Increasing new highs

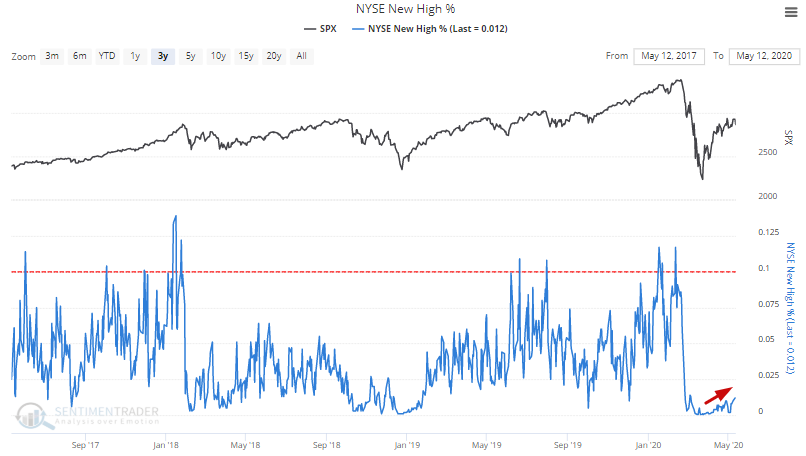

The recent uptrend in U.S. equities has caused the % of issues making new 52 week highs to tick higher.

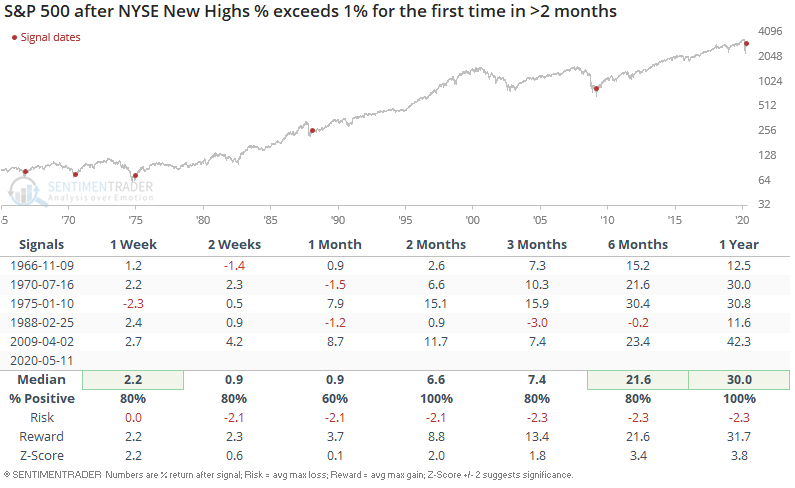

For example, the % of NYSE issues making 52 week highs has exceeded 1% for the first time in more than 2 months:

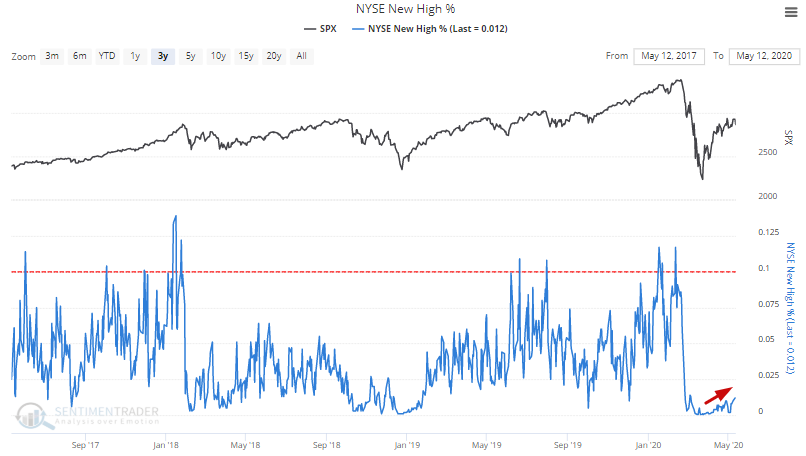

When breadth started to recover after a long streak of virtually no 52 week highs, the S&P 500's returns over the next year were universally bullish. This happened exclusively after major bear markets ended (after 2007-2009 bear market, after 1987 crash, after 1973-1974 bear market, etc):

