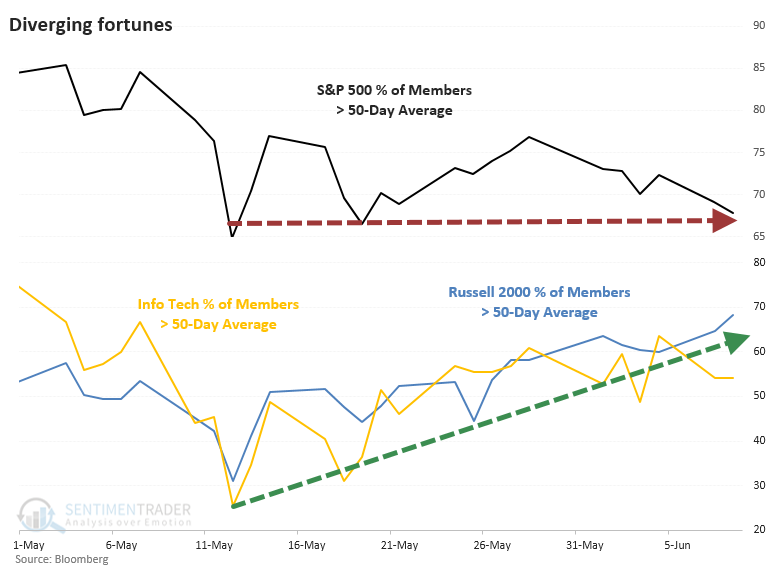

Over the past few weeks, there has been a remarkable rotation under the surface.

Since some riskier stocks took a mini-tumble into early May, many of them have stormed back. On May 12, only 31% of stocks in the Russell 2000 were holding above their 50-day moving averages. In the Info Tech sector, only 25% of stocks were above their averages. Both have seen participation more than double since then, while the S&P 500 has stagnated internally, as pointed out by the esteemed Liz Ann Sonders.

A SEA OF RED FOR THE S&P

The big question, as always, is "so what?"

Bulls want to believe that the S&P 500 is just treading water and about to head higher, preceded by increasing risk appetite from investors moving into high-beta stocks. Bears will argue that stagnation is a sign of indecision and chop, something usually seen at peaks.

