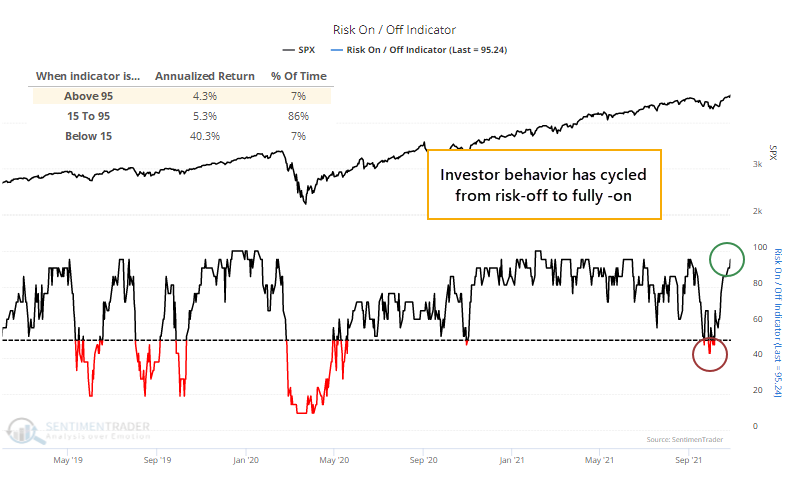

Investor Behavior Cycles Back to Full Risk-On Mode

Investors are fully back in risk-on mode.

By early October, stocks had been mired in the longest pullback in over 200 days, finally ending some long momentum streaks, and risk appetite was declining fast. For the first time since the pandemic, the Risk-On/Risk-Off Indicator fell below 50% on consecutive days.

None of those were cause for concern. Historically, buyers have returned quickly after momentum and risk-taking behavior had been so strong, for so long.

RISK-ON MODEL RISES ABOVE 95%

Now that stocks have rallied again, investors are back in risk-on mode, in a big way. Speculation in options has ramped up, there is little fear of a November pullback, and almost all core indicators are showing risk-seeking behavior. More than 95% of indicators showed a risk-on attitude by late last week though that's ticked down a tad since then.

A reading of 95% is in the top 7% of all days since the year 2000, and the S&P 500's annualized return is relatively small after such high readings. It shows a bit of overheated sentiment that tends to work itself off with small gains at best in the short-term.

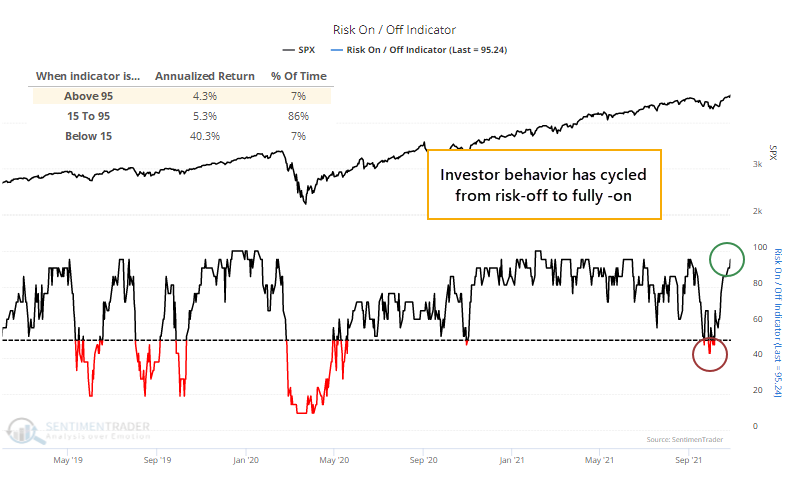

A couple of weeks ago in a premium note, Dean showed that the Risk-On/Risk-Off Indictor was quickly cycling higher. When sentiment turns like this, it tends to keep going, driving prices higher still. This is one of the quickest cycles from risk-off to fully risk-on behavior since 1998. The table shows the others.

There was some short-term weakness after the others as investors took a breather. But only one, during the bear market of 2002, led to substantially lower prices within the next few months. The 2019 signal eventually preceded the pandemic crash, so there's that.

