Household equity holdings plunge, but remain too high

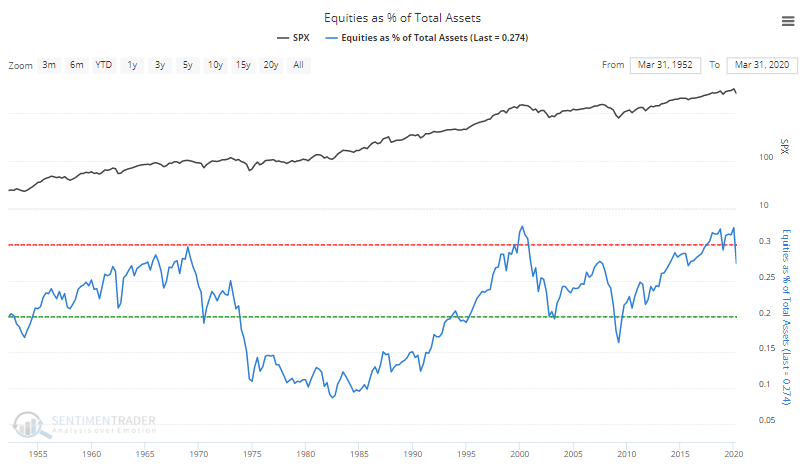

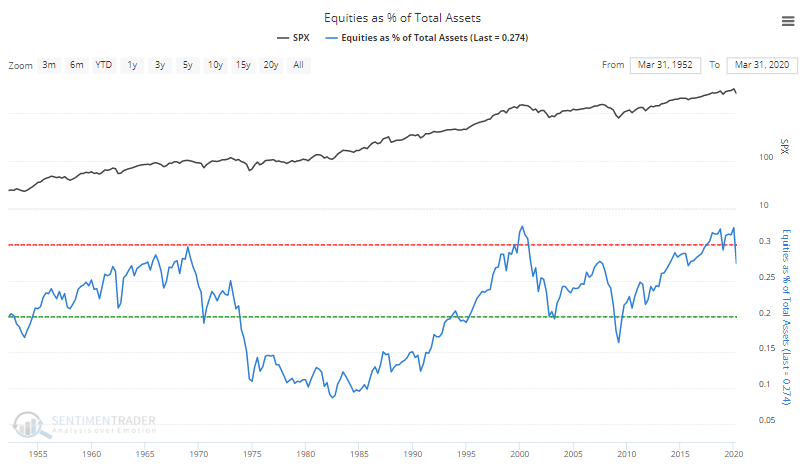

The first quarter put a wallop on household finances. According to the latest release from the Federal Reserve, which monitors asset levels through the end of March, equities as a percentage of households' total assets fell from 32.4% to 27.4%.

This is the 2nd-largest drop on record.

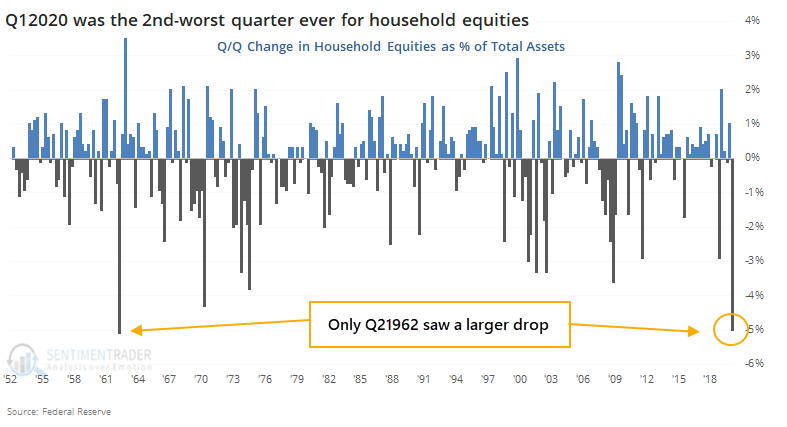

When equities as a percentage of total assets fell 3% or more in a single quarter, it was a mixed sign for the S&P 500 going forward. Because it's a quarterly data series and has a 2-month lag, we use longer time frames in the table.

While this triggered at major market lows in 1962, 1970, 1974, 2002, and 2008, it was also very early in 1973 and 2001. Even with those failures, 1-3 year returns were well above average. Because of the variability among returns, and the small sample size, the z-score couldn't make it above 2, however. Also, the best bear market lows occurred when stocks accounted for 20% or less of total assets, and the first quarter of 2020 barely made a dent in that.

