Individual investors won't give up the bearish ghost

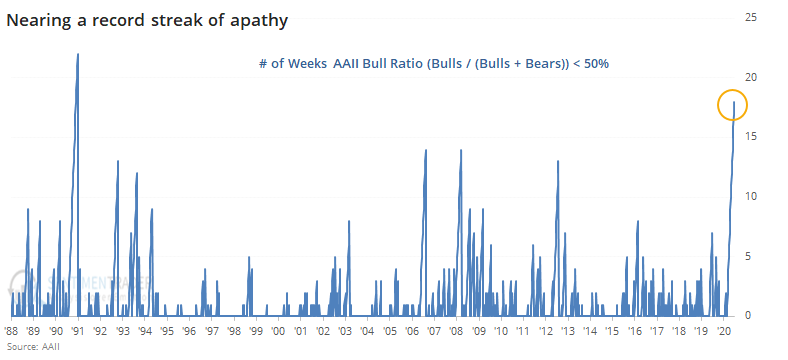

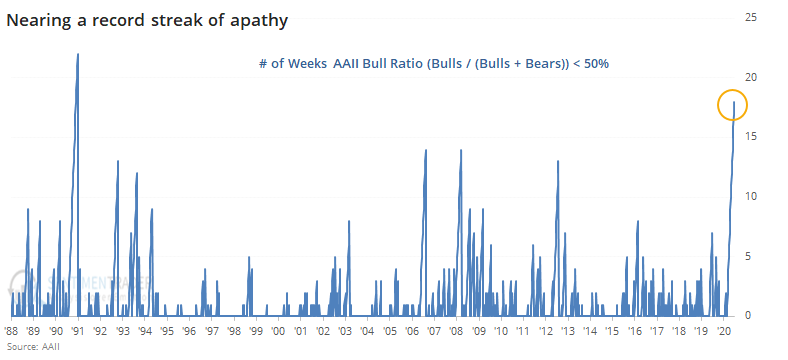

The latest survey from the Association of Individual Investors showed yet another week of apathy, even outright pessimism. This is now the 18th straight week with the survey showing more people thinking stocks will go down than up, the 2nd-longest since the survey's inception.

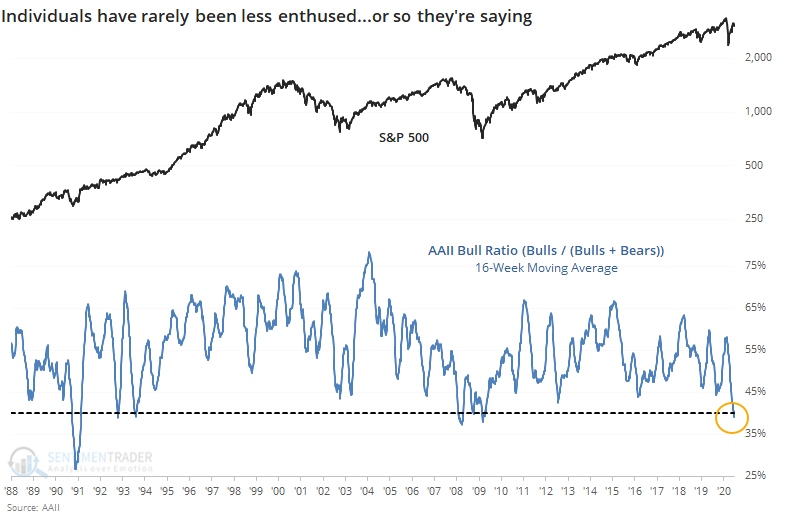

This streak has pushed the 16-week average of the Bull Ratio below 40% for the first time since 2009.

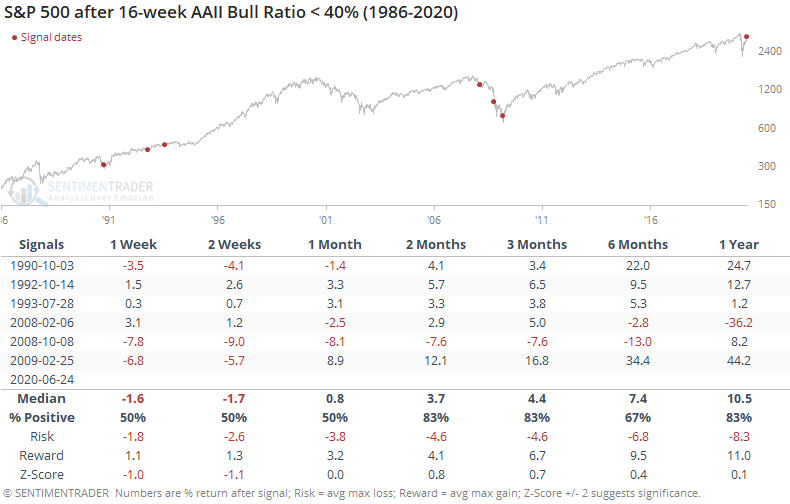

When the ratio first became this depressed, it wasn't an automatic contrary buy signal. The S&P 500 had more work to do on the downside when it first triggered in 1990 and it was woefully early in 2008. That helped contribute to a poor risk/reward ratio over the short- to medium-term.

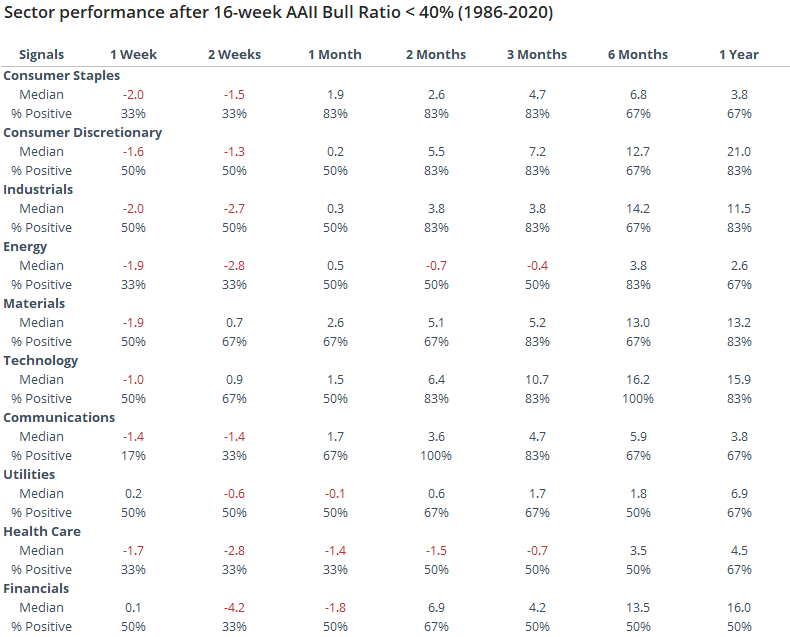

Among sectors, higher-beta ones like discretionary and technology performed best over the medium- to long-term. Health care and financials were among the worst.

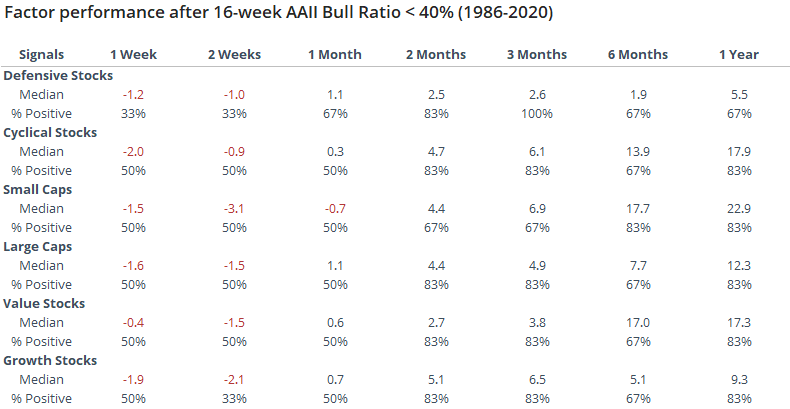

For factors, there wasn't a clear bias, though cyclical, small-cap, and value stocks showed the highest average returns.

This is a really odd time in the survey. In its nearly 35-year history, it has never really behaved this way. It's exceptionally unusual to see retail investors become more pessimistic during a rally, especially a historic one. When indicators don't behave as they have in the past, we become wary. Because of that, we're reading less into it than we normally would.

The safest bet historically was waiting until the 16-week average climbed back above 50%. That would have meant missing the low, of course, but it also prevented one from buying too early, which was a bigger benefit during the last protracted bear market.