Hoping to extend the Santa Claus Miner rally

Key points:

- The "Santa Claus Miner Rally" typically extends from mid-December into early January

- January of mid-term election years have tended to be favorable for gold miners

- We will focus on the first half of January in a mid-term election year

The Santa Claus Miner Rally redux

In this article, I noted that the standard Santa Claus Miner Rally period in question begins on the close of the 11th trading day of December and extends through the close on the first trading day of January in the New Year. For 2021 this period extends:

- From the close on 12/15/2021

- Through the close on 1/3/2022

However, as it turns out, January of mid-term election years has also tended to see strength in gold miners.

The period we will test is:

- From the close of December of a post-election year

- Through the close on Trading Day of Month #11 for January of the mid-term election year

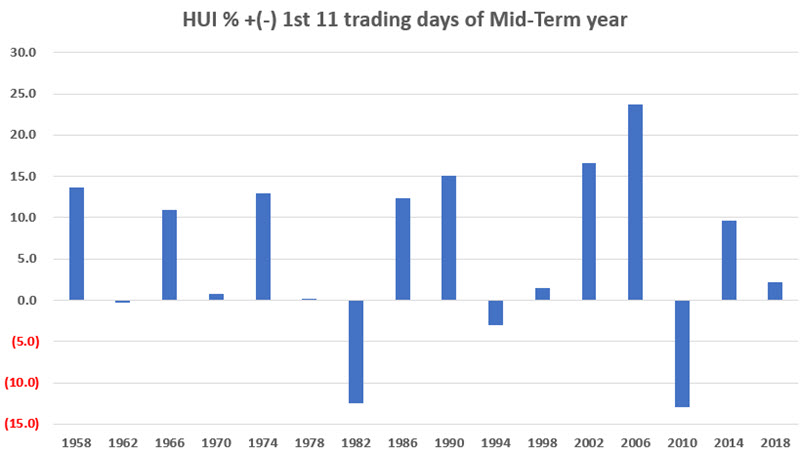

For testing purposes, we will use The Gold Bugs Index (HUI) as a proxy for miner stocks, for which we have data going back to 1957.

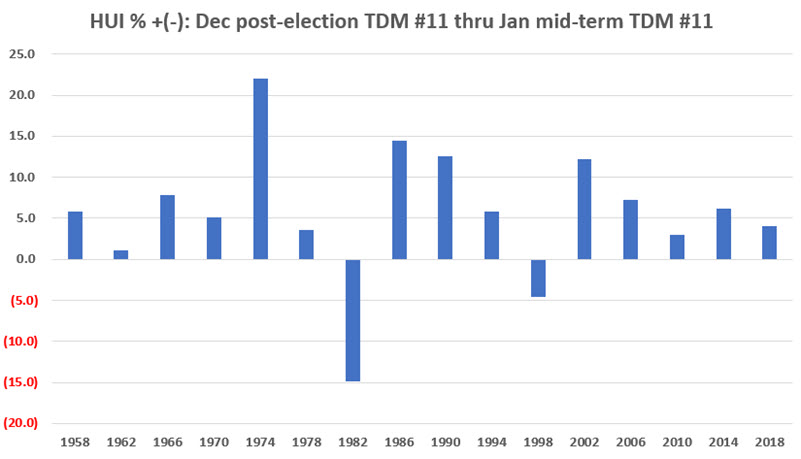

The chart below displays the results of the results every four years.

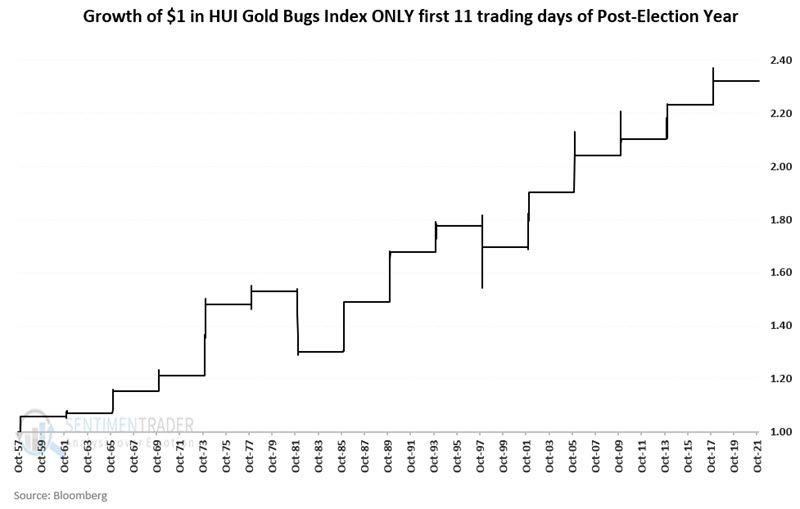

The chart below displays the growth of $1 invested in HUI ONLY during January's first eleven trading days during post-election years, starting in 1958.