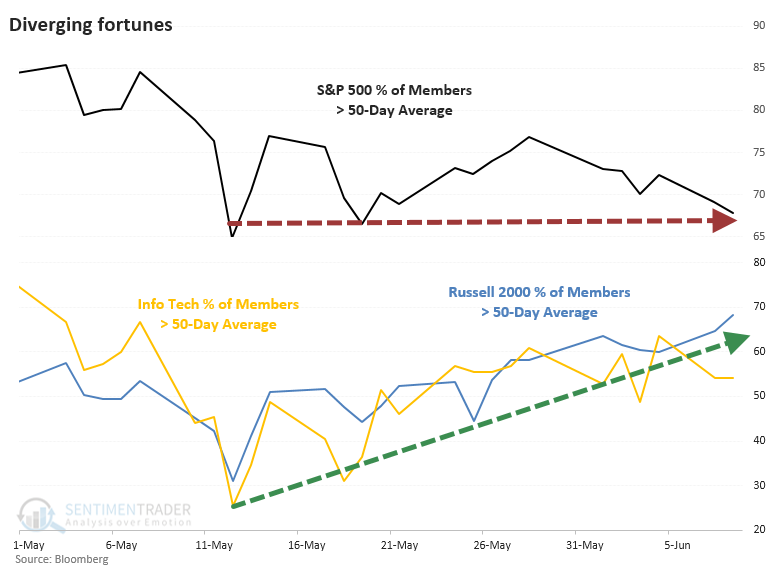

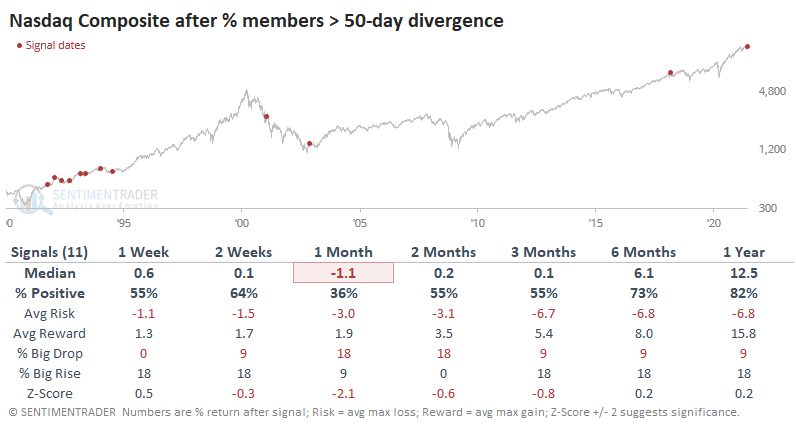

Looking at available history, bears have the more compelling evidence on their side, depending on the index and the time frame. The table below shows the S&P 500's future returns when its percentage of members above the 50-day average rises less than 12.5% over a multi-week period while the percentage of members above their averages in Small-Caps and Tech rises more than 25%.

For the S&P, this was a horrible sign. Over the next two months, it managed to rally only twice out of eleven attempts, and both of those crapped out soon after. Weakness was mostly confined to the first couple of months after these signals; over the next 6-12 months, the S&P fared well except for 2001.

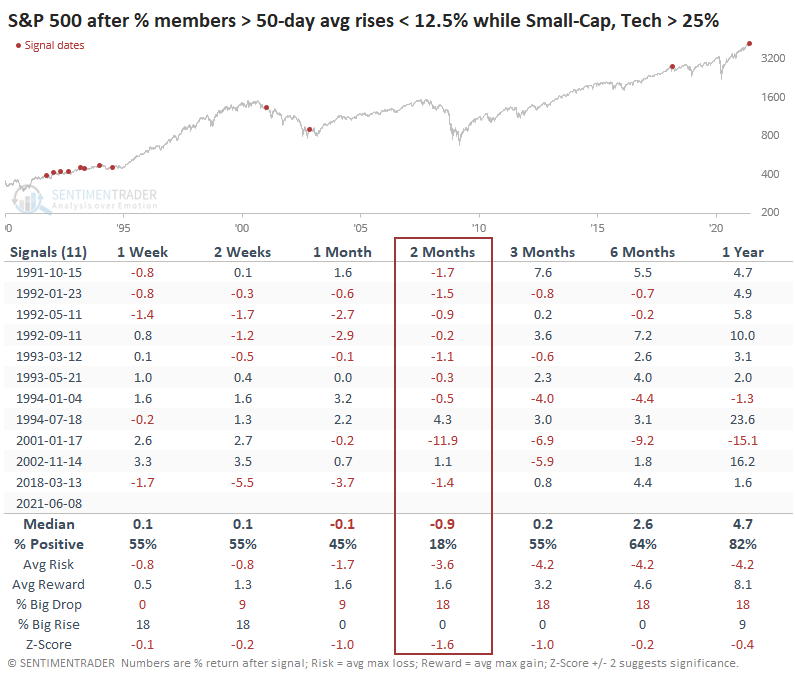

For the other two indexes, however, it wasn't as ominous.

While its future returns weren't great, the Russell 2000 did rally most of the time. The Nasdaq showed poor performance during the next month, then mostly worked higher.

