If I Could Only Pick One Index for the Next Seven Months

OK, I will grant you that it is a flawed premise since nothing requires me or you to pick just one index for the next six months. Still, it is kind of an intriguing question. And if you are talking "odds, based strictly on historical performance," there is, in fact, a clear favorite. So, let's get to it.

THE DATA

We want to test returns ONLY during the 7-month period extending from the end of October through May each year.

For this test, we will use monthly total return data for:

- S&P 500 (Large-cap) Index

- S&P 400 (Mid-cap) Index

- Russell 2000 (Small-cap) Index

We will start our test at the end of October 1981 (because that is the first year of data available for the S&P 400 Midcap Index).

THE TEST

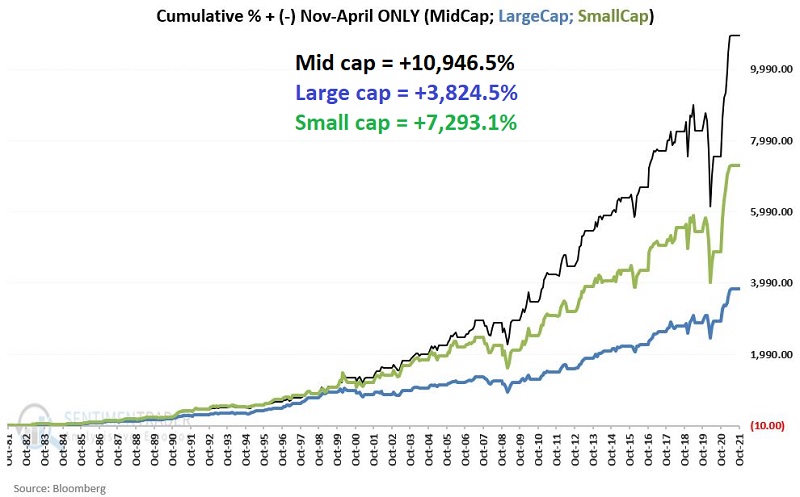

The chart below displays the cumulative % return for each of the 3 indexes held ONLY during November through May each year since 1981.

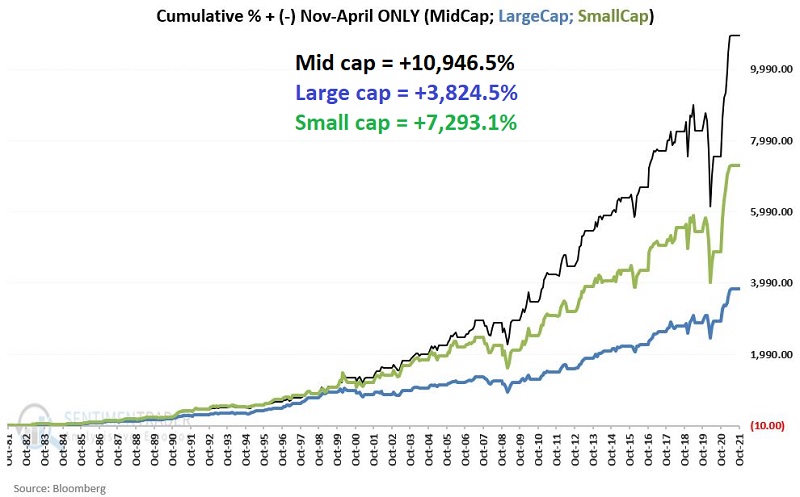

The cumulative returns for each index during Nov-May appear in the table below.

The cumulative returns for each index during Nov-May appear in the table below.

ANALYZING RESULTS

In terms of raw returns, Midcaps have clearly been the winner of the past four decades. However, consistency is just as important. In other words, we want to perceive an actual recurring "edge" and not rely on something that has a few big outliers here and there.

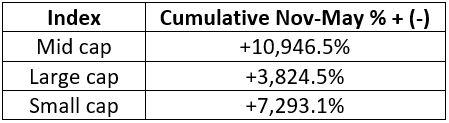

The table below displays the comparative performance figures for each index.

As you can see in the table above. Midcap's show:

- Largest % of UP years (88%)

- Highest average and median returns

- Highest Average / Std. Deviation

- Small "Worst" year

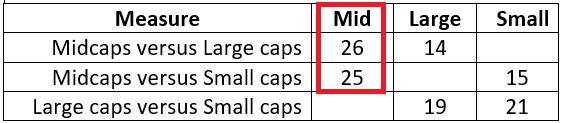

The table below analyzes the annual 7-month performance of each index versus the other indexes. The key things to note:

- In 26 of 40 years (65% of the time), Midcaps outperformed large caps

- In 25 of 40 years (63% of the time), Midcaps outperformed small caps

SUMMARY

During November through May over the past 40 years, Midcap stocks:

- Have shown a gain 88% of the time

- Has outperformed Large caps and Small caps 65% and 63% of the time, respectively

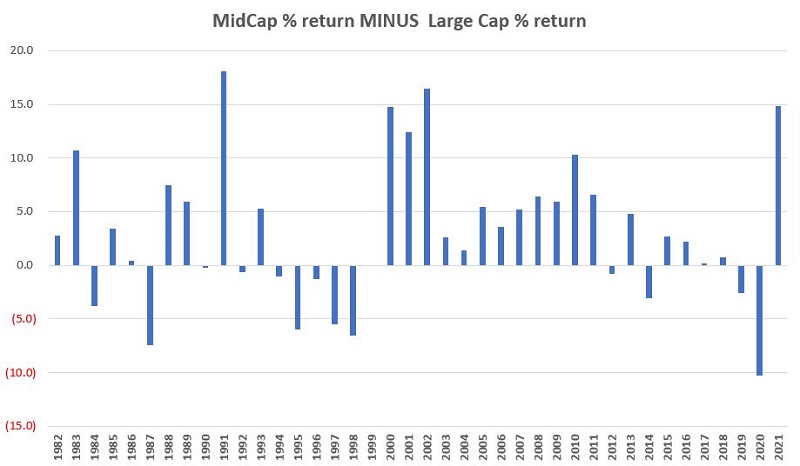

The chart below displays the annual result of Midcap return minus Large Cap return for Nov-May.

There is no way to predict which index will perform the best (or the worst) between November and May on a year-to-year basis. But the long-term results clearly seem to suggest that Midcap stocks appear to offer an "edge."