Institutions believe in stocks a lot more than mom-and-pop

Institutions are a lot more optimistic than mom-and-pop, and that may not be a good thing.

The latest results from a monthly survey by Yale University show that overall confidence about stocks is high, and it's especially so among institutions. Please see the Yale University website for underlying charts and data.

The survey asks four questions, with the tabulations designed to show what percentage of respondents are optimistic.

- The percent of the population expecting an increase in the Dow in the coming year.

- The percent of the population expecting a rebound the next day should the market ever drop 3% in one day.

- The percent of the population who attach little probability to a stock market crash in the next six months.

- The percent of the population who think that the market is not too high.

Based on the latest responses to each question, institutions represented in the survey are about 65% confident in the market. Individuals, however, are only about 54% confident. That sets up a classic "smart money" versus "dumb money" battle.

We saw on Tuesday that it isn't usually that easy, though. Just because someone has more money or more education does not make them a better investor. If anything, it's the opposite.

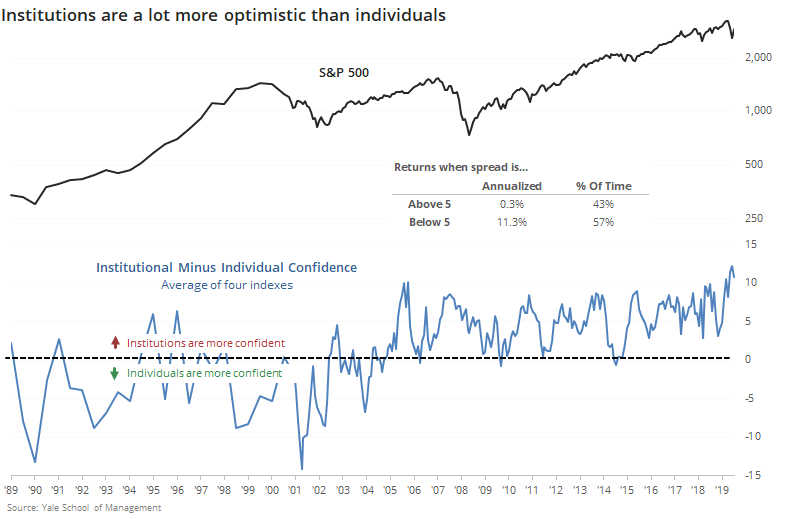

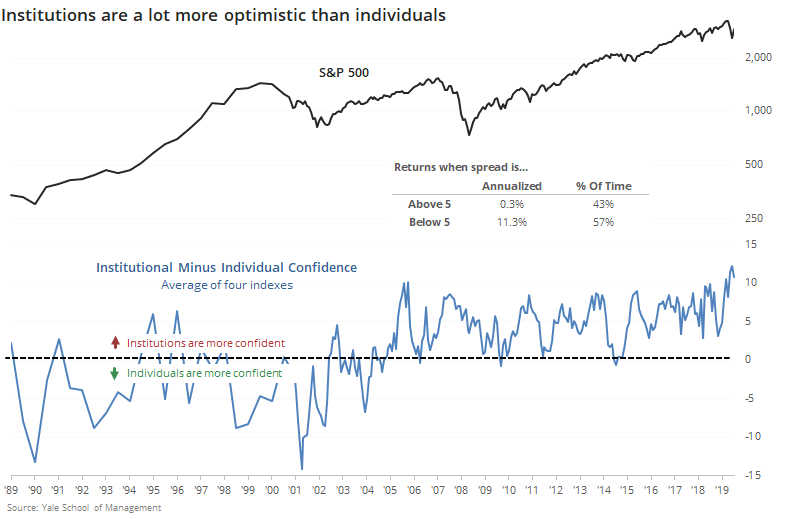

Below, we can see the spread between overall confidence levels in institutions vs. individuals.

While it ticked down in April, it's still near the highest level in more than 30 years. Looking at the S&P 500's annualized returns, it averaged only +0.3% when the spread was more than +5 (meaning institutions were quite a bit more optimistic than individuals) versus a healthy +11.3% when the spread was below +5.

The spread has been gyrating within a range since 2005, so if we only look at the annualized returns since then, it remained at +0.3% when the spread was above +5 and it rose to +14.9% when below. So, it has only gotten stronger as a contrary indicator. This is not nearly enough to scream "sell" but it has a long enough history to at least suggest some caution.