Housing stocks are on fire, and optimism is at record highs

Thanks to a housing market that has held up surprisingly well despite the tumult of 2020, homebuilders have never been more optimistic. A monthly survey by the National Association of Home Builders shows that builders enjoyed the tailwind of low mortgage rates.

"Derived from a monthly survey that NAHB has been conducting for 35 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor. All the HMI indices posted gains in August."

This is quite a reversal from an index that had been at an 8-year low only a few months ago. When the survey rebounds from below 50 to approach or exceed its prior multi-year high, it hasn't been a great sign for their homebuilders' stock prices going forward.

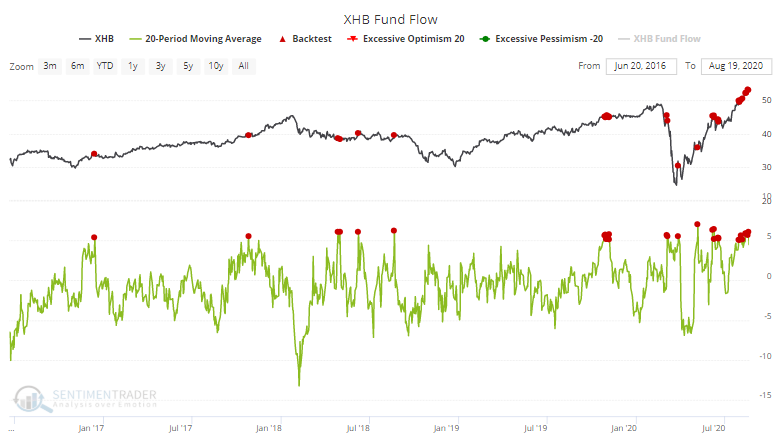

ETF investors have taken note, putting more than an average of $5 million per day into the XHB fund over the past 20 sessions.

Our Backtest Engine shows that future returns were muted when flows were this high. Returns were significantly better when the fund averaged a $5 million per day outflow.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Full returns in homebuilding stocks after sentiment gets extremely optimistic

- The seasonal pattern in XHB

- The Optimism Index on lumber is nearing all-time highs

- Growth stocks have outperformed value for a record-tying number of months