Institutions are coming off the "sidelines"

One of the standout pieces of data during the pandemic was the exponential rise in money market assets, including those catering to retail investors and institutions.

This always brings up the bulls' argument that there is a lot of "cash on the sidelines" to drive stocks higher, as the WSJ noted in late 2019. Clearly, it's not always a good argument but it's continuing to get repeated and probably will for all of time, despite common sense and empirical evidence.

Probably the best refutation of this line of thinking comes from money manager Cliff Asness (bold added):

"Every time someone says, “There is a lot of cash on the sidelines,” a tiny part of my soul dies. There are no sidelines. Those saying this seem to envision a seller of stocks moving her money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines.

If you want to save those who say this, I can think of two ways. First, they really just mean that sentiment is negative but people are waiting to buy. If sentiment turns, it won’t move any cash off the sidelines because, again, that just can’t happen, but it can mean prices will rise because more people will be trying to get off the nonexistent sidelines than on. Second, over the long term, there really are sidelines in the sense that new shares can be created or destroyed (net issuance), and that may well be a function of investor sentiment. But even though I’ve thrown people who use this phrase a lifeline, I believe that they really do think there are sidelines. There aren’t. Like any equilibrium concept (a powerful way of thinking that is amazingly underused), there can be a sideline for any subset of investors, but someone else has to be doing the opposite. Add us all up and there are no sidelines."

When we start to see the meteoric rise in money market assets stop and reverse, surely the "cash on the sidelines" argument will be used. And we're starting to see that right now among institutions.

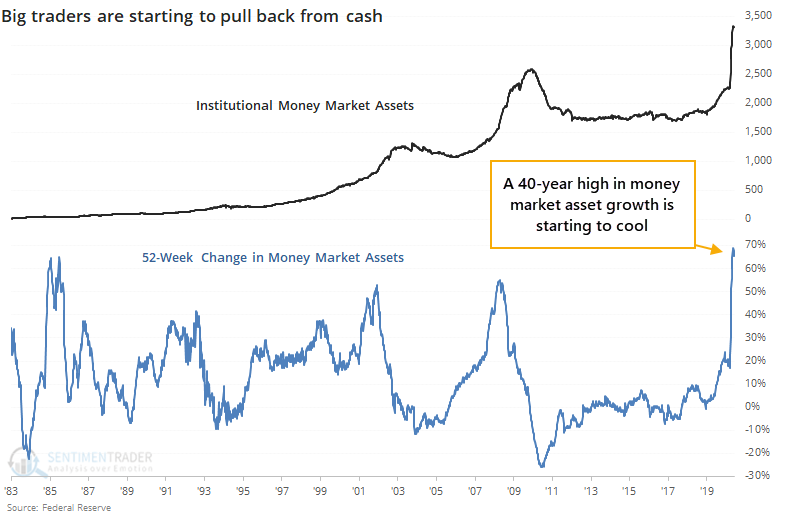

Through late May, the year-over-year growth in institutional money market assets surged to nearly 70%, the highest in almost 40 years. The latest data shows that's finally starting to cool.

It seems like this should be a good thing. If institutions are pulling funds from cash, then it has to go somewhere. Bulls like to assume that the most logical place is in stocks. Historically, it has been tough to support that assumption.

