Internal momentum in Brazil is recovering again

Key points:

- Internal momentum in Brazil's Ibovespa index has turned positive after a deeply oversold reading

- When the McClellan Summation Index cycles from oversold to well above zero, the Ibovespa tends to keep rising

- It has a better record of gains when the cycle unfolds over a longer stretch, as it did this time

Brazil is regaining momentum again

Despite what appears from the outside to be political chaos, Brazilian stocks have held up quite well.

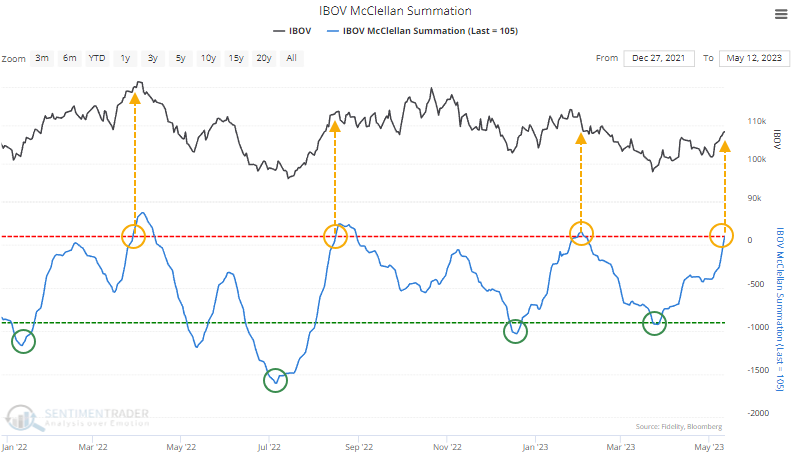

Internal momentum has been consistent and persistent enough to push the McClellan Summation Index for Ibovespa stocks back above the zero line. The last few times these stocks witnessed such momentum, the rallies petered out immediately.

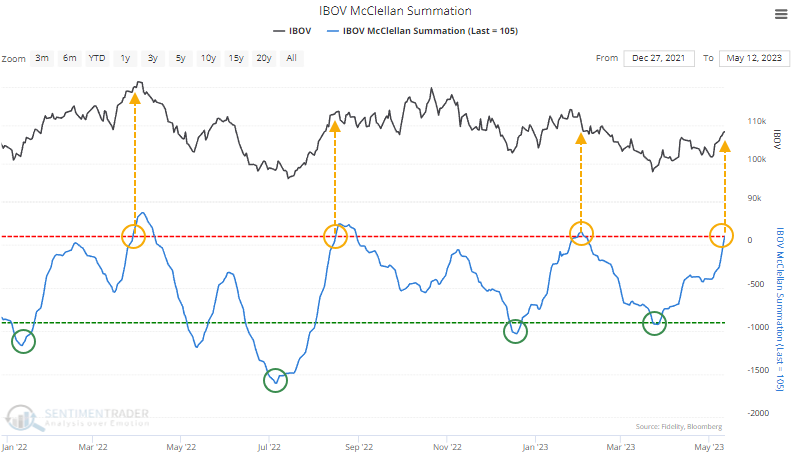

Something we often see with non-domestic markets is that they tend to perform best either when deeply oversold or when showing strong upside momentum. There is some evidence that's the case with this indicator and this market, as the Ibovespa's annualized return was +26.6% when the Summation Index was above +100.

