Interest rates and trend-following - part I

Key Points

- Interest rates tend to rise and fall in decade-long cycles

- A simple trend-following method can be beneficial in keeping investors on the right side of the long-term trend

- Using a 120-month exponential moving average kept investors on the right side

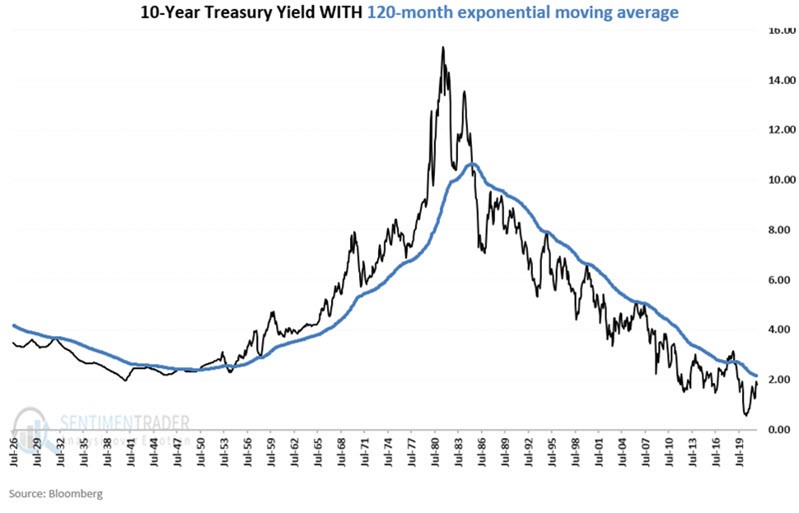

Indicator #1: 10-Year Treasury yield versus 120-month EMA

The chart below displays the month-end yield for 10-year treasury notes since July 1926, along with its 120-month exponential moving average.

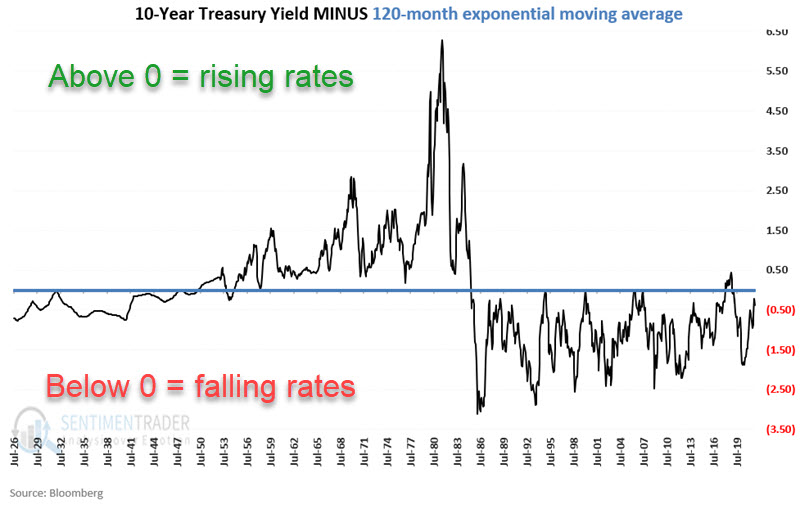

The next chart showsthe month-end yield for 10-year treasury notes since 1913 minus its 120-month exponential moving average. This value fluctuates above and below 0. When the reading is above 0 it implies that interest rates are in an uptrend, and when the reading is below 0, it implies that interest rates are in a downtrend. The good thing about interest rate trends is that they tend to persist for a very long period of time.

Measuring trend-following results

Our goal is to determine how well our indicators track the trend in interest rates, not necessarily the exact impact on bond prices. In measuring results, we will look solely at changes in bond yields. So, for example, if yields rise from 4% to 5%, we will note that as an increase of 1.00 point in yield. Conversely, if yields fall from 8% to 7%, we will note that as a decrease of 1.00 point in yield.

