Implications of lumber's struggles versus gold

Key points:

- The ratio of lumber to gold prices has hit a new 52-week low

- While taken as a warning sign, new lows in the ratio have not consistently preceded poor returns in stocks

- For lumber and gold themselves, new lows in the ratio also tended to precede rebounds

Lumber prices have hit a new low relative to gold

There is never a paucity of potential problems for equity investors. After suffering through last year, it seems everyone is waiting for the next shoe to drop and using any excuse to reduce exposure.

One worry that has cropped up lately is the drastic moves in some commodities. The ratio of lumber to gold prices is a fairly common one, as lumber is a reflection of building and economic activity. In contrast, gold is mostly just a shiny rock that sometimes serves as a safe haven asset.

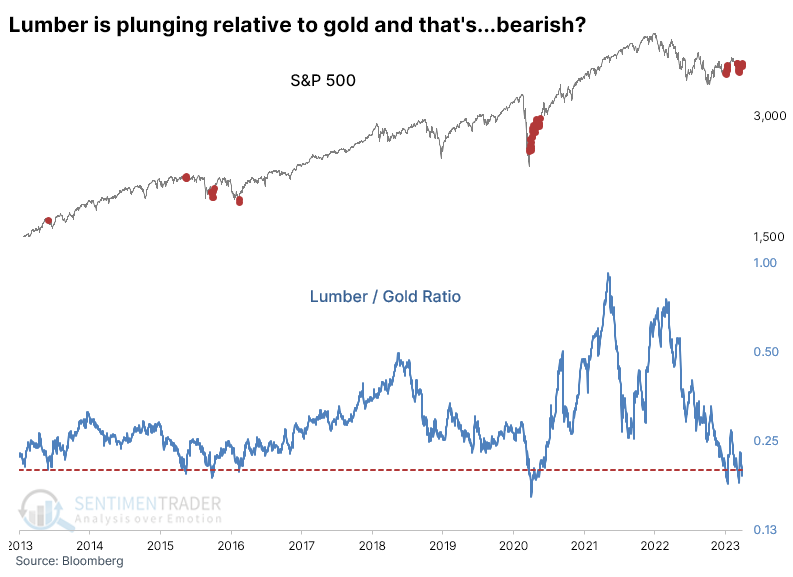

In recent weeks, the former has been plunging while the latter soars. That raised concerns that an essential part of the economy is faltering while investors rush into the "safety" of gold. Over the last decade, though, a low ratio of lumber to gold prices hasn't been a very good reason to worry.

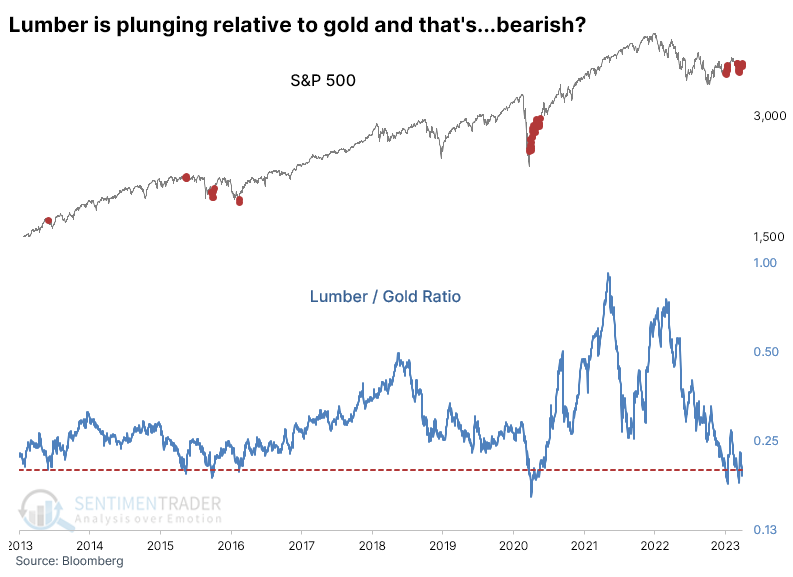

Taking a long-term view, a lagging lumber/gold ratio gave a few decent heads-ups. Because the ratio has undergone significant regime shifts in the past, it's most helpful to look at a relative measure, like the level of the ratio compared to its other readings over the past year.