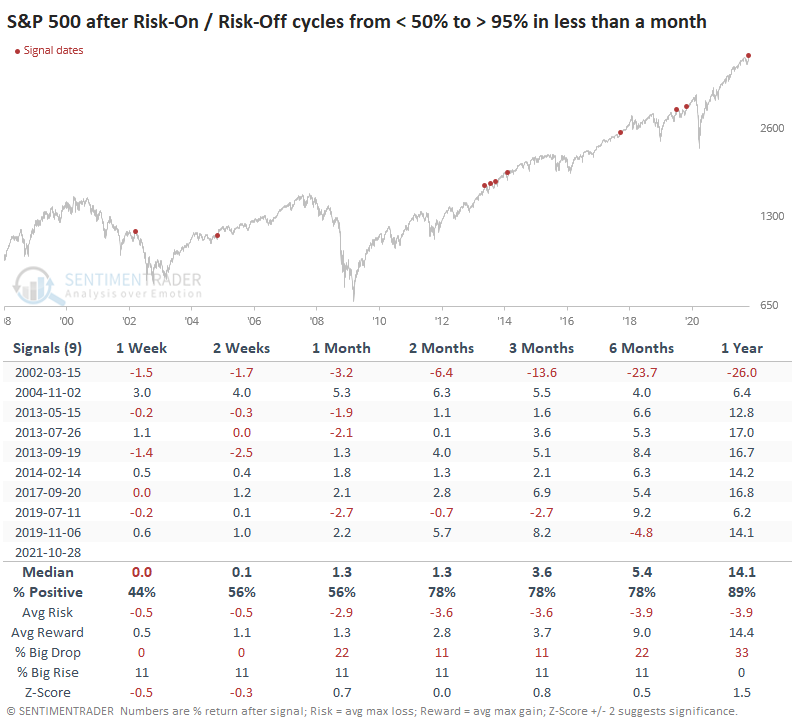

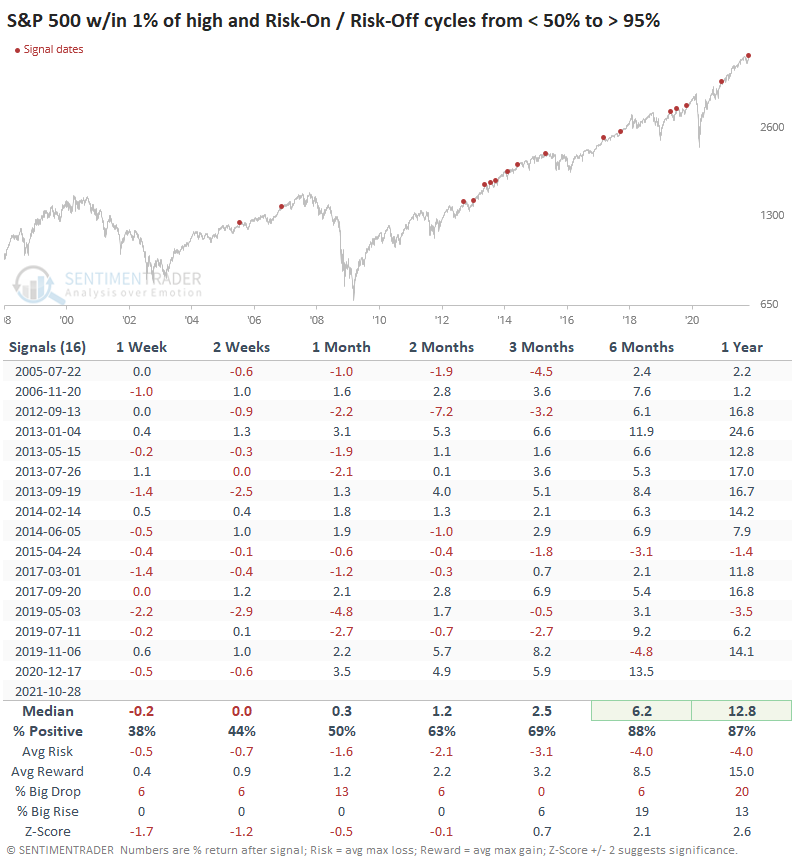

RISK-ON BEHAVIOR NEAR A HIGH LED TO EVEN HIGHER PRICES

If we add some context and only look at times when the model cycled like this while the S&P 500 was within 1% of a multi-year high, then we get signals that are more aligned with what we're seeing now.

Again, shorter-term returns were weaker than average. Even clear risk-on environments need to take a rest now and then. But over the medium- to long-term, returns were well above average, with a good risk-to-reward ratio. Granted, it helps that almost all of them were triggered during one of the greatest bull markets in history, but even accounting for that, returns were above random.

Out of the 16 signals, only 4 of them preceded a loss of more than -5% at any point within the next three months. But only 5 of them preceded a gain of more than +5% as well, so while risk might be limited, so was reward. With an uptick in speculative activity, higher-beta areas of the market tend to be most at risk of a pullback. But a return to risk-on behavior is not a reason in itself to become overly defensive.