How I use the Intermediate Term Optimism Index

One day in the future, the stock market will experience a correction, and investor sentiment will turn from optimism to pessimism. Luckily for us, Jason created the best toolbox of sentiment indicators on the planet.

Designing a good trading signal with sentiment indicators is similar to the methodologies I use for price-based alerts. The model should identify a sharp and sudden reversal from an extreme market condition.

Today's note aims to share a concept that identifies when the Intermediate-Term Optimism Index reverses from a pessimistic extreme.

COMPONENT

- SentimenTrader Intermediate-Term Optimism Index (Optix)

THE CONCEPT

The Intermediate-Term Optimism Index (Optix) signal identifies when the N-day net change in the Optix Index registers a sharp reversal upward from a pessimistic extreme. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA FOR THE S&P 500 ETF (SPY)

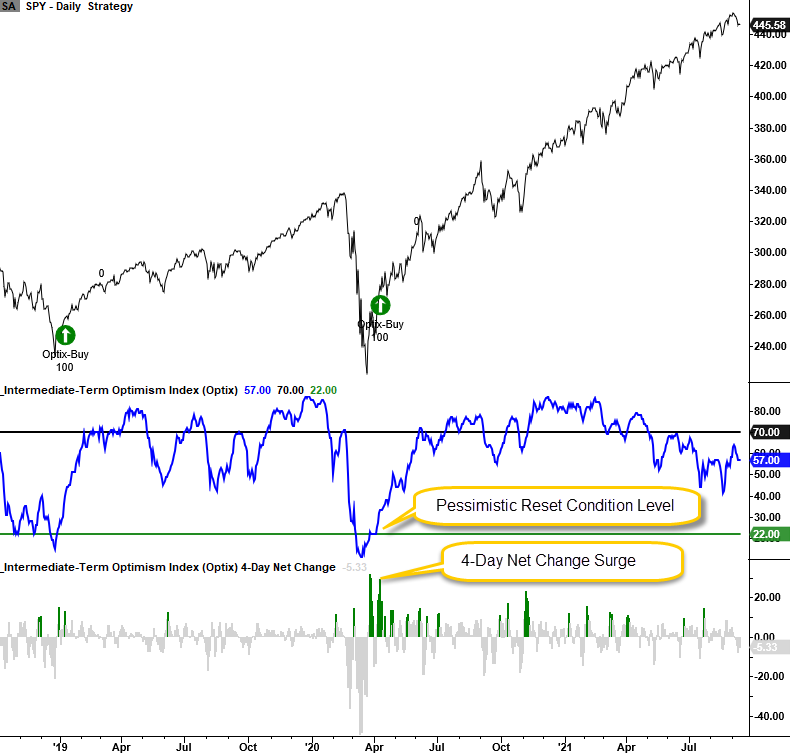

- If the intermediate-term optimism index crosses below 22%, then the pessimistic reset condition is active.

- If the reset condition is confirmed and the 4-day net change in the optimism index crosses above 10% and the 5-day rate of change for the SPY ETF > 0% within five days of the cross, then buy.

- If the intermediate-term optimism index crosses above 70%, then the optimistic reset condition is active. i.e., the optimistic reset condition screens out duplicate signals.

CURRENT DAY CHART

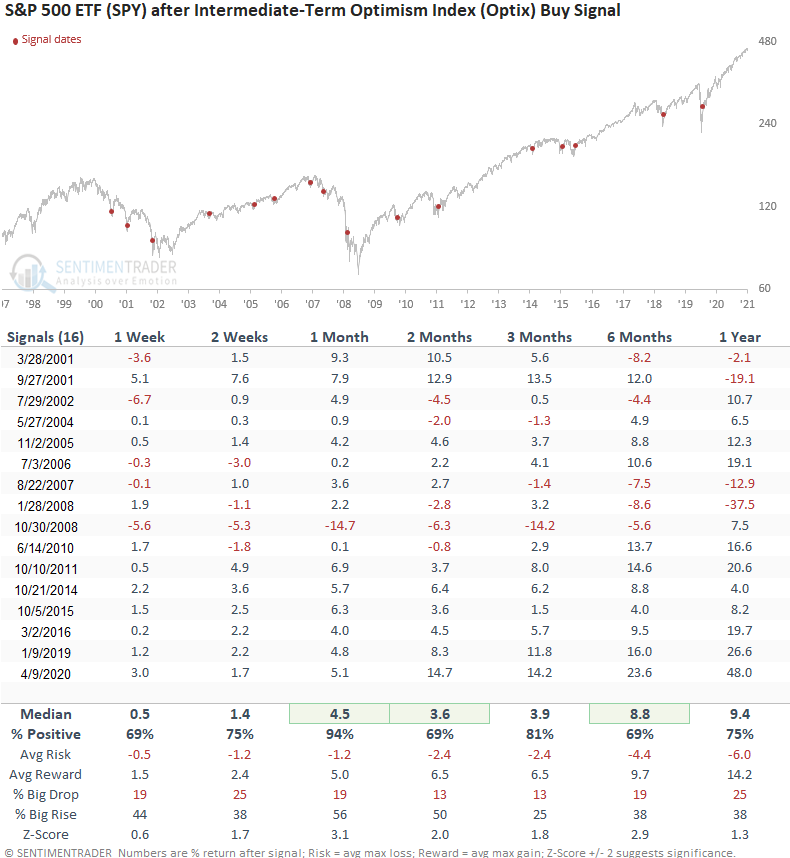

HOW THE SIGNAL PERFORMED

Results look good, especially the 1-month timeframe.

OPTIMISM COUNT

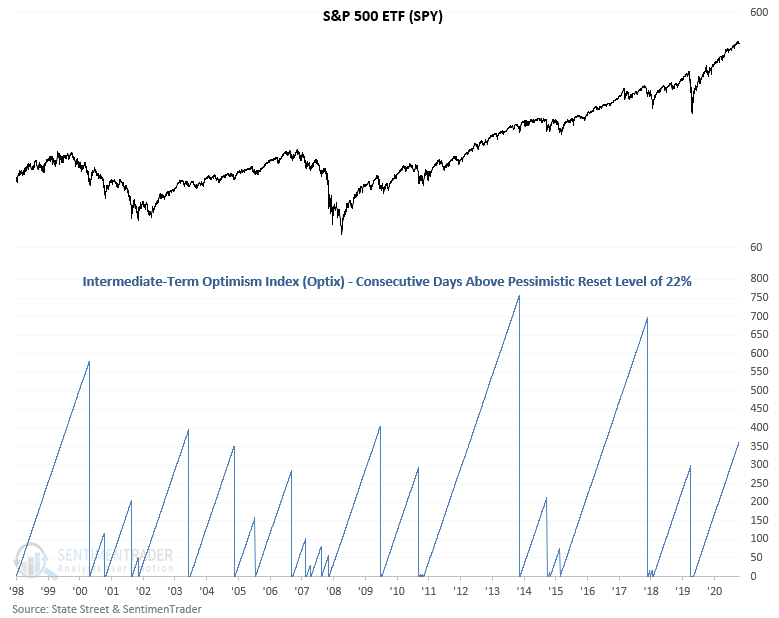

As the following chart shows, investors can remain in an optimistic mood for a long time.