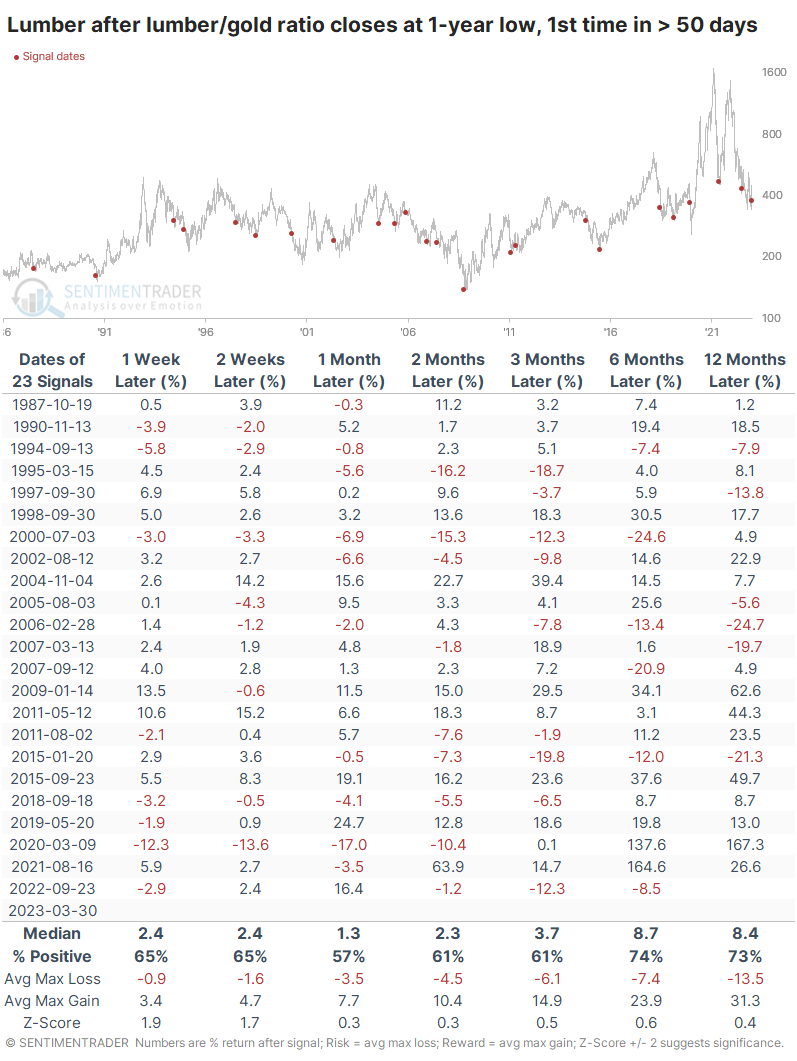

The chart below plots red dots on the S&P 500 whenever the lumber/gold ratio sets a new 52-week low.

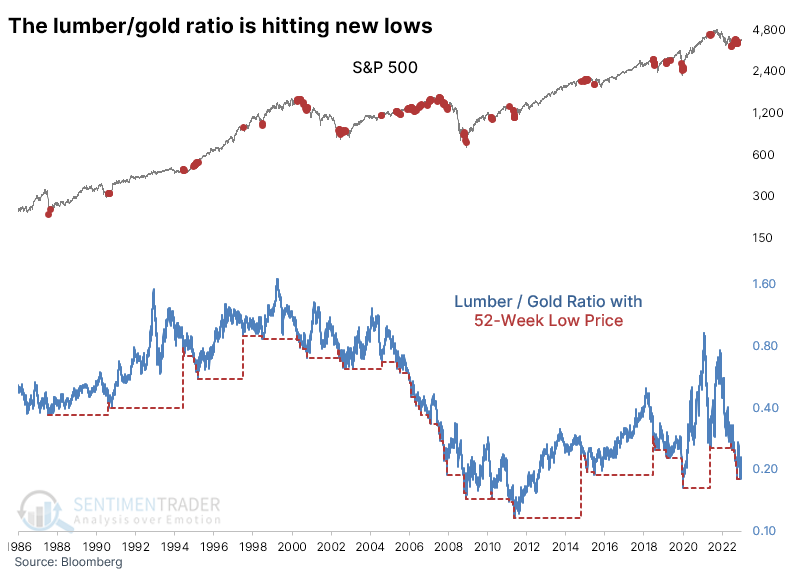

The table below shows future returns in the S&P when the ratio set a new low for the first time in at least 50 sessions, which was triggered at the end of March.