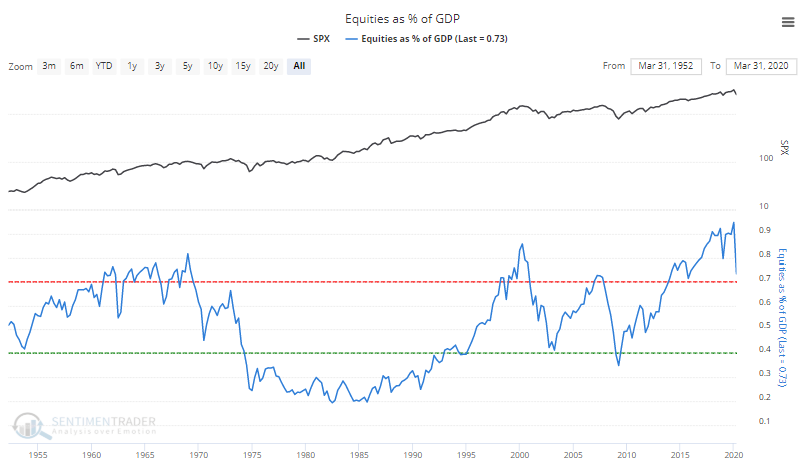

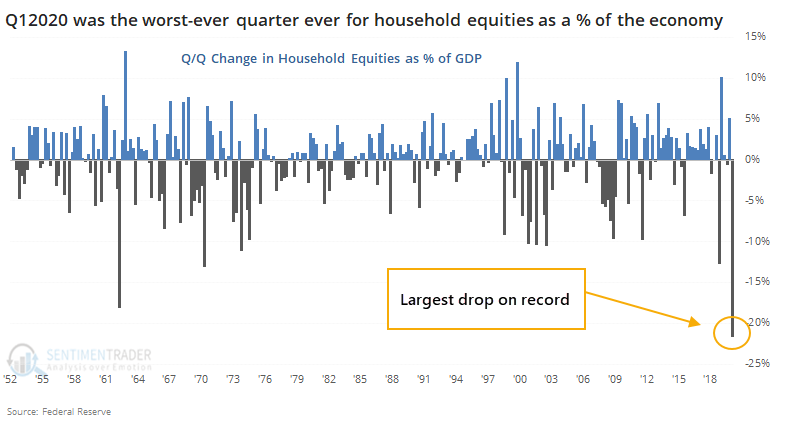

As a percentage of GDP, equity holdings plunged even further, from 94.8% to 73.3%.

That's the largest drop on record. Never before had equities dropped more than 20% as a percentage of the economy in only one quarter.

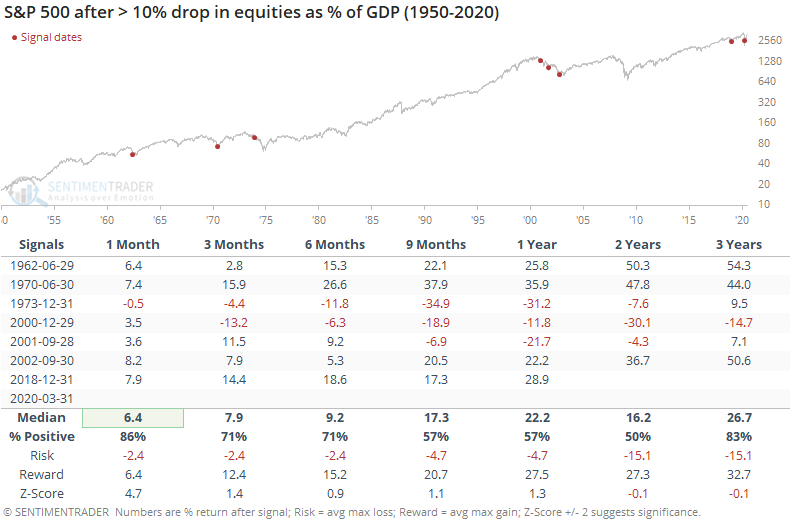

Quarters when equities declined 10% or more as a percentage of GDP mostly overlapped the dates in the first table.

This was too early to be considered a buy signal three times, and was successful four times, so kind of a toss-up. The biggest caveat now is that at 73%, it's still high relative to the most bullish historical extremes. The best returns occurred when equity holdings fell to under 50% of U.S. GDP.