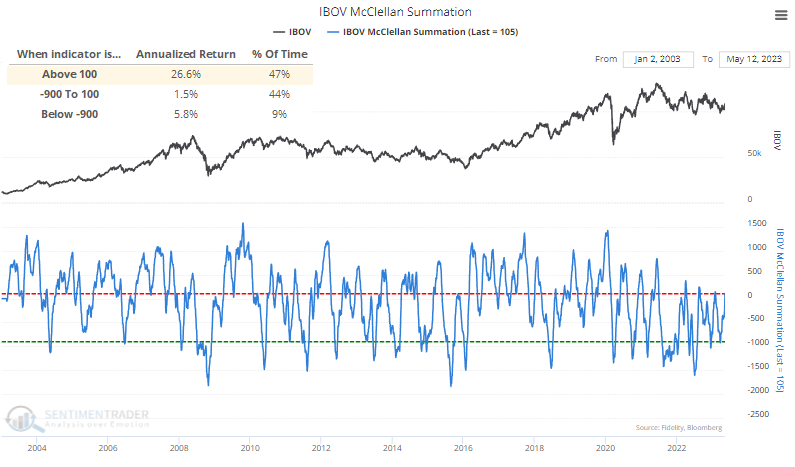

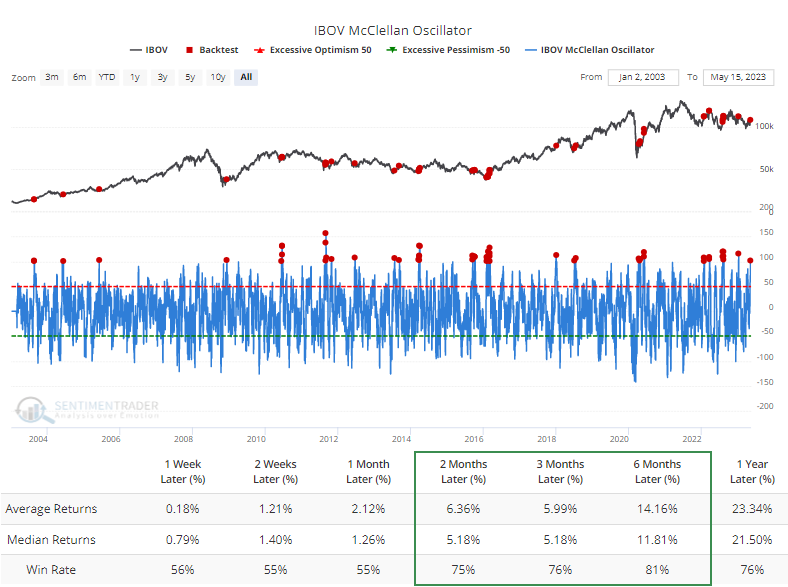

We can also see this with the shorter-term McClellan Oscillator. The Summation Index comprises a running sum of Oscillator readings, so it makes sense that the recovery in the Summation Index is due to increasingly positive readings in the Oscillator. It jumped above +100 last week, and the Backtest Engine shows that the market tended to respond well to such impressive internal thrusts, averaging a return of over +14% during the next six months.

Brazil has done well after momentum cycles, especially if it takes a while

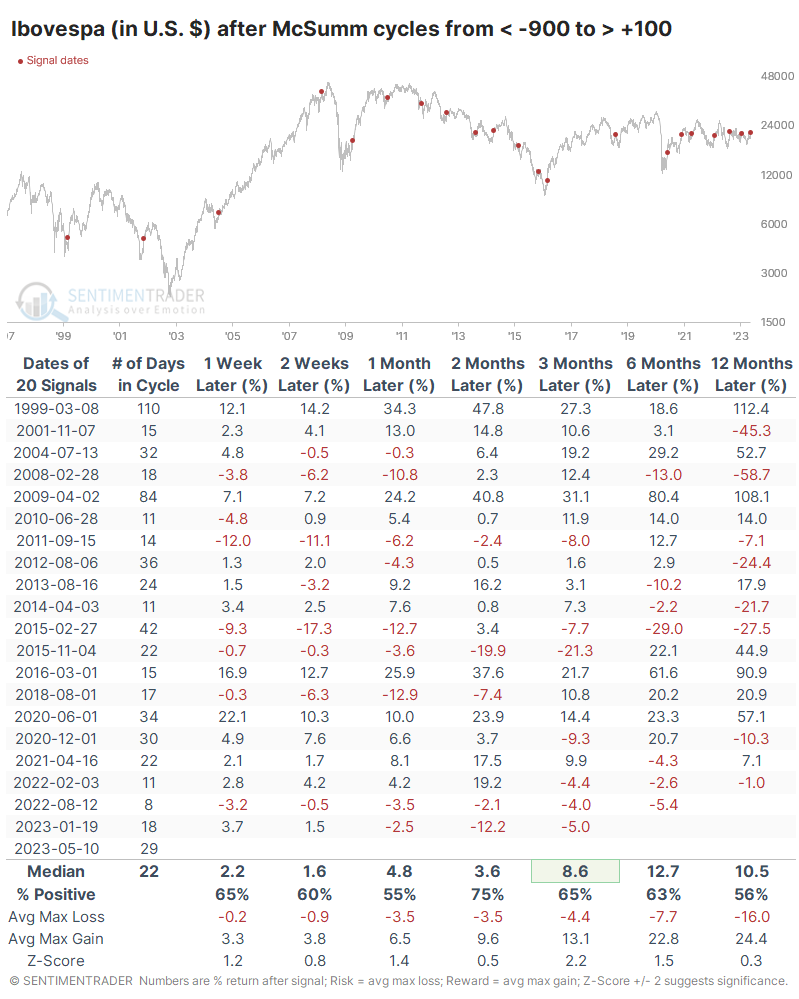

If we take a signal-based approach, the table below shows when the Summation Index cycled from below -900 to above +100. Returns were decent - above random across all time frames - but not impressively consistent. Also, the last few signals were all losers, as noted above.

Historically, it has been the most positive to see rapid improvements in market breadth in U.S. markets. Quick breadth thrusts have become a trendy topic in recent years, but dating back decades, they have been a good sign for future returns.

