Insane volatility across countries

I've looked at volatility from many different angles over the past few weeks, and it has mostly been the same. Volatility is extremely high, which *should* be a bullish sign for equities. But given the extremely rapid pace of this recession+bear market, a lot of historical comparisons have not worked out so far.

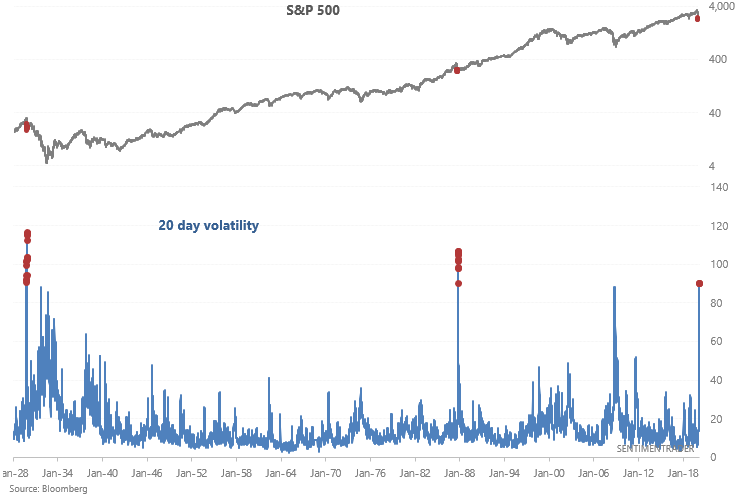

The S&P 500's 20 day volatility can only be compared to 2 periods in history: the start of the 1929-1932 bear market, and the 1987 crash.

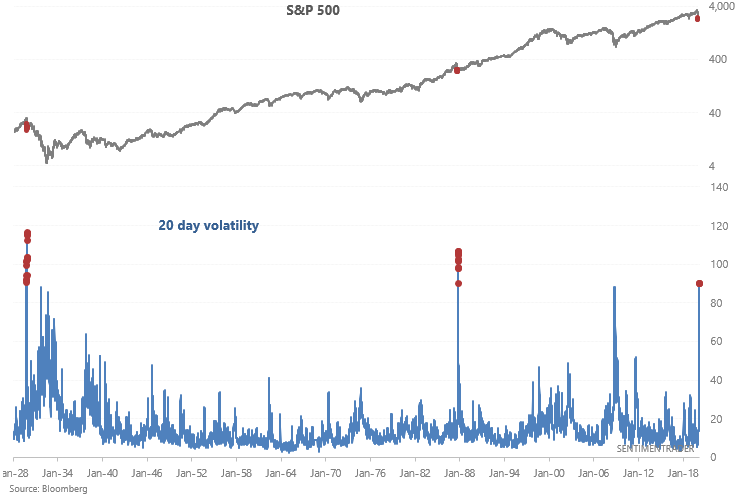

When volatility was this high in the past, the S&P 500 rallied vigorously over the next 3-6 months EVEN if there was lots of short term chop. Once again, there are really only 2 cases: 1929 and 1987.