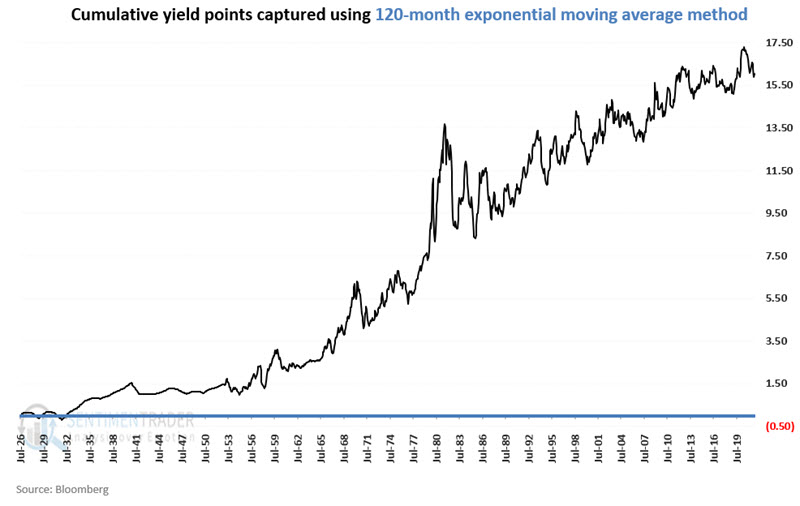

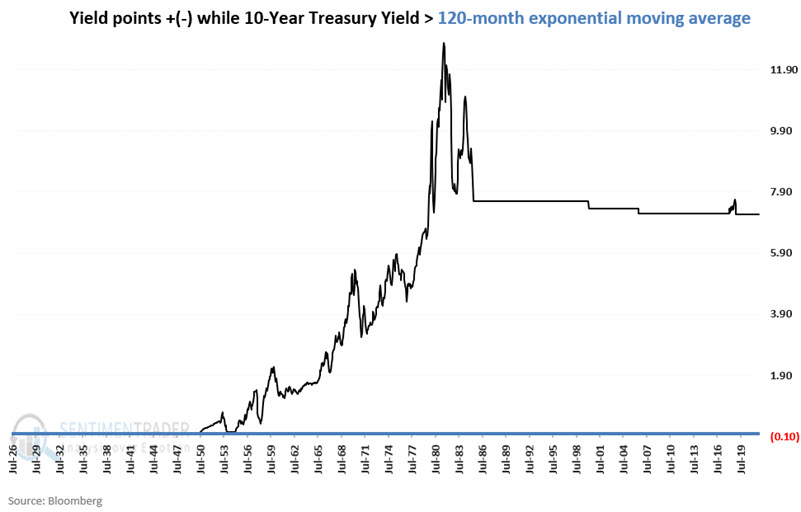

The chart below displays the cumulative gain/loss in yield points while the chart above is above 0, i.e., when the 10-year yield is above its 120-month EMA. This simple measure stayed with the rising rate trend from the late 1940s through the peak in the early 1980s before giving back some of its gains as rates fell hard from 1982 to 1985. In the past 20 years, there have been a handful of small whipsaws. That is the nature of most moving average-based methods.

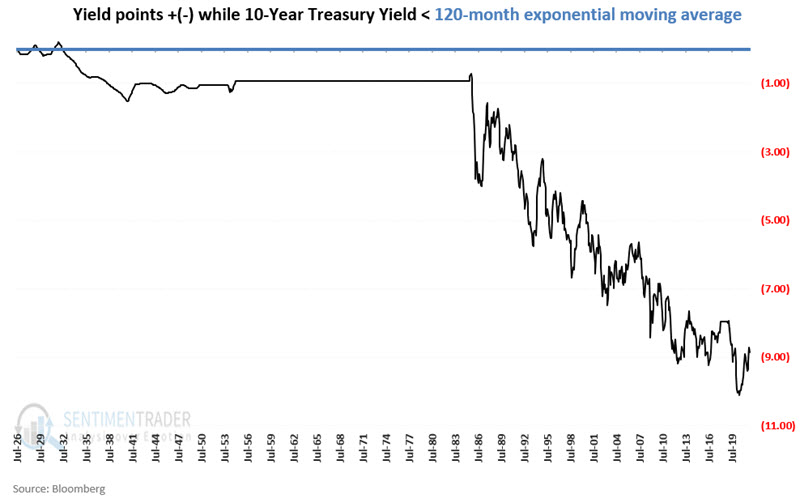

The chart below displays the cumulative gain/loss in yield points while the chart above is below 0, i.e., when the 10-year yield is below its 120-month EMA.

To measure the efficiency of this simple method for tracking interest rates, let's use the following methodology:

- Add changes in yield points if the 10-year yield is ABOVE its 120-month EMA

- Subtract changes in yield points if the 10-year yield is ABOVE its 120-month EMA

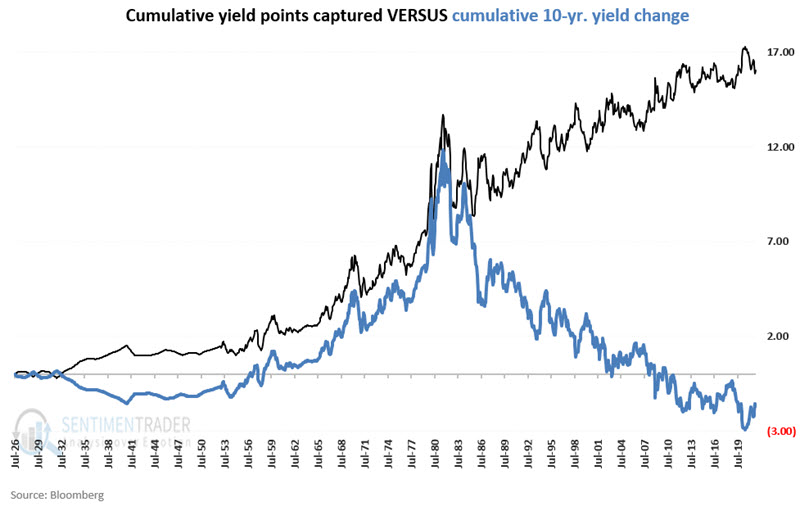

The chart below shows the cumulative yield points captured using the 120-month EMA method since 1926.

The chart below displays the same information as the last chart and the cumulative net change for the 10-year treasury yield since 1926.

Since July 1926, the 10-year treasury yield rose from 3.48% to a high of 15.32% by 1981 before falling to 1.79% at the end of November 2021. In other words, 10-year treasury yields have fallen -1.69% since July 1926; hence the blue line in the chart above is negative.

What the research tells us...

Interest rates tend to move in extremely long-term waves. A simple trend-following approach appears to do an excellent job of keeping investors on the correct side of interest rate trends. At the end of November 2021, the trend for interest rates is still deemed as falling, with the 10-year yield at 1.79% and the 120-month EMA at 2.16%.