Indexes, and safe havens, rally without bringing members along

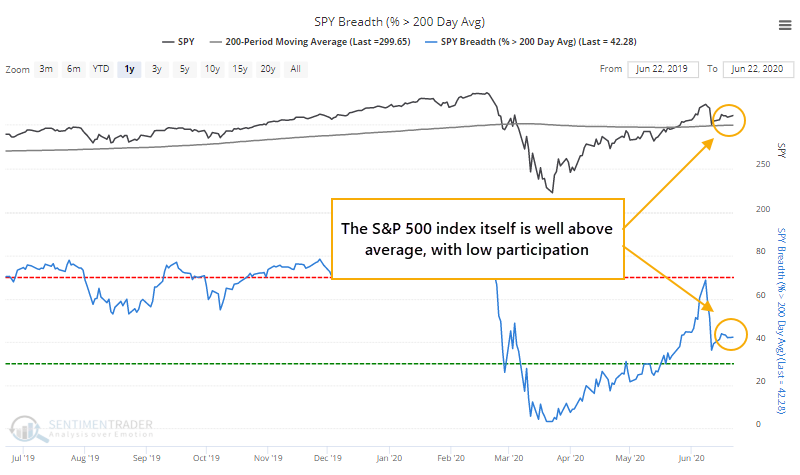

The Nasdaq keeps rallying, the S&P 500 has moved well above its 200-day moving average, and yet relatively few stocks seem to be coming along for the ride.

As Troy showed in a premium note, the Nasdaq Composite has rallied 7 days in a row, while fewer than 45% of stocks in the S&P 500 have moved above their 200-day moving averages. That hasn't happened since the year 2000.

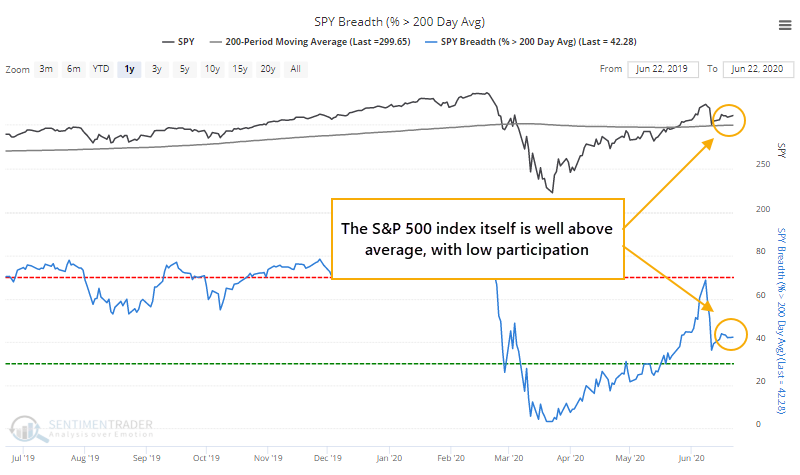

The S&P itself moved to more than 3% above its 200-day average, and yet less than half of stocks within the index have managed to climb above their own averages. As we saw last week, this is a theme across industries, sectors, and world indexes.

The last time that happened was also in the year 2000. Since 1990, the only signals were from 1998 through 2000.

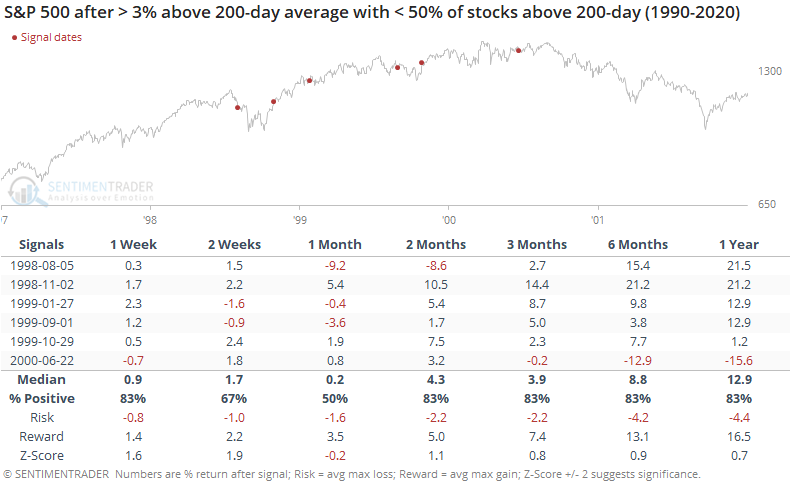

If the S&P was above its 200-day average by any amount, while fewer than 45% of its members were above their averages, then that only happened in 2007, and 1999 prior to that.

It's curious that this streak in the Nasdaq is occurring simultaneously with gold. Typically, the latter is considered a safe haven, more likely to rise when stocks are volatile.

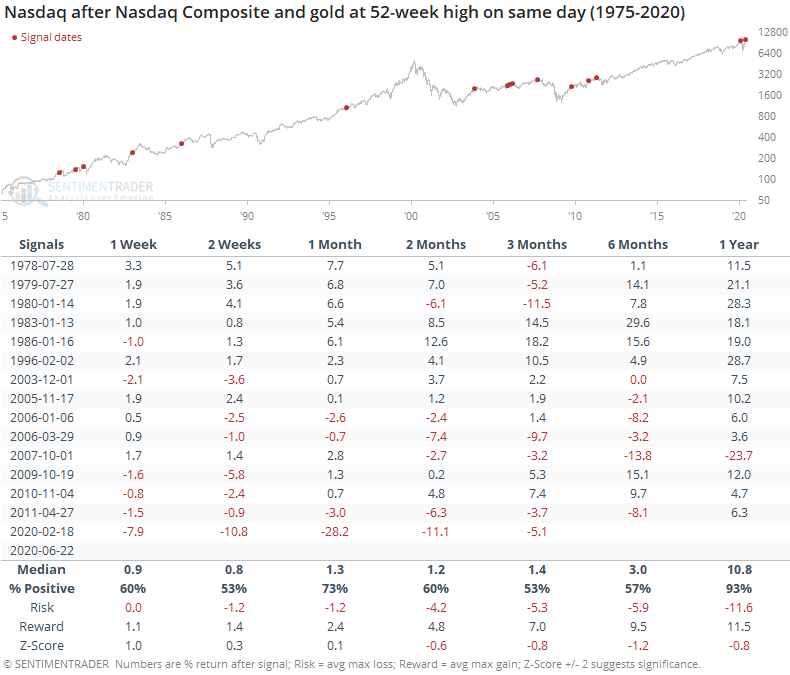

Over the past 15 years, this led to consistently negative short- to medium-term returns in the Nasdaq, but not so much prior to that.

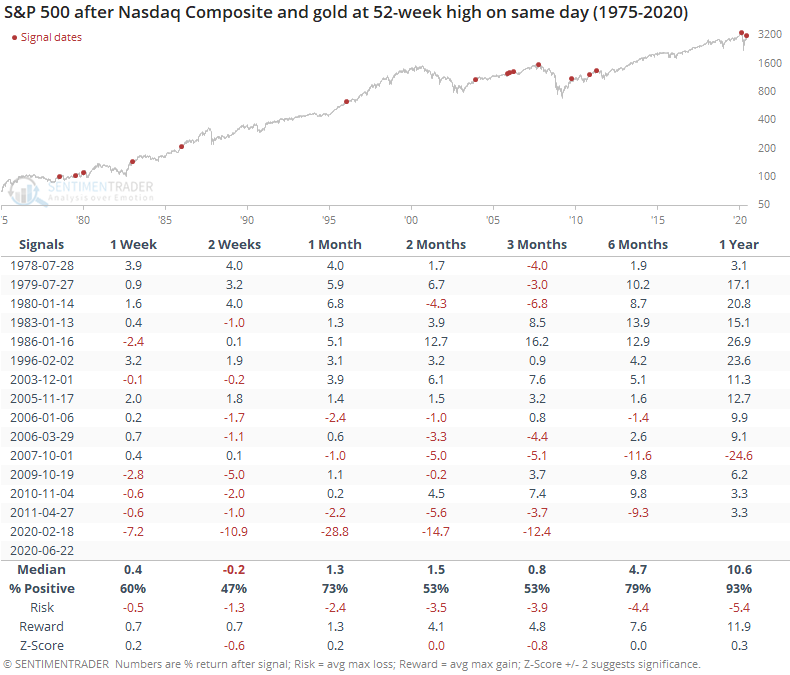

For the S&P, it also tended to be a short- to medium-term negative over the past 15 years. The risk/reward was unimpressive up to three months later.

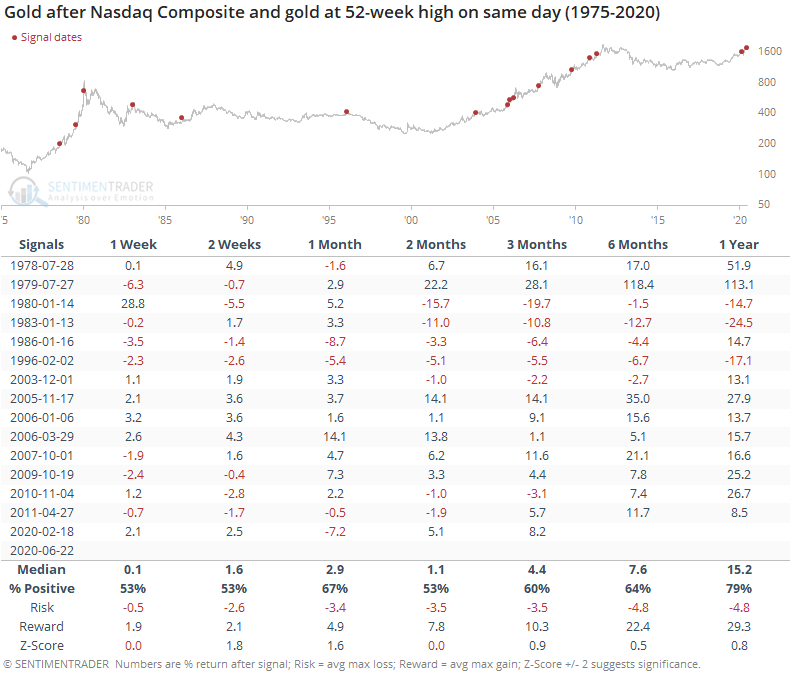

For gold, it was a mixed sign, but kind of the opposite of that in the Nasdaq and S&P. Up to the last 15 years, it was mostly negative over the short-term medium-term, and mostly positive since then.

Oddities like this started building in late 2019, and it took months before any potential consequences. The above studies don't suggest an immediate worry, as the future returns were too inconsistent to suggest "sell." But periods of rising index prices and high optimism, during markets where relatively few stocks are in long-term uptrends, have a strong tendency to resolve lower in the weeks-to-months ahead. Seeing some safe-haven assets rally along with stocks adds to the discomfort.