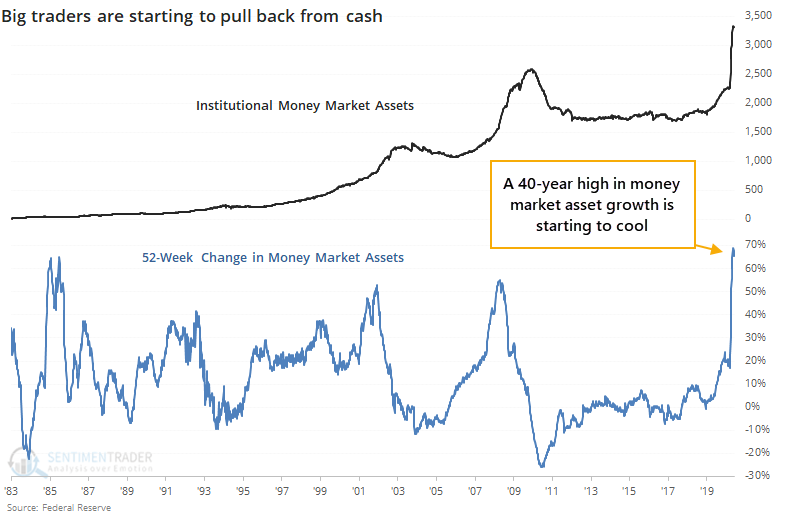

When the yearly growth in institutional money market assets reached at least 40% then pulled back by at least 3%, it did consistently signal that they would keep pulling money out of those liquid accounts. But it did not consistently signal that the money was going into stocks, or at least that it made a difference.

Over the next 1-3 months, the S&P tended to fall, with poor returns and risk/reward ratio. The growth in institutional assets in money markets started to reverse early in the last two bear markets, not at the end of them.

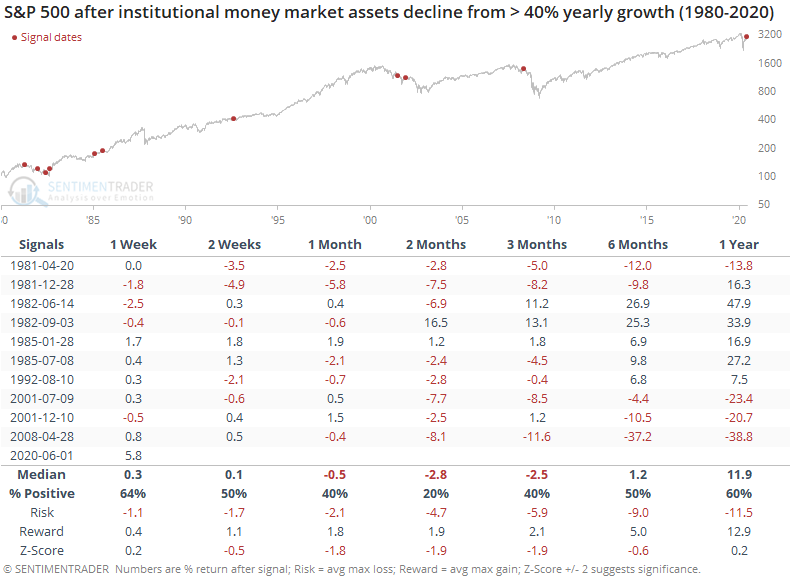

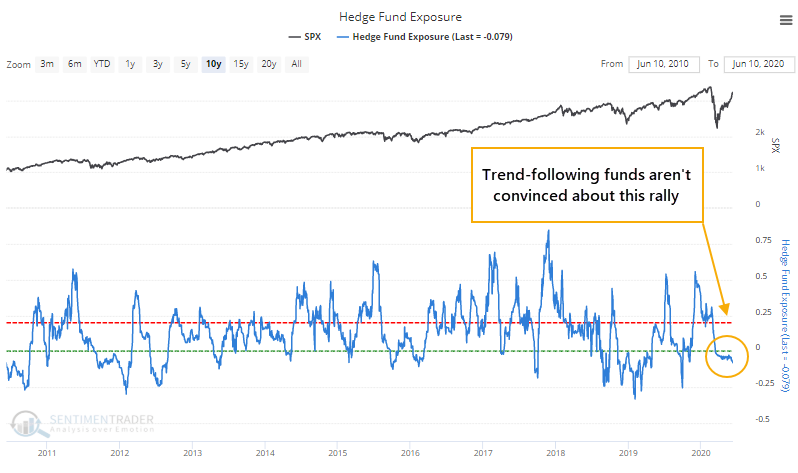

One reason to think that at least some of that money could find its way into stocks is the seeming under-exposure that hedge funds have to stocks. This is based on a rolling 20-day beta of the return in equity long/short hedge funds to the return in the S&P 500.

