Indexes are losing steam, stocks not so much

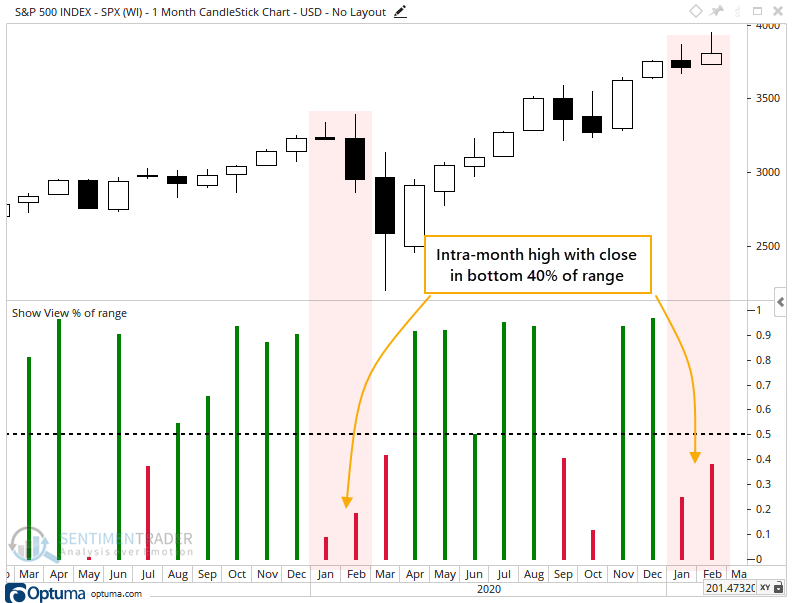

With another month in the books, stocks looked tired once again in February. Despite shooting to record highs during the month, the S&P 500 fell near month-end to close in the bottom 40% of its range.

Just like it did in January.

The only other time in recent years when the S&P rose to a 3-year high at some point during the month and then closed in the bottom 40% of its range, on back-to-back months, was in January and February of 2020.

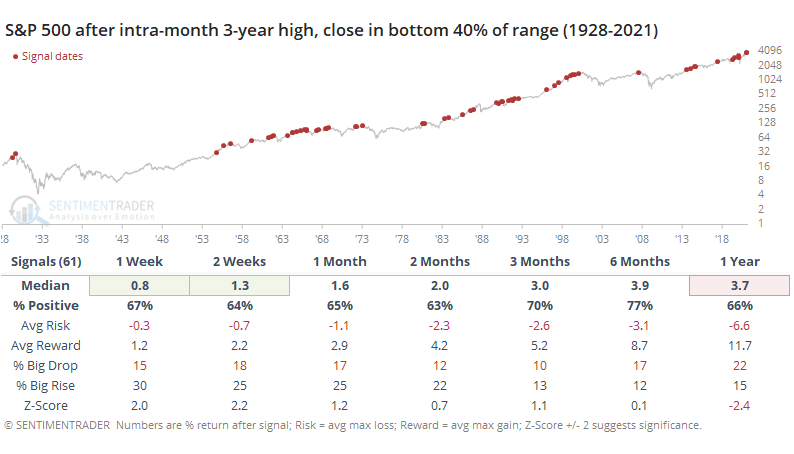

After any month that saw the S&P trade to a 3-year high and then close in the bottom 40% of its range for the month, the start of the next month went okay, as it looks like it's on track to do again, but generally, it was not a great longer-term sign with only a 3.7% median return over the next year.

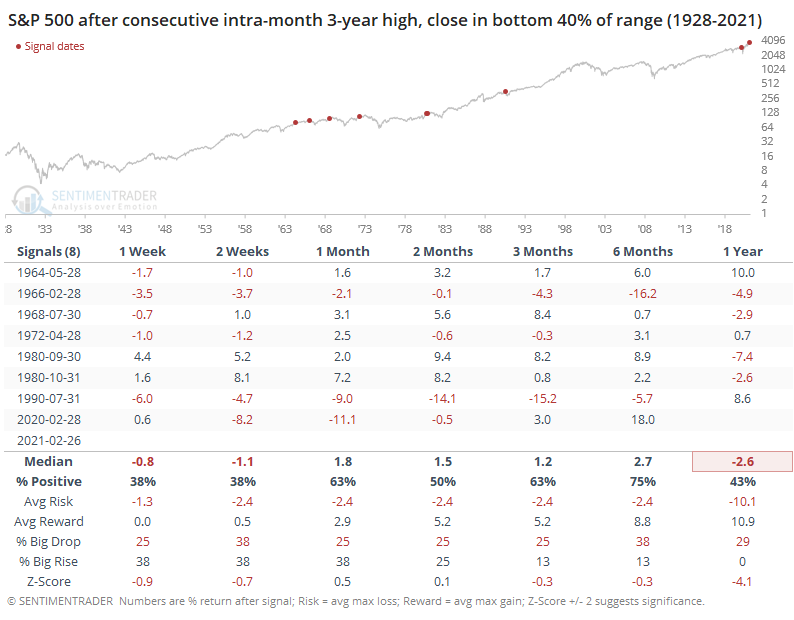

What makes the current display of exhaustion unique is that it's happened for two consecutive months. When we filter the table to only include consecutive signals, then it becomes much rarer and significantly less positive.

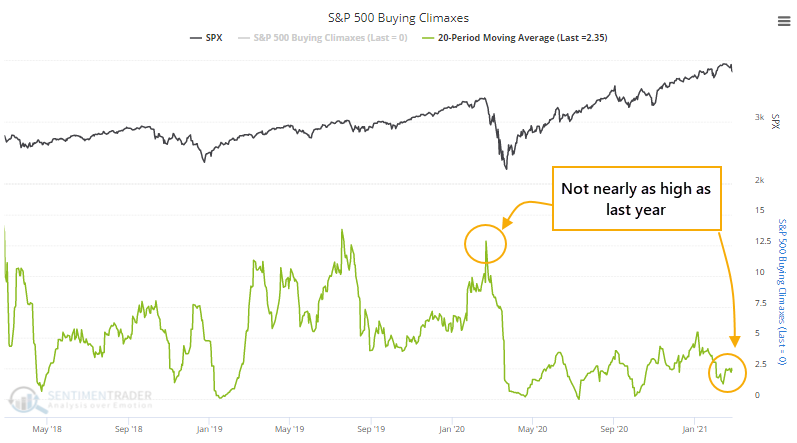

Among individual stocks, the number of buying climaxes in the S&P 500 over the past 20 days isn't high enough to be a concern. A buying climax triggers when a stock trades at a 52-week high and then closes below the close of the prior day.

When stocks were peaking last year, there was a consistent tendency to see a large number of individual stocks pull back from new highs. We're not seeing that now.

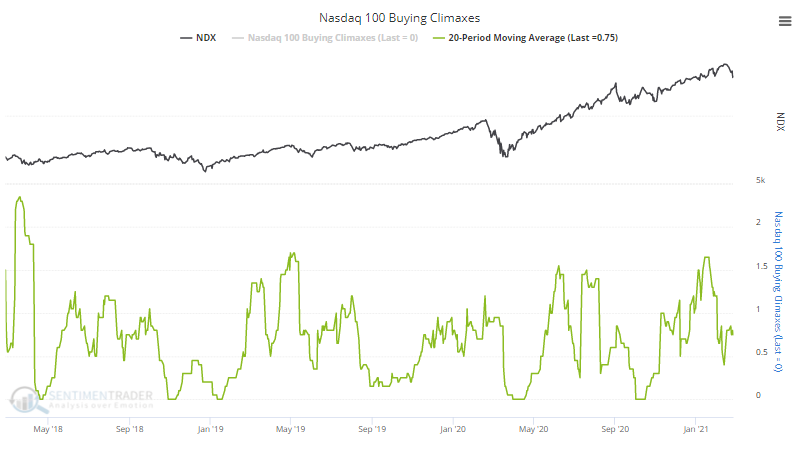

Among members of the Nasdaq 100, though, buying climaxes are coming down from a fairly high level, so it's a bit more of a concern among big tech.

We've been looking closely for signs of internal deterioration, waning momentum, and buying exhaustion ever since sentiment started to register extremes a couple of months ago. There were some cracks in January but buying interest has mostly come back enough to erase those concerns.

Stocks don't have to trigger any of these warning signs before the indexes fall into a correction, it just makes it a higher probability if they do. Evidence is pretty weak so far that we're seeing widespread enough exhaustion to be a major concern.