In record time, small stocks (almost) double

Last week, some signs of "smart money" selling were triggering, yet options speculation was hitting records.

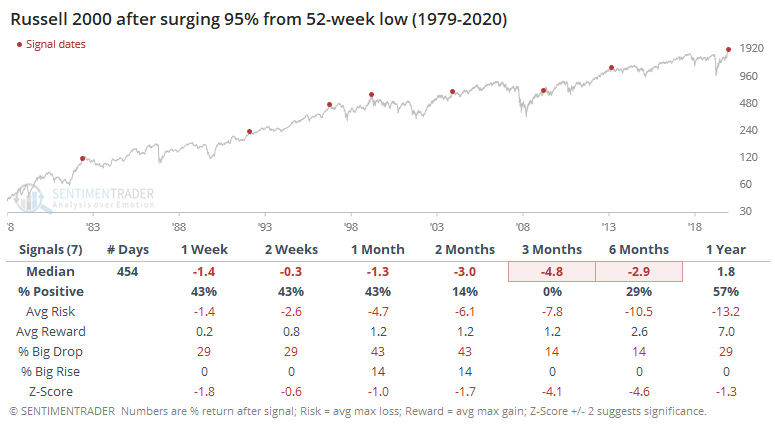

Choppy conditions over the past week didn't seem to dent that behavior at all. Among the smallest of traders, 54% of volume flowed into buying call options to open. That's a record amount of focus among the most speculative of strategies and among the most speculative of traders.