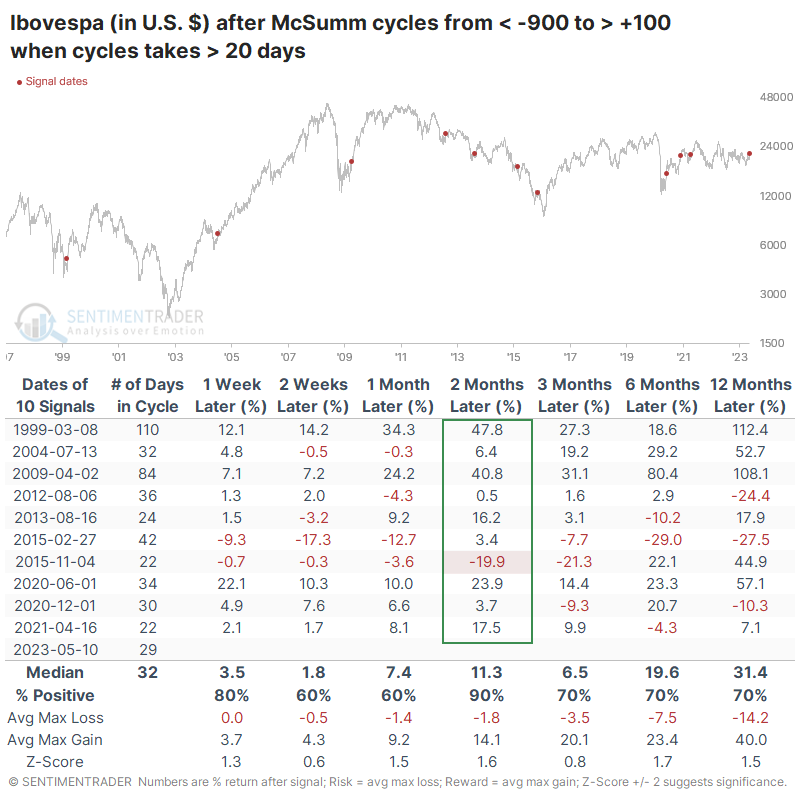

However, slower cycles are often better when it comes to foreign markets. Those indexes tend to underperform when investors rapidly push into stocks after just rushing out.

The table below highlights signals from the table above when the cycle took longer than a month. Over the next two months, the Ibovespa rose after 9 out of 10 signals. The sole loser was very large, heading into the final waterfall decline and bear market low of 2016, but it also showed a massive gain over the next year.

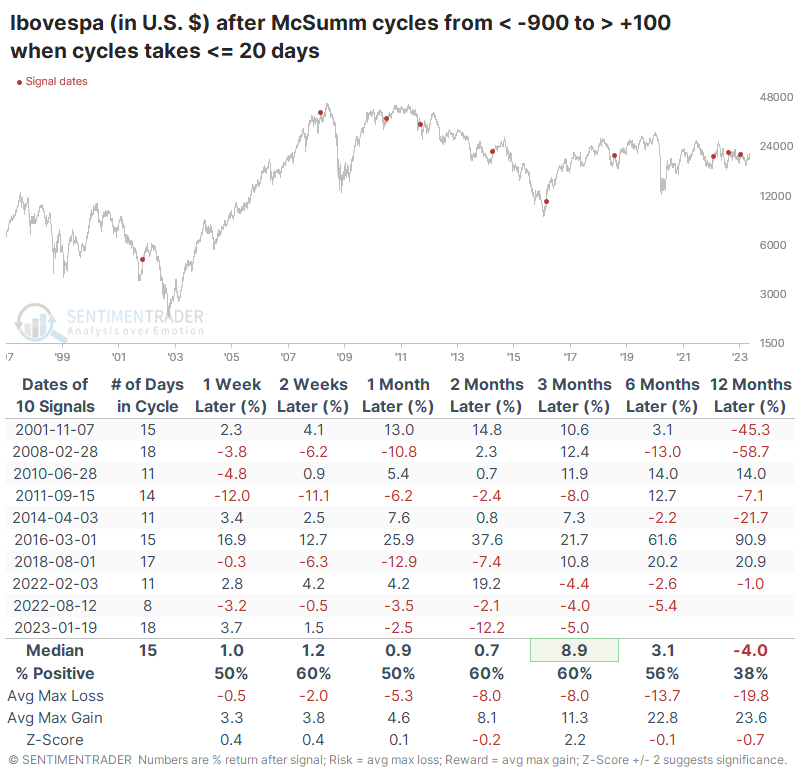

Contrast those returns to when the Summation Index cycle was concise, under a month. The Ibovepsa was more than twice as likely to see a double-digit decline at some point within the next two months after these quick cycles. Its median return over the next year was -4.0% versus +31.4% after longer cycles.

What the research tells us...

Many emerging markets have been trying to form bases in recent months, and some of them have held up better than certain domestic sectors. Recent sessions have had other compelling thrusts, particularly in markets like Brazil.

History has taught us to be skeptical of thrusts in overseas markets because there has been a consistent tendency to see those give back gains. It has been more likely to fail when the thrusts are quick and severe while more likely to persist when the thrusts occur over a longer stretch. There is decent evidence that's been the case for the Ibovespa, which argues for a higher likelihood that the market can build on its gains in the months ahead.