Imminent Recession (So They Say)

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

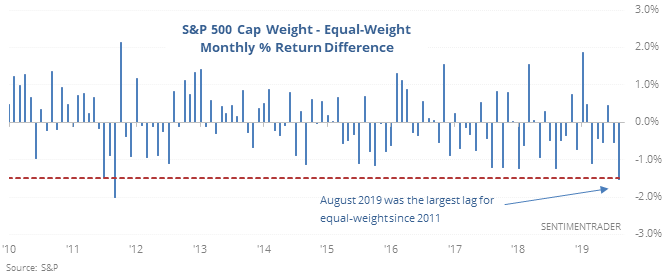

An unequal month

An index that equally-weights each of the stocks in the S&P 500 badly under-performed the capitalization-weighted version of the index that everyone watches.

That masks some underlying weakness in the index. But when both indexes fall, with the equal-weight version falling the most, it did not consistently signal future weakness.

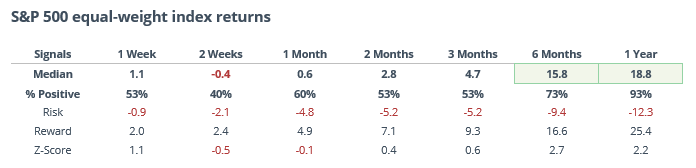

The S&P 500’s returns going forward were a bit weak shorter-term, but strong over the medium- to long-term. That’s for the cap-weighted index that everyone uses. For the equal-weight index, shown below, returns were even weaker shorter-term, but stronger longer-term.

Survey says

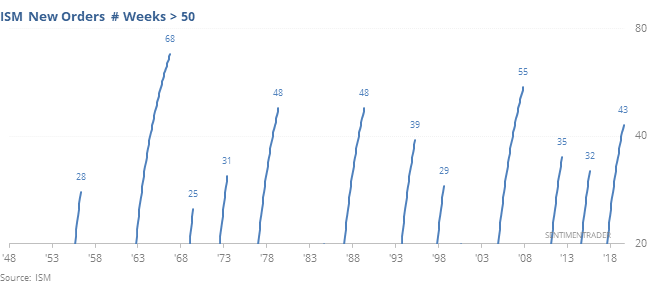

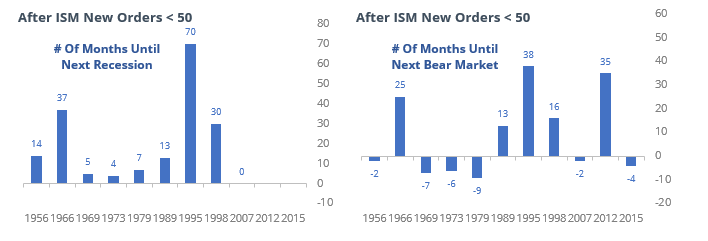

The widely watched ISM Manufacturing and New Orders surveys showed contraction for the first time in several years in August.

This has triggered a bout of large-font headlines suggesting the U.S. economy is heading into an imminent recession. And these surveys a major input to many recession models, raising the probability of future weakness. But when the surveys slip below 50 after a long period of positive momentum, it has not been a consistent signal of imminent recession, and even less so a looming bear market in stocks.

Exhausted

Last week, 50 companies in the S&P 500 had a selling climax, where they hit a 52-week low then rebounded to close above the prior week’s close. The Backtest Engine shows that the only period when this many selling climaxes led to a negative return was in 2008. The other weeks either preceded gains or smallish, temporary losses.

Highly correlated

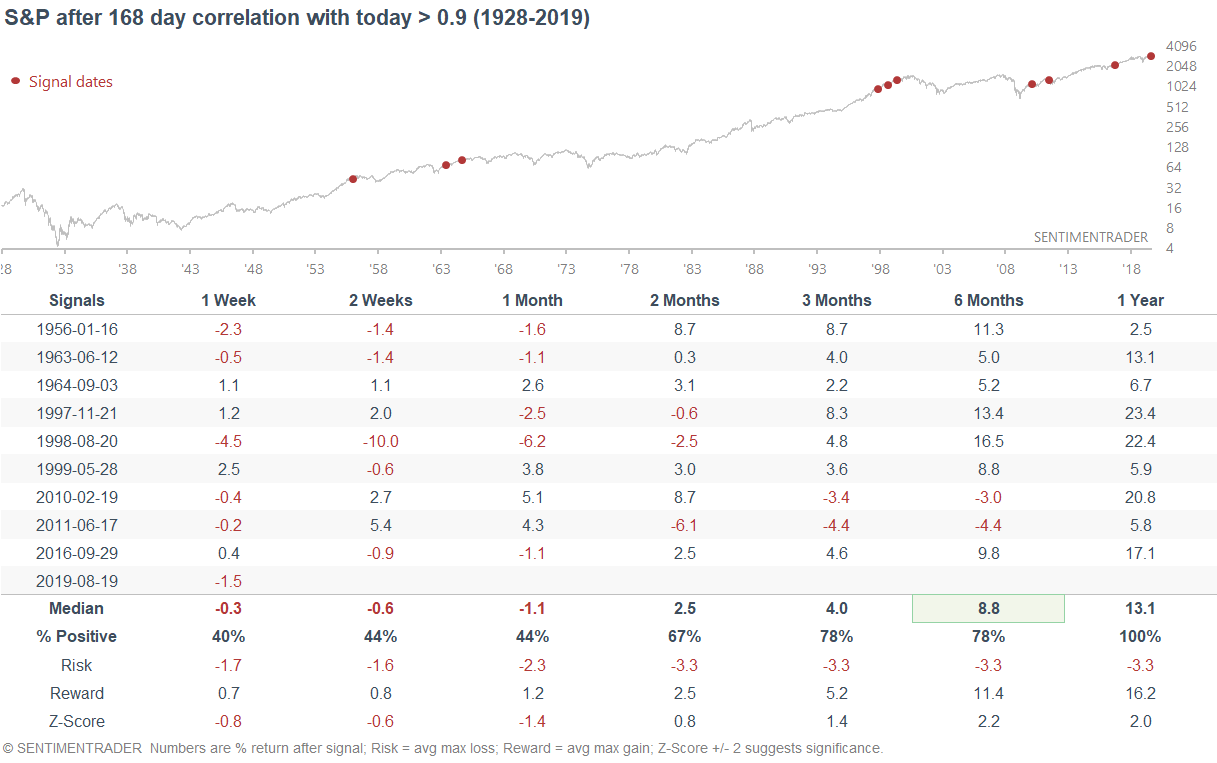

There has been another bout of “the past 8 months look just like 2007” price charts going around. As Troy noted over the weekend, there have been 9 periods of 168 days with a correlation higher than 90% to the last 168 days (dating back to the end of 2018). A year later, all of them were higher, by an average of 13.1%.

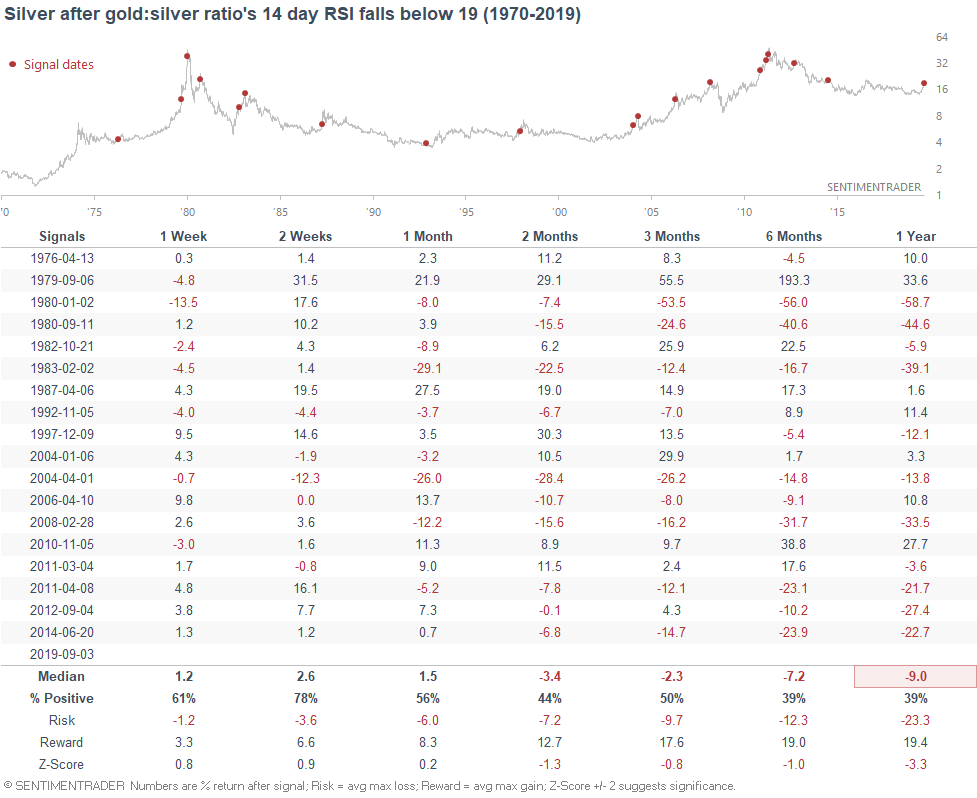

Gold:Silver

Silver continues to play catch-up to gold's rally. Silver surged yesterday, causing the gold:silver ratio to tank.

As a result, the gold:silver ratio's 14 day RSI has fallen to 18, which is extremely low. In the past, this wasn't too good for silver over the next 6-12 months.