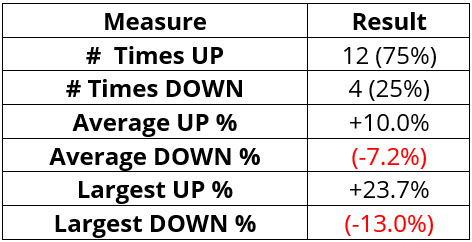

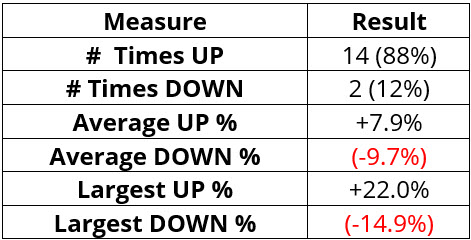

The table below displays the relevant performance numbers.

The key things to note from a real-world trading perspective:

- % of winning trades is excellent (75%)

- However, two of the four losses have been more than -12% (-12.4% in 1982 and -13.0% in 2010)

- The implication is that a trader must decide if they want to implement some stop-loss after entering a trade

Extending the Santa Claus Miner Rally

Now let's consider the standard Santa Claus Miner Rally period during post-election years and extend the holding period through the close of January Trading Day of Month #11 in the mid-term election year.

In other words:

- Buy gold miners at the close of Trading Day #11 of the post-election year

- Sell gold miners at the close of Trading Day #11 of the mid-term election year

For this cycle, the favorable period:

- Began at the close on 12/15/2021

- End at the close on 1/18/2022

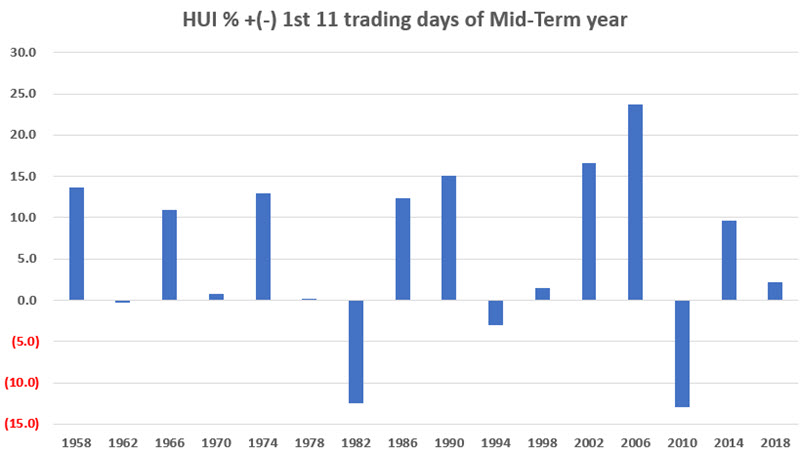

The chart below displays HUI performance over this extended period every four years.

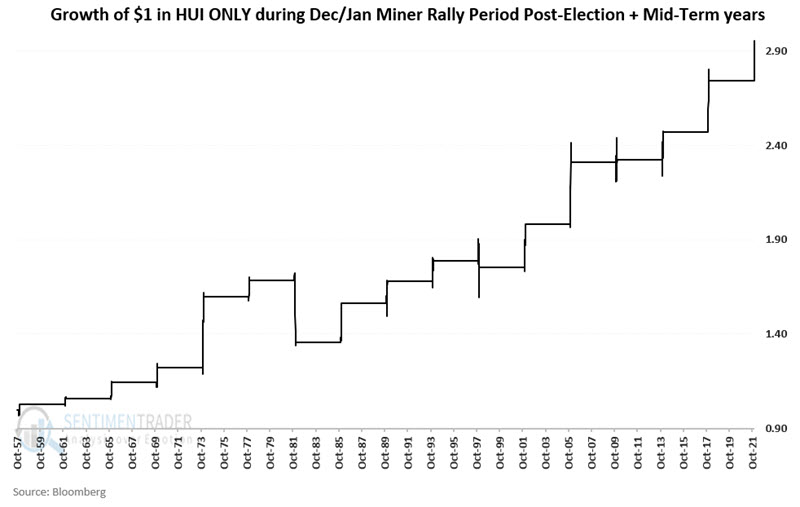

The chart below displays the growth of $1 invested in HUI ONLY during the extended Santa Claus Miner Rally period every four years.

The table below displays the relevant performance numbers.

Trading Notes

Likely choices for trading purposes include ETFs GDX, IAU, and GDXJ (NUGT offers 2x leverage - twice the potential gain and twice the potential risk). Another alternative is ticker PMPIX (ProFunds Precious Metals UltraSector Fund Investor Class) which is leveraged 1.5 to 1.

What the research tells us…

If history proves an accurate guide, the rally in gold miners that started on 12/16 may extend through 1/18/2022. Nevertheless, traders must recognize the speculative nature of trading gold mining stocks and remember that significant loss is possible.