Individual Investors Flee

One of the data points that will likely get some attention today is a collapse in bullishness among the individual investors who participate in a weekly sentiment survey published by the American Association of Individual Investors.

For the results included through Wednesday, only 18% of respondents are anticipating higher stock prices over the next six months. That's the lowest figure since April 2005. Even during the grips of the 2007/2008 bear market, there were more optimistic investors than there is now.

The bulls are only one side of the equation, however. AAII also measures the percentage of bears, which stands at 46%. That figure regularly pushed above 50% during the bear market.

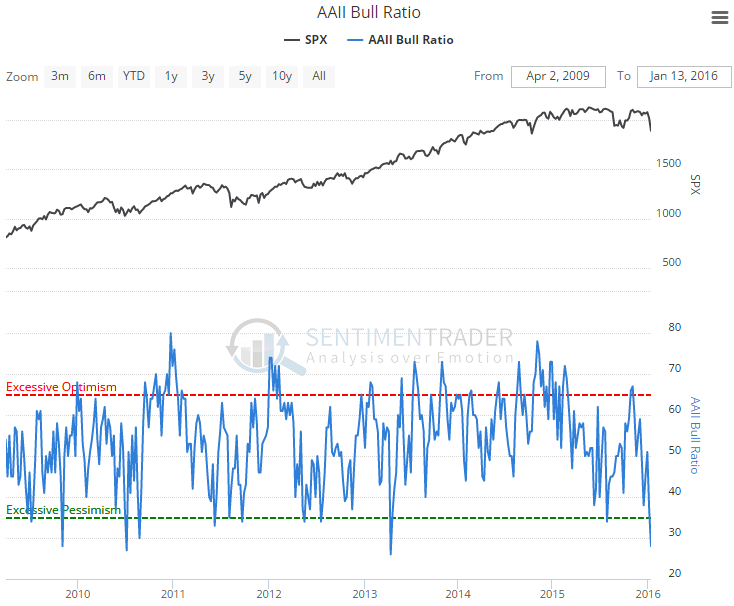

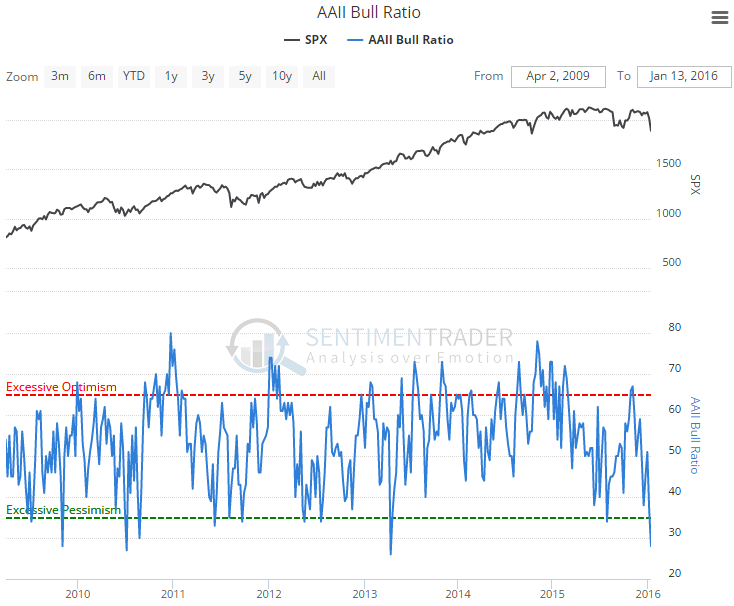

Our preferred measure for this survey is the Bull Ratio (Bulls / (Bulls + Bears)), which takes into account both the bullish and bearish respondents. That ratio just dropped to 28%, the lowest since 2013.

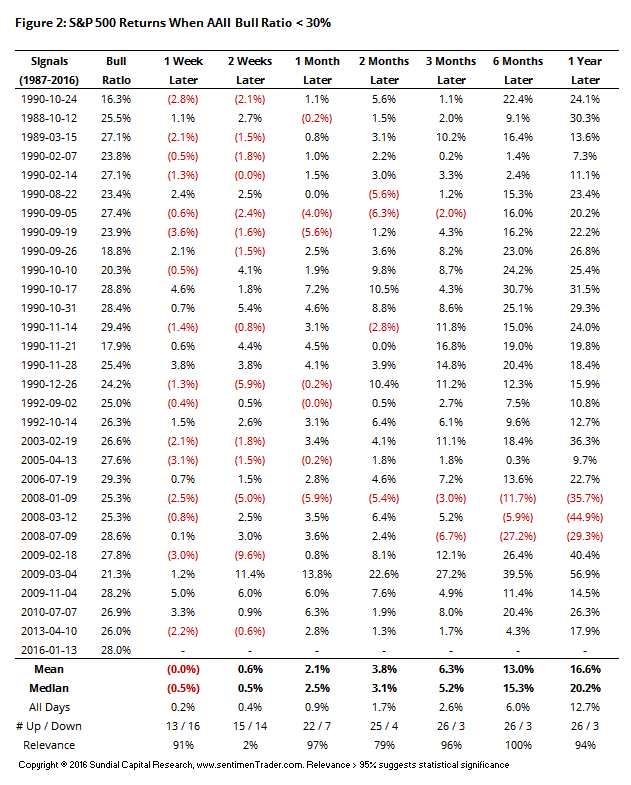

Figure 2 shows the results in the S&P 500 after every week in which the Bull Ratio was below 30%.

In the medium- to long-term, results were excellent. Three months later, 26 out of 29 weeks showed a positive return, doubling a random return during the study period. It continued to improve over the ensuing months with the only losses occurring during the 2008 bear market.