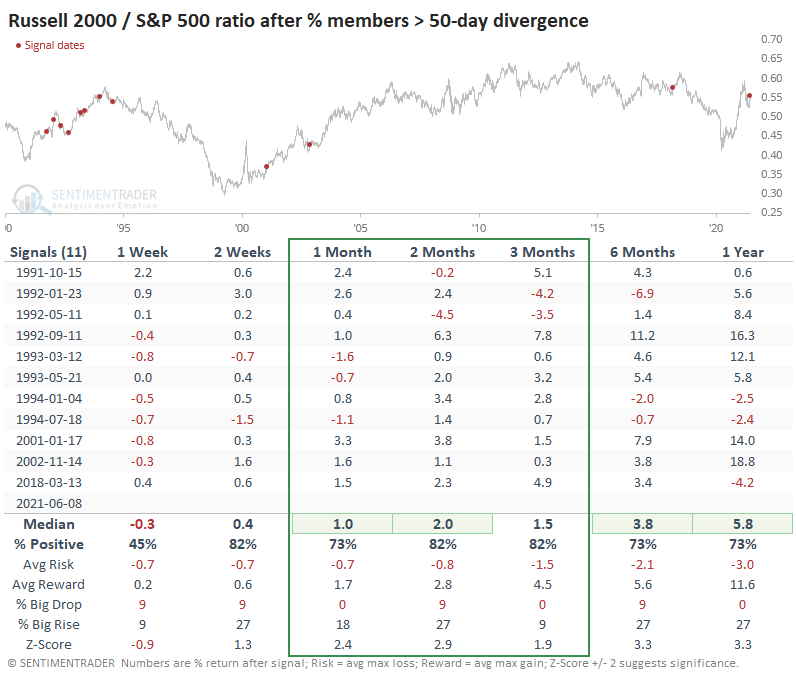

THE RATIOS ARE KEY

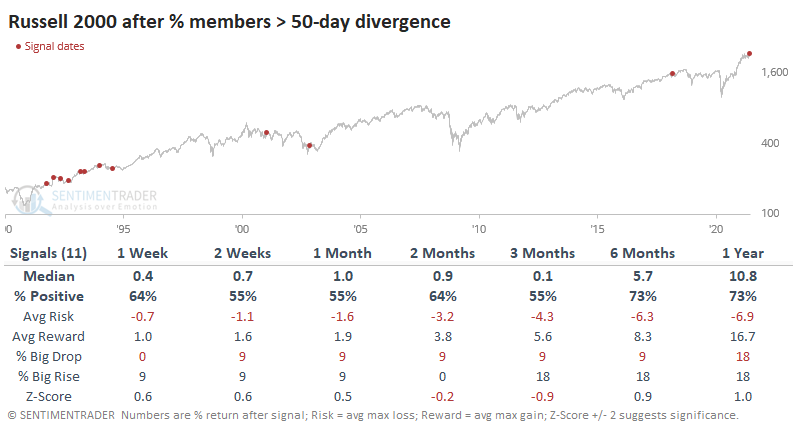

When we look at the ratios between indexes, that's where this turns interesting. Looking at future returns between the Russell 2000 versus the S&P 500, there was a clear bias toward Small-Caps.

The ratio between the two indexes consistently - and significantly - rose over the medium- to long-term. The Russell showed impressive outperformance over almost all time frames and nearly without exception.

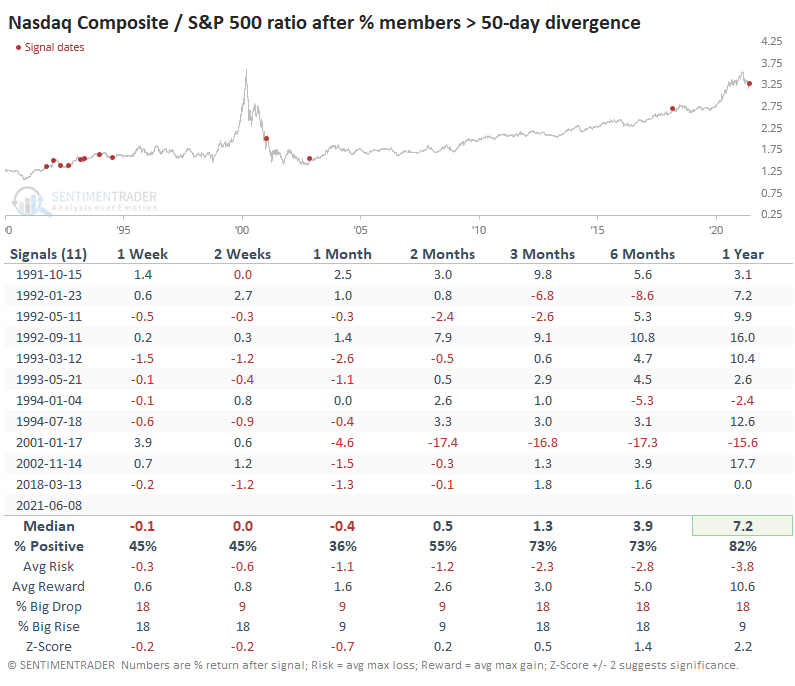

The Nasdaq Composite showed some shorter-term weakness but improved longer-term.

The biggest oops was when this scenario popped up early in 2001. The post-bubble puke wasn't yet finished, and anyone relying on this positive divergence in breadth between indexes would have suffered terrible losses, absolutely and relatively.

Overall, though, the suggestion is clear that this kind of internal divergence between the types of stocks within each of the three indexes favors recent trends. That suggests that while it is a negative sign for the broader market, investors may find some relative solace in the very stocks that have been holding up best, particularly Small-Caps.