Prior to the last couple of years, this was a consistent contrary indicator. Maybe something changed in 2019, but funds never really seemed fully geared toward stocks, and it hasn't been an effective signal since 2018.

It's been a better signal if we look at trend-following funds, and that, too, is showing that exposure is still low.

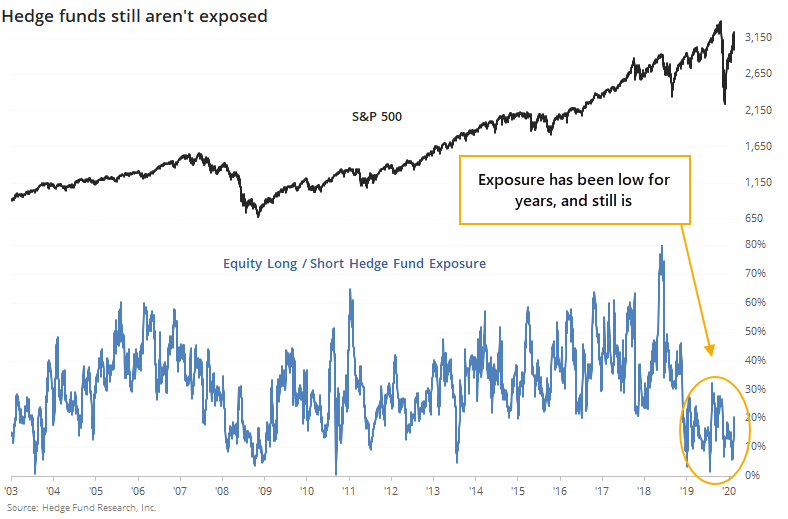

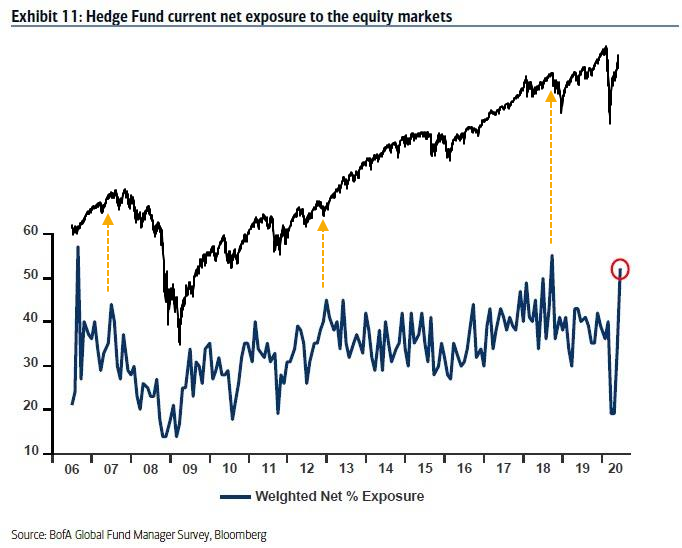

According to a survey by Bank of America, their hedge fund clients show a high degree of exposure. Theoretically, this should be a more accurate measure because ostensibly they are directly observing positions, instead of implying them like the above indicators.

Other times when BofA clients had high exposure led to generally poor returns, but it was a much better contrary signal when funds had low exposure.

It's hard to read too much into all this. Hedge funds might (or might not) be heavily exposed, which doesn't tell us a whole lot. We'd place more weight on the direct readings from BofA, so maybe this is a modest negative. It would be more compelling as a warning sign if it had a better track record, and other measures of exposure were suggesting funds were aggressively long.

The fact that institutions have started pulling funds from money markets should be a good sign but objectively has not been. The overall tone is slightly negative, but not enough to consider it an edge.