If you didn't enjoy the first half of September...

Key points:

- September is widely recognized as the poorest performing month for the stock market

- It is a mistake to assume that the market will decline simply because the month happens to be September

- A lesser-known fact is that weakness is much more common during the last ten trading days of September

September as a whole

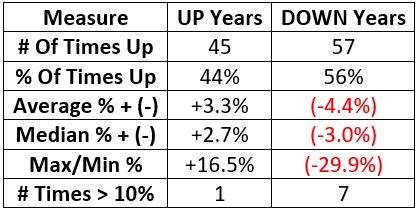

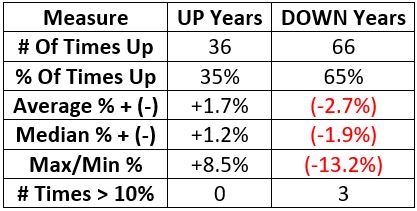

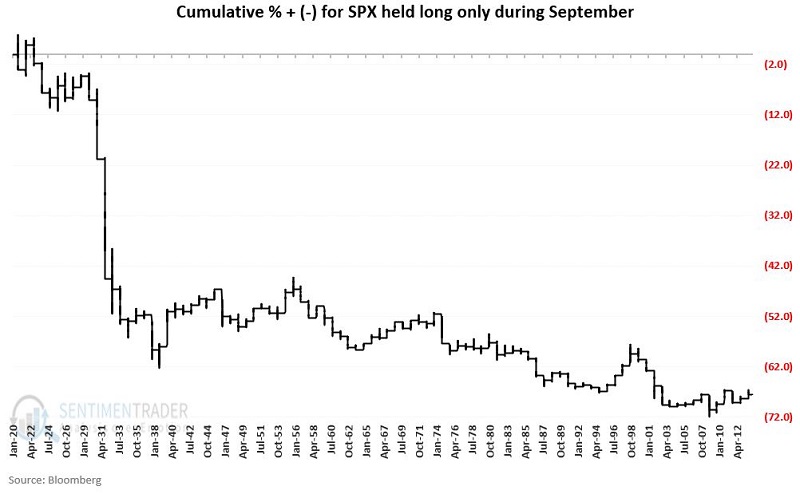

We use S&P 500 Index daily price data for testing starting in 1920. The chart below displays the cumulative percentage return for SPX held long only during September each year beginning in 1920, and the table summarizes monthly results.

The overall results are not good. Nevertheless, a 44% Win Rate means it is a mistake to stick one's head in the sand merely because the calendar reads September. To find something potentially more useful, let's take a closer look at Intra monthly returns.

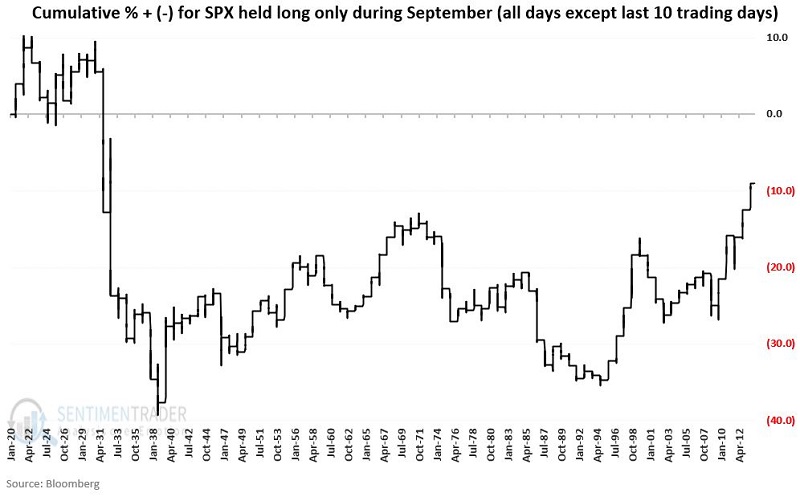

The first part of September

We will define "the first part" of September as every trading day before the last ten trading days of the month. The chart below displays the cumulative return for SPX held long-only all trading days in September before the last ten trading days. The table summarizes the results.

Note that the Win Rate for September before the last ten trading days of the month is above 50%. Still essentially a coin-flip but not necessarily a reason to bail out of stocks.

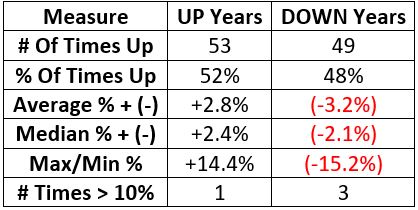

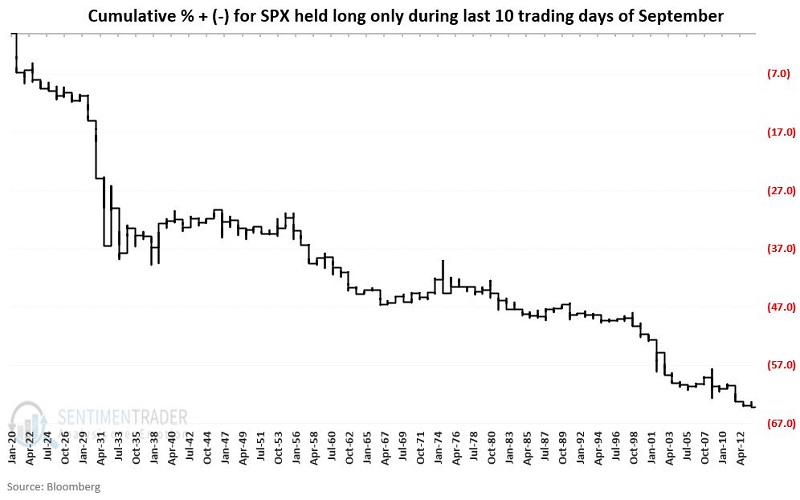

The latter part of September

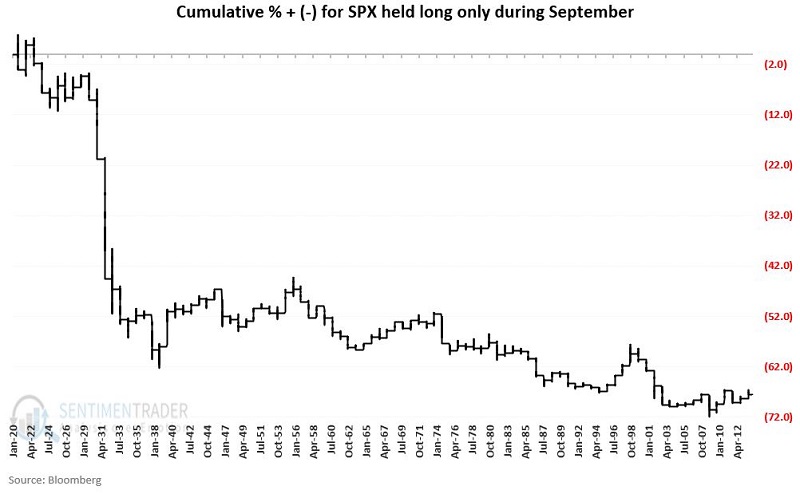

We will define "the latter part" of September as the last ten trading days of the month. The chart below displays the cumulative return for SPX held long only during the last ten trading days of September, and the table summarizes the results.

Note the persistent long-term downtrend in the chart above. If a time of year invites hedging, this would be it.

What the research tells us…

It is a mistake to assume that the stock market will decline simply because the calendar reads September. However, long-term results suggest that caution is clearly in order during September - particularly when we get to the last ten trading days of the month.

For 2022, this particularly unfavorable period extends from the close on 2022-09-16 through the close on 2022-09-30.