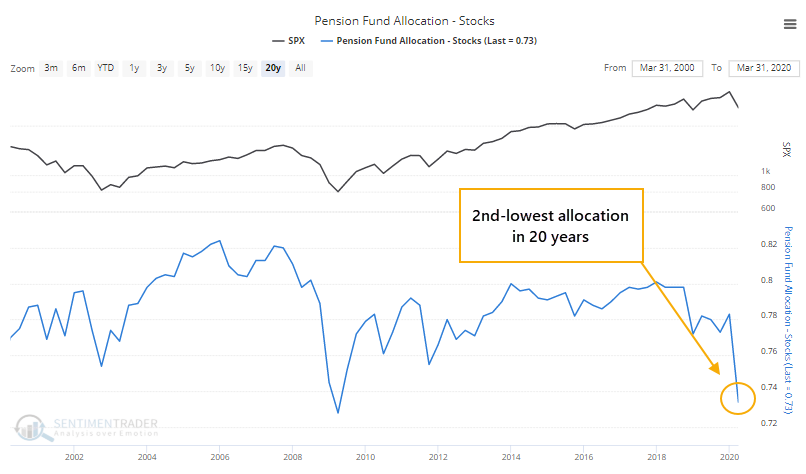

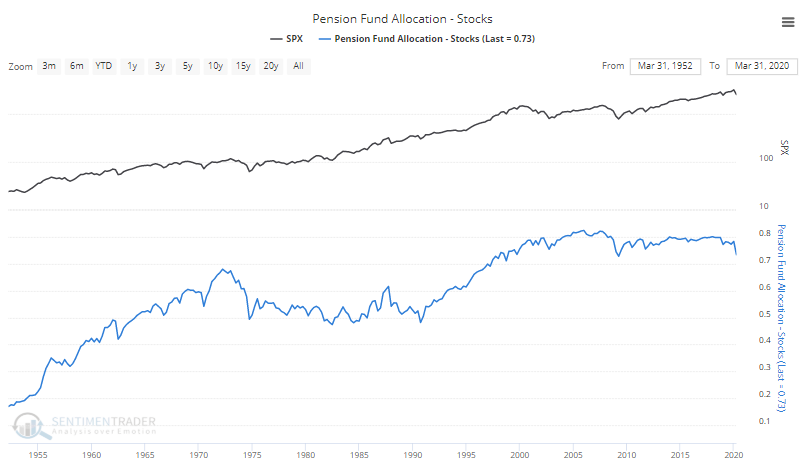

Despite their massive funding troubles, private pension funds appeared to hold or even sell stocks during the quarter. Their allocation to equities dropped to the 2nd-lowest in 20 years, next to the 1st quarter of 2019.

Over a very long time frame, their allocation has been much lower, but not since 1998.

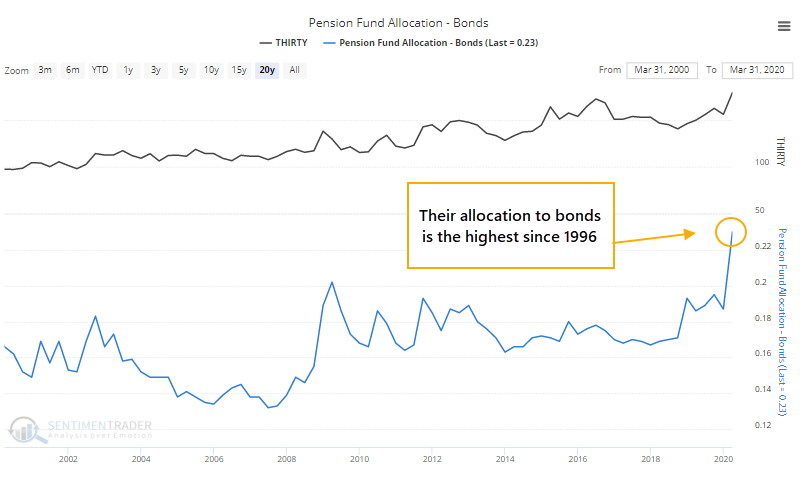

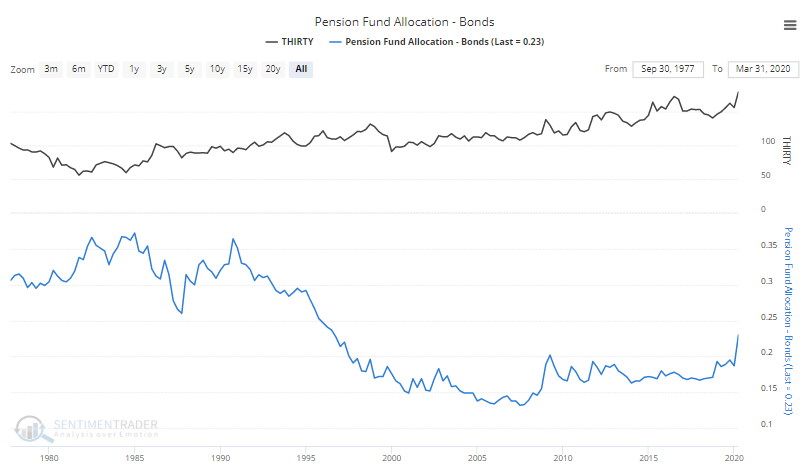

Their allocation to bonds skyrocketed, and at 23% of total assets, is the highest since 1996.

It has been much higher in the distant past, but clearly not anywhere near this in recent decades.

Pension funds have been decent contrary indicators over the past 20 years or so. They seem to make the wrong moves at the wrong times, probably why they have had constant trouble funding their obligations. Based on this alone, it's a modest positive for stocks.

When stocks have declined as much as they did in the first quarter, relative to other assets and economic output, it has tended to precede decent long-term returns. The fact that slow-moving pension funds have such low exposure, with such high obligations, suggests that they should be a steady buyer, another longer-term positive.

The biggest caveat is that household equity holdings are still historically high and major bear market lows occurred when stocks were a much less prominent part of total assets. Because of that, we can't consider this a positive yet, on any time frame.