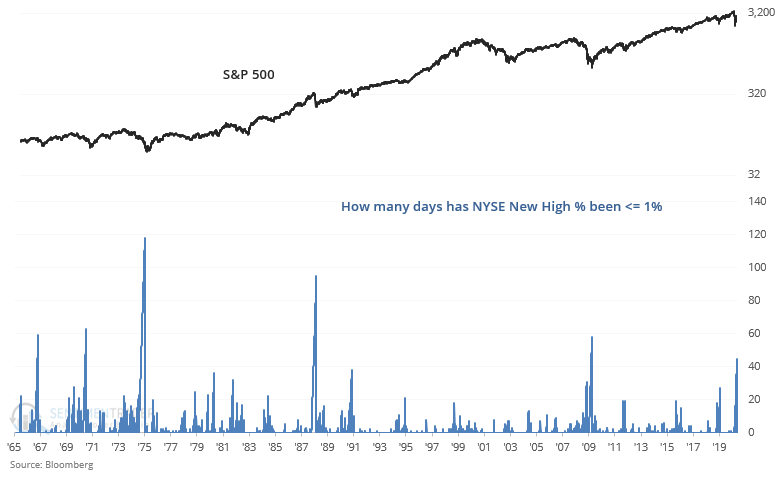

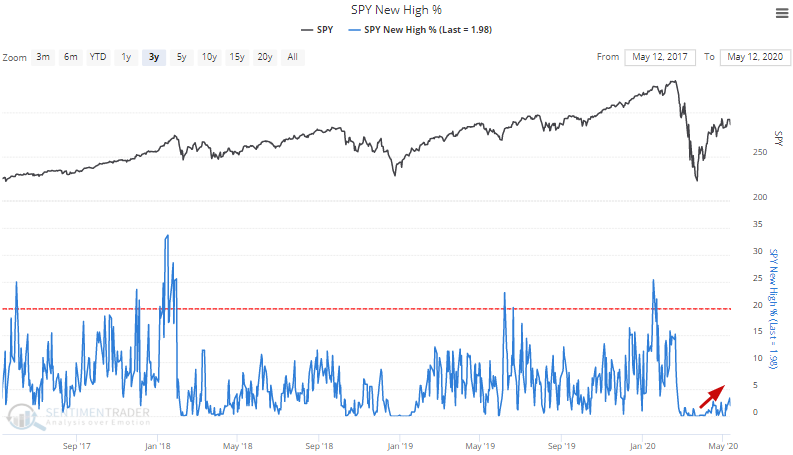

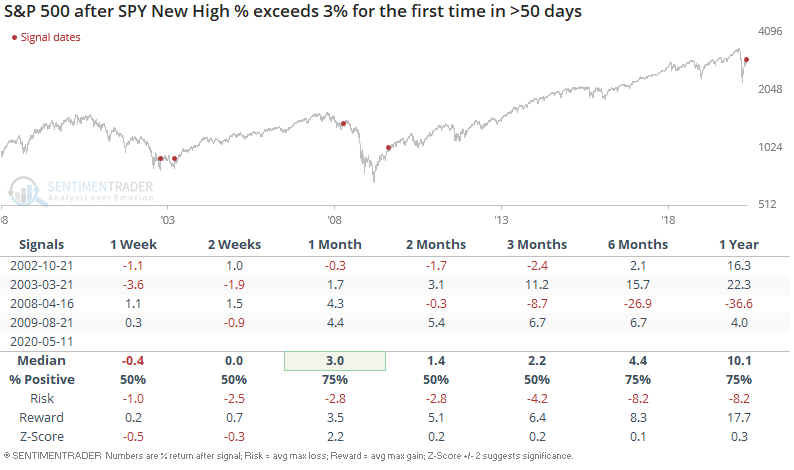

Similarly, the % of S&P 500 members at a 52 week high ticked above 3% for the first time in more than 50 days:

This was mostly a good sign for U.S. equities over the next year, with a big exception in April 2008 when the 2007-2009 bear market was just getting started.