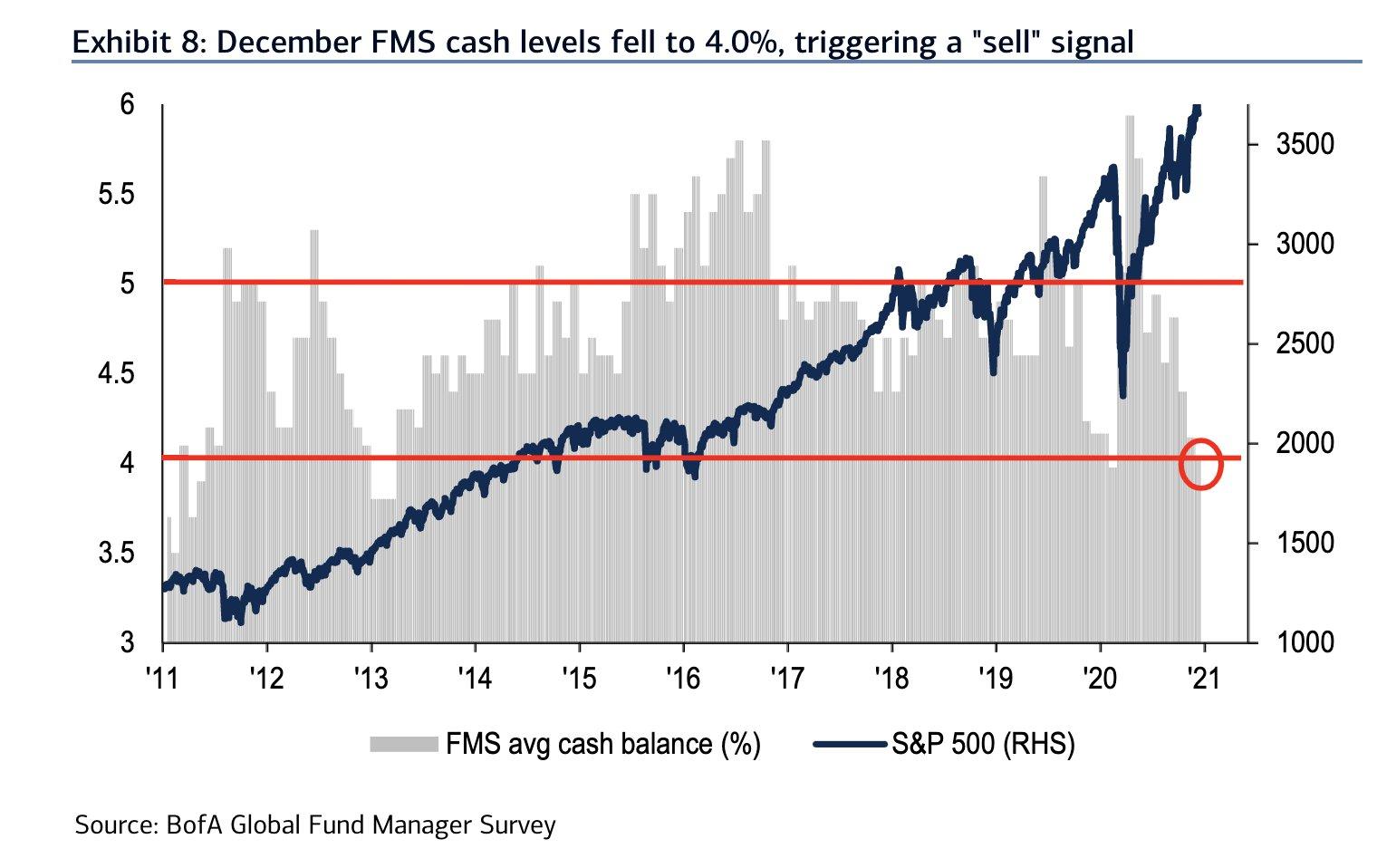

It's hard to blame folks for getting so positive. After being left behind, smaller stocks have surged in recent months, and that contributed to impressive, even historic, positive breadth readings. About the only cautionary signal is just how stretched prices have become. At its high on Monday, the Russell 2000 almost doubled from its most recent 52-week low.

Even a surge of 95% off a low has preceded losses in the small-cap index over the next 3 months every time.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Full returns after the Russell 2000 almost doubles from a low

- What that meant for the S&P 500

- Looking at a near-double in small-cap stocks from a low since 1926

- Dumb Money Confidence is rolling over from a record high

- The Optimism Index on the U.S. dollar is curling higher from extreme pessimism

- The McClellan Oscillators for the DAX and Shanghai Composite are oversold

| Stat Box Among S&P 500 stocks, 11 of them suffered a "buying climax" on Monday. A climax is triggered when a stock hits a 52-week high and then closes lower than where it closed the previous day. This is the 10th-highest reading in the past 6 months. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

1. Putting some color on the extremes in put/call ratios, it's not just that traders are turning over a massive amount of calls relative to puts on equities, they're doing the exact opposite in indexes. Buying calls on stocks and hedging with puts on the index? [Variant Perception]

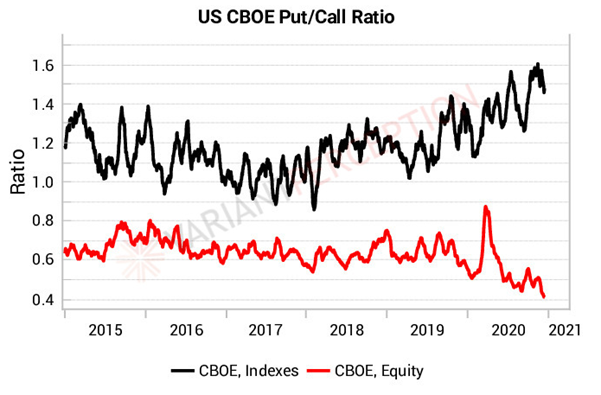

2. At least those options traders might be getting good prices because of a deep market. If they were trading the futures instead, then they might not be quite so fortunate, as liquidity in the biggest futures market of them all remains near historic lows. [Bloomberg]

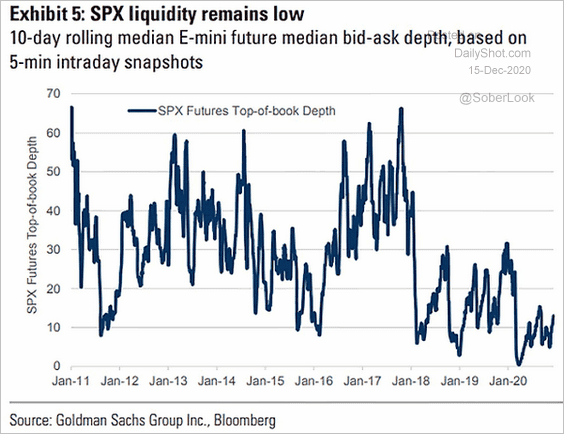

3. Fund managers seem to be in the camp of not wanting to look silly by being under-invested ahead of year-end. Cash levels among them have plunged by 40%, triggering a sell signal according to a BofA research model. [BofA]