Overall returns for the S&P weren't great, but they also weren't consistently terrible. Over most time frames, its median return was higher than a random return, and the maximum gain exceeded the maximum loss. The worry is that several signals preceded double-digit losses.

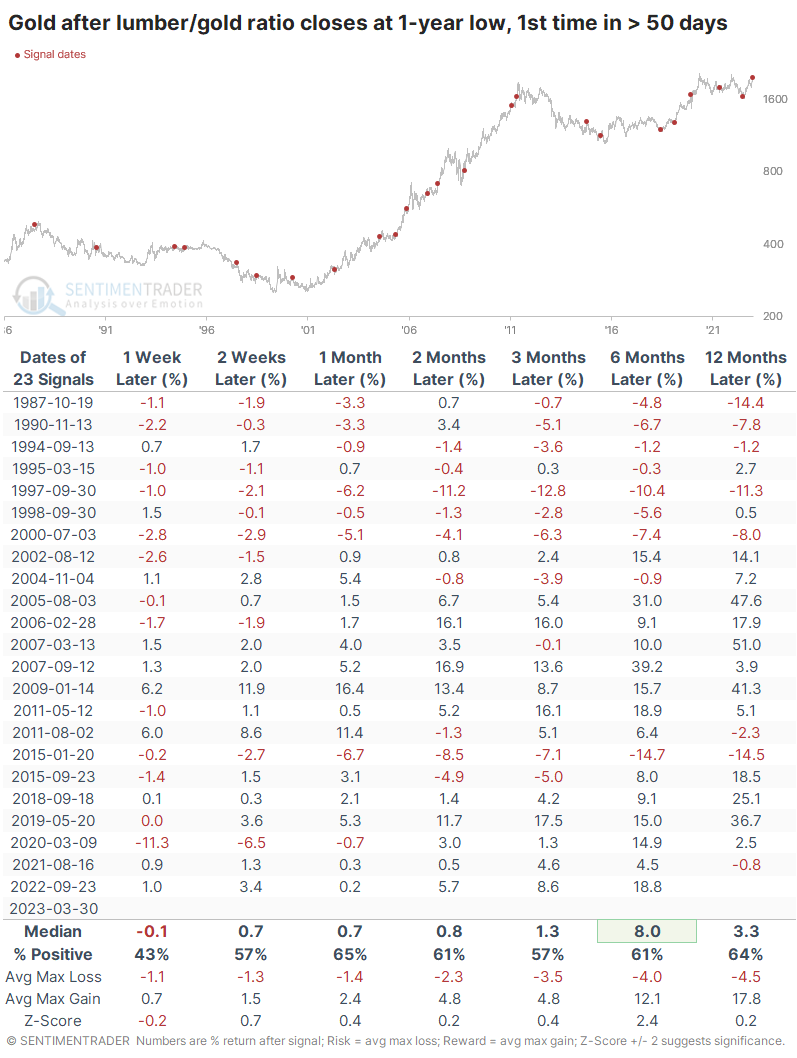

A new low in the ratio preceded higher lumber and gold prices, too

New lows in the ratio were mainly a good sign for lumber prices. Even though the contract has spent years (even decades) without going much of anywhere, there was a modest tendency toward mean-reversion. Over the next six months, lumber rose 74% of the time, averaging +8.7%. There were many double-digit, even some triple-digit, gains, but also four signals that suffered double-digit losses.

Curiously, gold also tended to show positive returns, especially over the past twenty years; before 2002, not so much.

What the research tells us...

Analysts increasingly tend to use ratios of economic metrics or asset classes to glean macroeconomic insights and apply those to the prospects for stocks. "Insights" is often a misnomer because, most of the time, extremes in those ratios have highlighted one or two cherry-picked disasters and nothing special the rest of the time. A new low in the ratio of lumber to gold seems to be one of those, as it preceded consistently positive returns for the S&P 500 over the past 40 years.