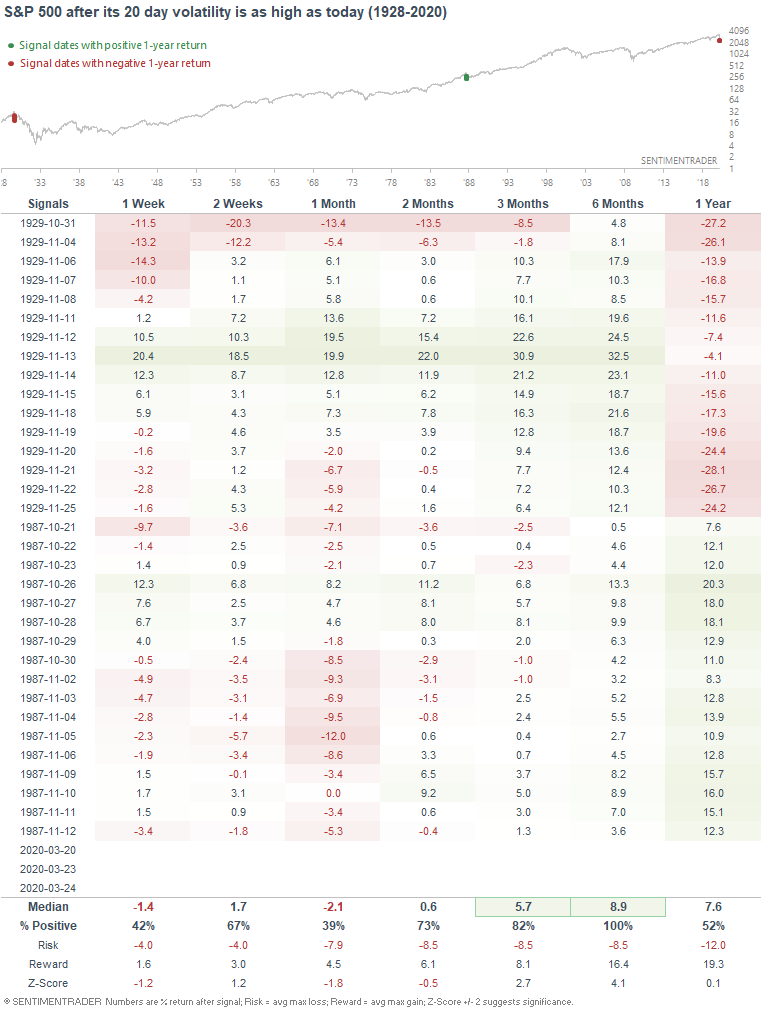

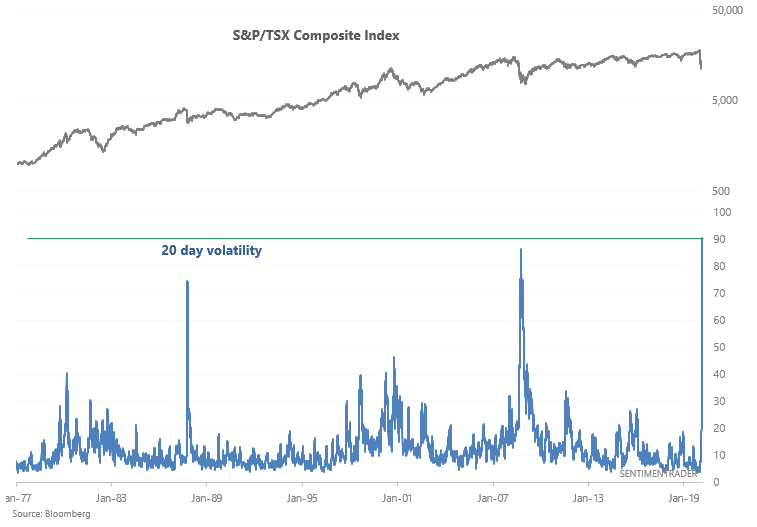

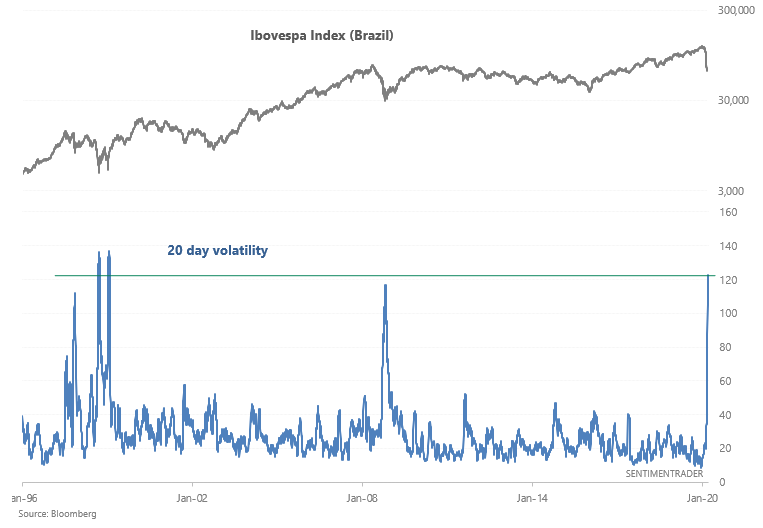

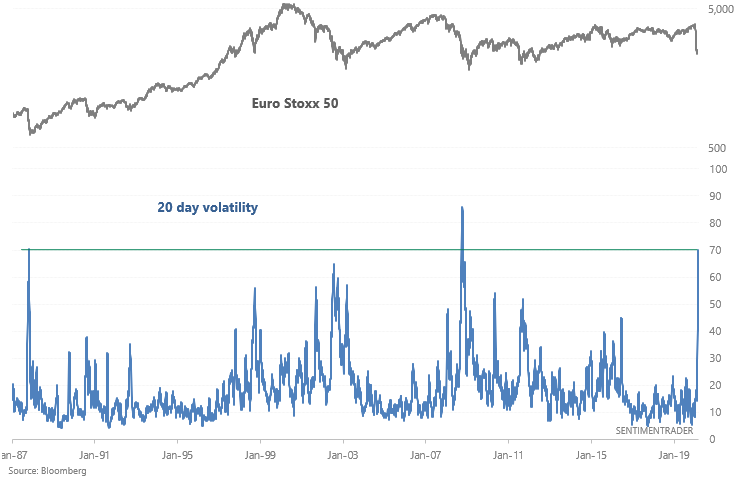

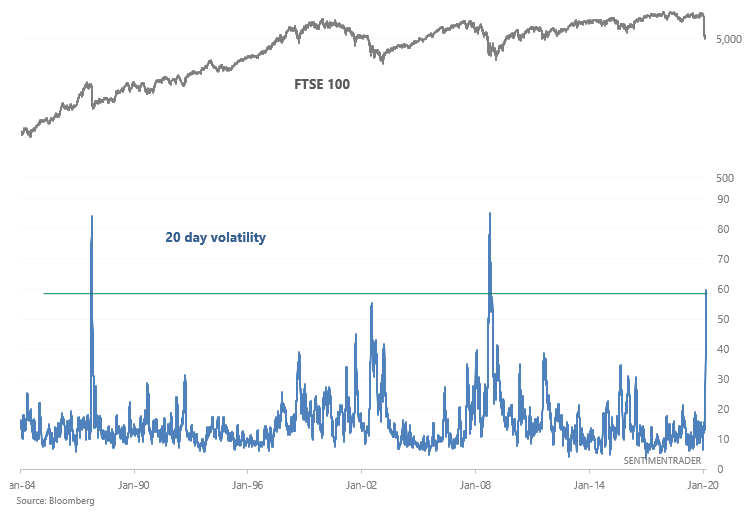

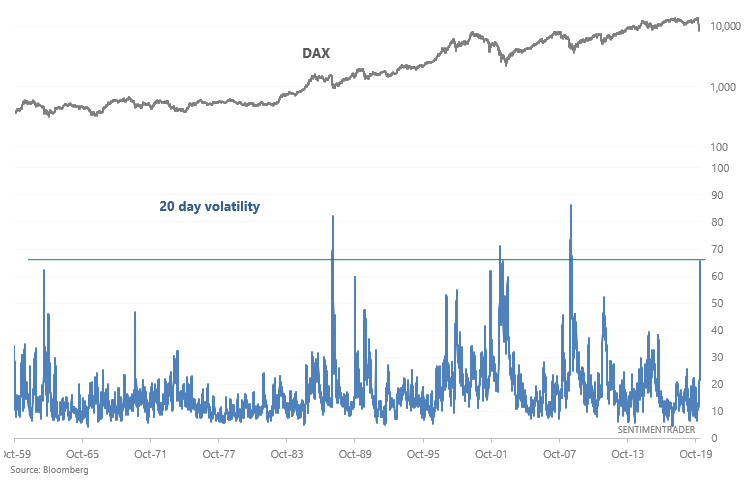

Volatility in other countries' stock market is just as extreme.

For example, volatility in Canada is at its highest reading ever, higher than the 1987 or 2008 crashes. Granted, there is less historical data than in the U.S.:

Volatility in Brazil is among the highest ever:

Volatility in Europe can only be compared to that of 2008 and 1987:

Volatility in the UK can only be compared to 1987 and 2008:

Same in Germany...

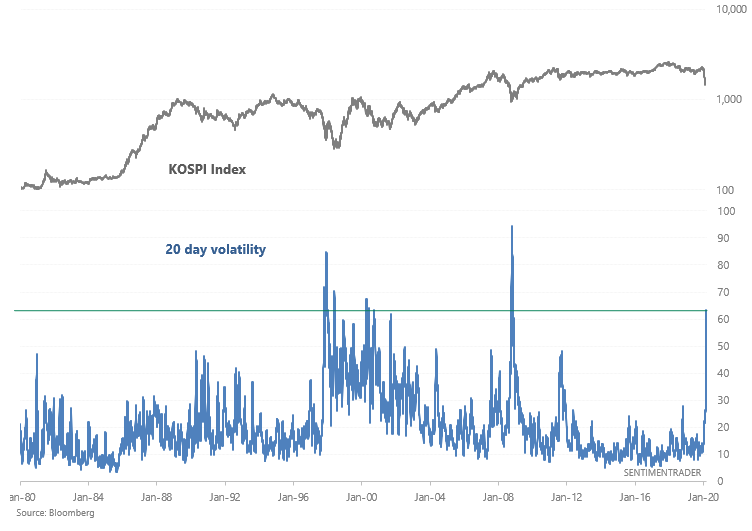

Volatility in South Korea is extreme high:

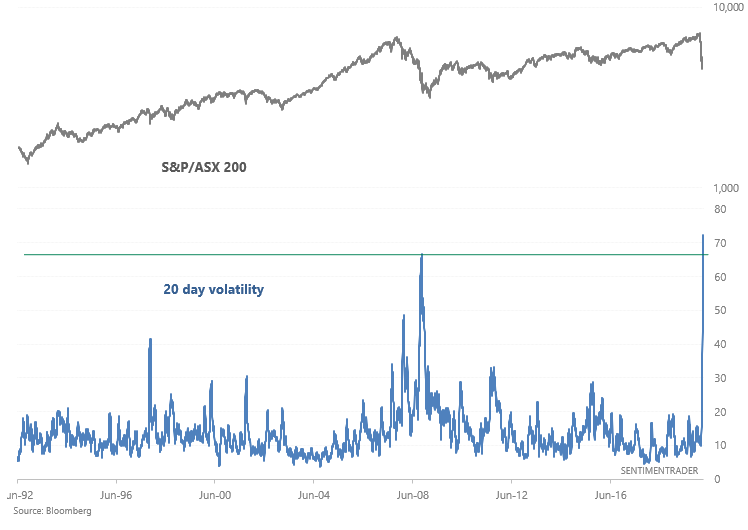

And volatility in Australia is at its highest reading ever, higher than even during 2008:

Overall, a sample size of 2 ("today is just like 1929" or "today is just like 1987") isn't very helpful. The human mind likes to compare today to the past, which gives it a roadmap regarding how to navigate the future. While this works when there's a decently large sample size, sample sizes of n=1 or n=2 are misleading. If you were in 1987 and used a sample size of n=1 ("today is just like 1929"), you would have been crazy bearish. Which clearly was the wrong thing to do, since 1987-1988 turned out to be nothing like 1929-1932.

In the end, extremely high volatility is a medium term bullish sign for stocks. But to think that the next 1-2 years will play out "just like 1929-1932" or "just like 1987-1988" is folly. The future is never just like the past.