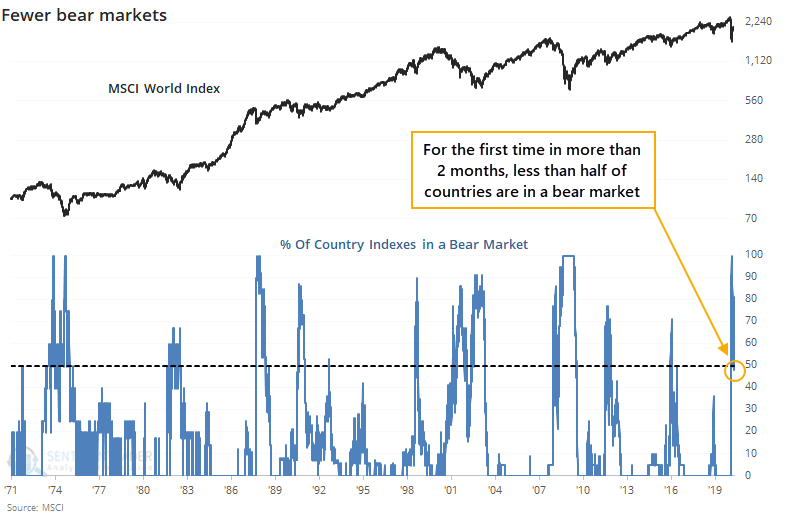

Indexes across the world haven't done this for 2 months

For the first time in months, less than half of major world equity indexes are in a bear market.

While some have an issue with semantics, by "bear market" we're using the simple definition that an index has to be trading at least 20% below its 52-week high.

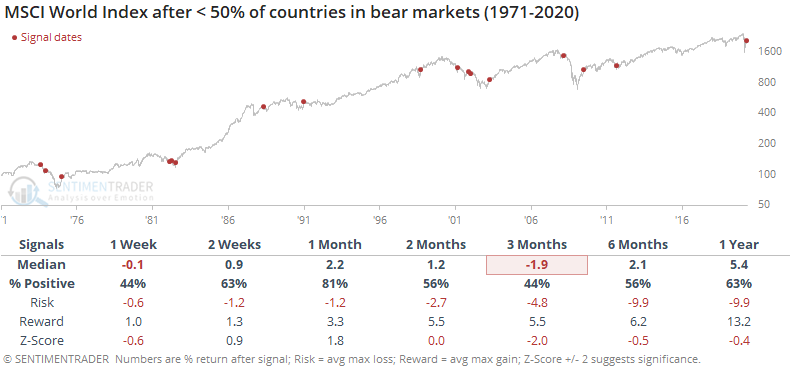

When more than half of the indexes recovered out of bear markets for the first time in months, it has been a mixed sign for the MSCI World Index.

It proved to be a false start too many times to consider it a positive now. Most of the time, the successful signal was the 2nd or 3rd one after a protracted decline. Or even if there was only a single signal, the World Index didn't typically take off on a sustained rally right away. It showed a gain 81% of the time a month later, but only 44% of the time after three months.

This is one of the unique breadth measures we follow on the site, which include:

- Percentage of country indexes in a bear market

- Percentage of country indexes in a correction

- Percentage of country indexes with a rising 200-day moving averages

- Percentage of country indexes above their 200-day moving averages

- Percentage of country indexes above their 50-day moving averages

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What happens when at least one country finally has a rising 200-day average

- What happens when there is a surge in countries above their 50-day average but none above their 200-day

- What happens when the S&P 500 finally sees a rising 200-day average

- What happens when the S&P sees a surge in stocks above their 50-day averages but not 200-day

- Rydex market timers have been piling into sector funds

- U.S. stocks have been highly correlated to the Australian dollar

- Gold and silver miners have seen a historic rally over the past 2 months

- The gold/silver ratio is oversold