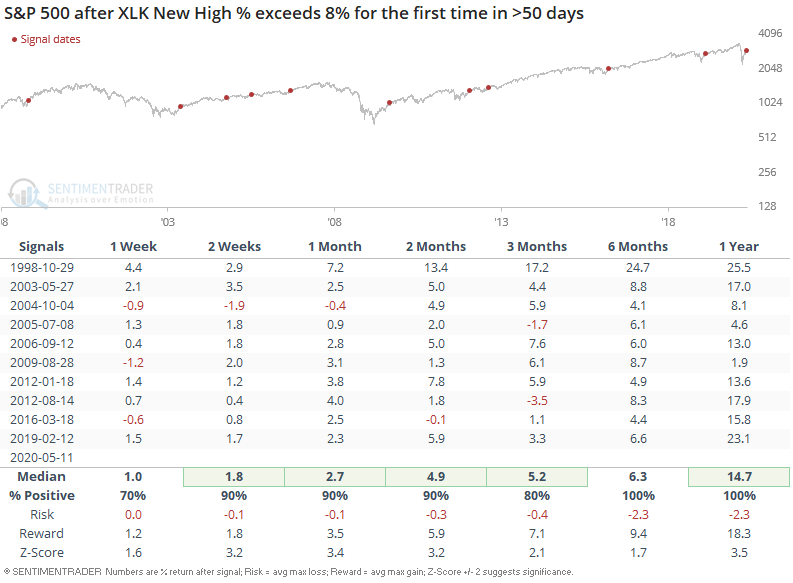

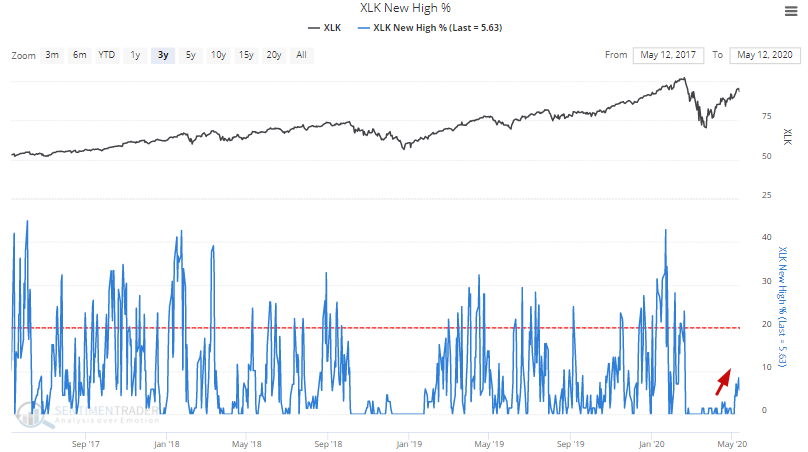

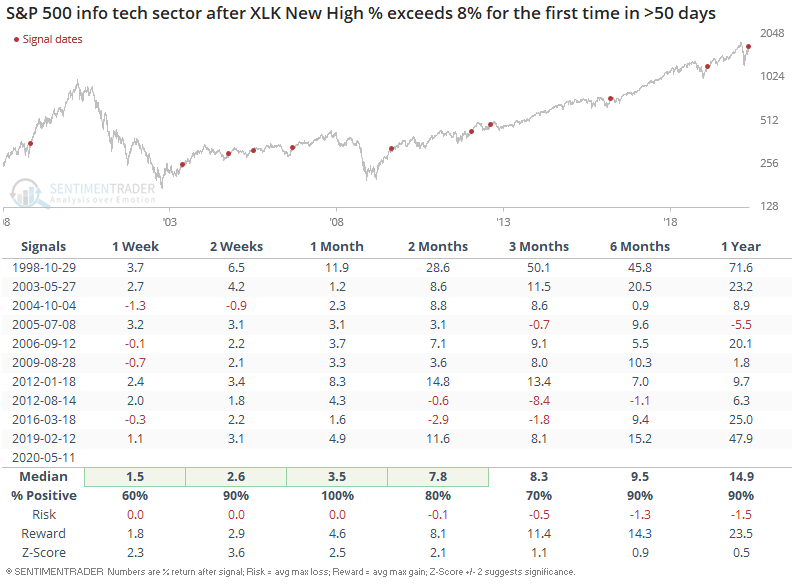

Tech has been leading the uptrend, and the % of S&P 500 information technology members at 52 week highs exceeded 8% for the first time in more than 50 days:

Once again, this mostly led to gains for the tech sector over the next 6-12 months:

And it always led to more gains for the broader S&P 500 over the next 6-12 months: