If Inflation is Transitory, Gasoline Prices Are About to Provide a Clue

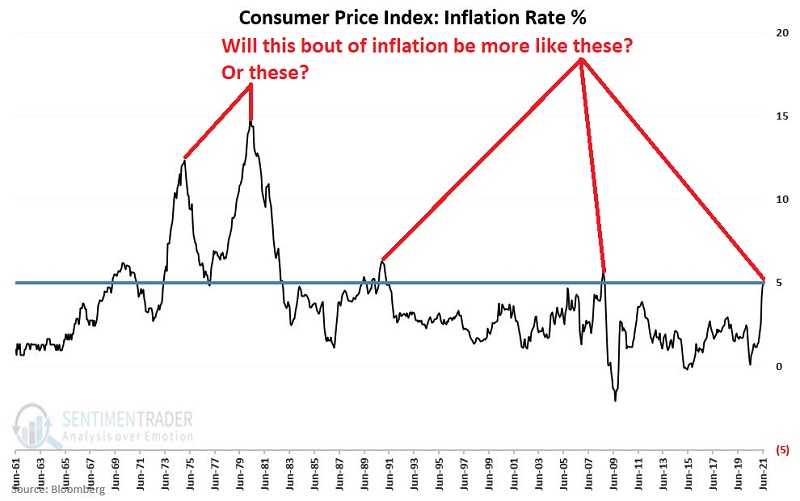

The latest release on the Consumer Price Index finds the current inflation rate now north of 5% - a rare occurrence in the past 40 years. The question on everyone's mind is: "Is inflation transitory? Or is this just the start of something bigger?" The chart below illustrates why the answer is important.

WHICH WAY FROM HERE

If you scour the internet for clues about whether inflation will accelerate or wane, you will find many. Let me condense my own take on all of this information to two points:

- You can find someone to say exactly what you want to hear

- Nobody knows for sure

If you can accept those two arguments, you can move on from speculating and hypothesizing and move onto actual evidence-based analysis.

THE IMPORTANCE OF GASOLINE PRICES

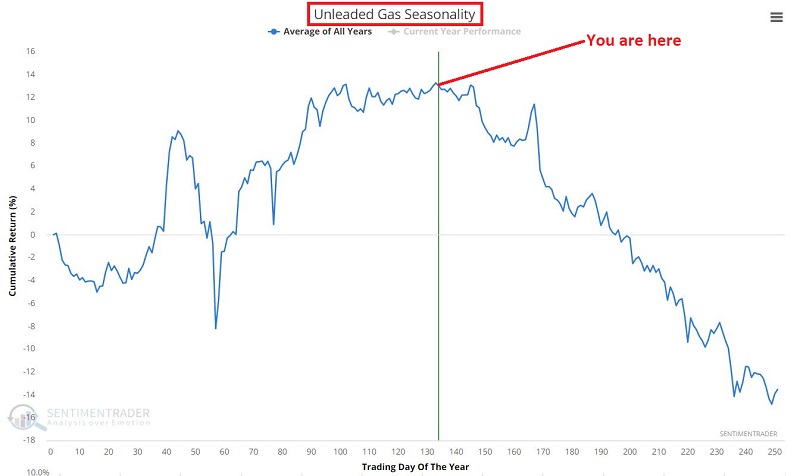

I first highlighted much of what appears below in a Public post on June 18th, 2021. We start with the Annual Seasonal Trend for Unleaded Gas futures, as shown below.

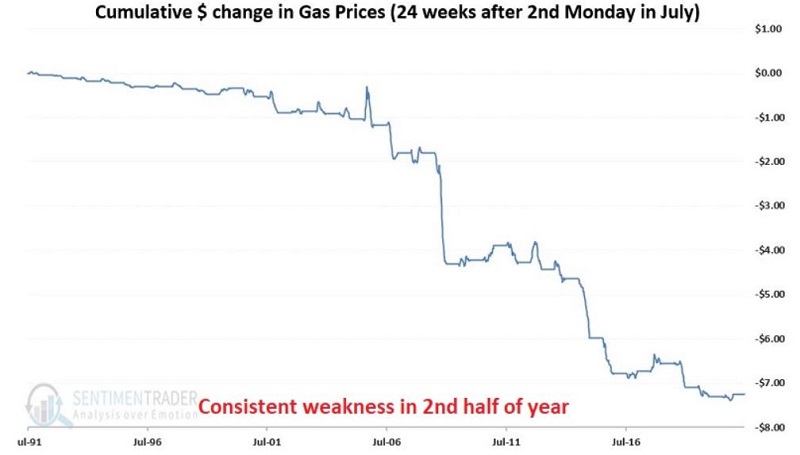

As you can see, there is a clear tendency for price weakness in the second half of the year in the futures market. How does this translate to the pump? The chart below uses Department of Energy data on the price of gasoline at the pump. The chart displays the cumulative dollar change in the price of gasoline at the pump during the 24 weeks after the 2nd Monday of July during every year since 1991. The trend speaks for itself.

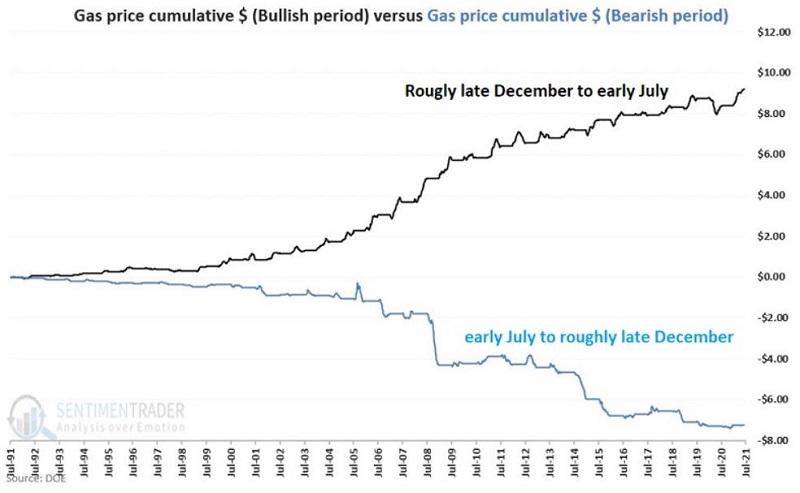

To fully drive home the cyclical nature of gas prices, the chart below also displays the cumulative dollar change in the price of gasoline at the pump during the remainder of the year.

Clearly, rising gasoline prices from late December into July and falling gasoline prices from early July into late December is a highly reliable long-term trend.

WHAT DOES IT MEAN?

The 2nd Monday of July 2021 (7/12/2021) has come and gone. We have now entered a period of seasonal weakness for the price of gas at the pump that typically lasts for 24 weeks (through 12/20/21 this year).

Here is what we may be about to learn:

- If the price of gasoline begins to move sideways to lower in the weeks ahead, then it may provide a strong clue that the current spate of inflation will, in fact, be transitory.

- However, if the price of gasoline continues to rise as it has in recent months - even during this period of expected price weakness - then it may provide a strong clue that the current spate of inflation may be more of a problem than a lot of people hope and/or expect.

I can offer no useful prediction as to how this will play out. But I will be keeping a close eye on the price of gas.