Individual investors refuse to say they're bullish

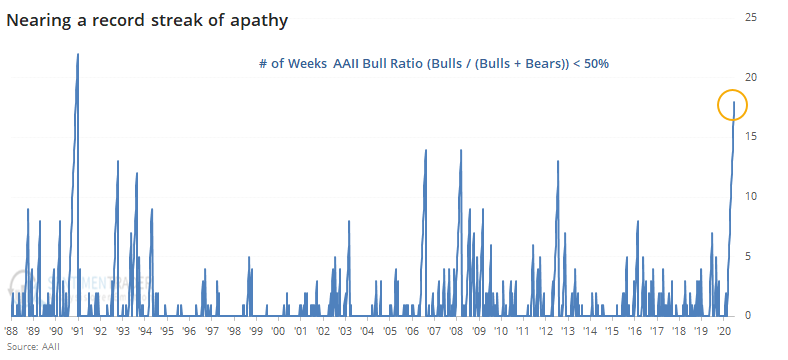

The latest survey from the Association of Individual Investors showed yet another week of apathy, even outright pessimism. This is now the 18th straight week with the survey showing more people thinking stocks will go down than up, the 2nd-longest since the survey's inception.

This streak has pushed the 16-week average of the Bull Ratio below 40% for the first time since 2009.

When the ratio first became this depressed, it wasn't an automatic contrary buy signal. The S&P 500 had more work to do on the downside when it first triggered in 1990 and it was woefully early in 2008.

This is a really odd time in the survey. In its nearly 35-year history, it has never really behaved this way. It's exceptionally unusual to see retail investors become more pessimistic during a rally, especially a historic one. When indicators don't behave as they have in the past, we become wary.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- An in-depth look at market and sector performance after very low Bull Ratios in the AAII survey

- The correlation between stocks and the dollar is the most negative in years - what that means for stocks, the dollar, and gold

- The % of S&P 500 members above their 50-day average has cooled off after a record high reading

- Same for the Nasdaq, and Canadian stocks

- The VIX didn't jump much on Friday despite a big down day in stocks

- The VIX has been above 20 for a very long time