Homebuilders have never been more optimistic despite high costs

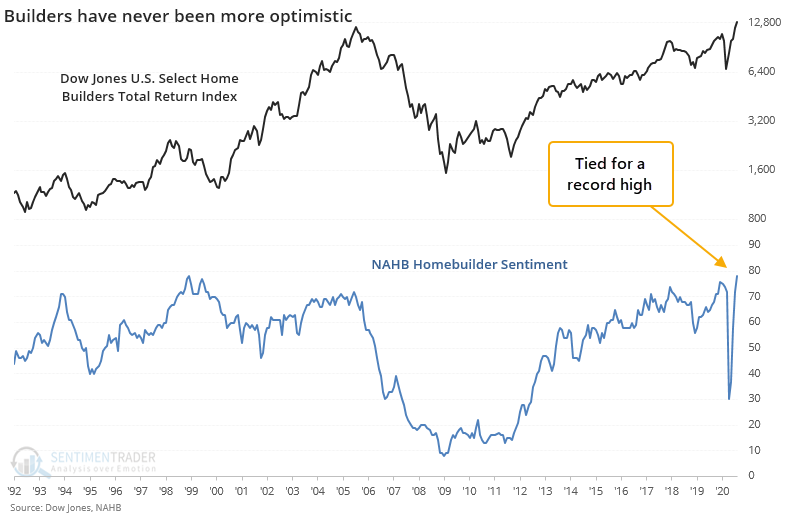

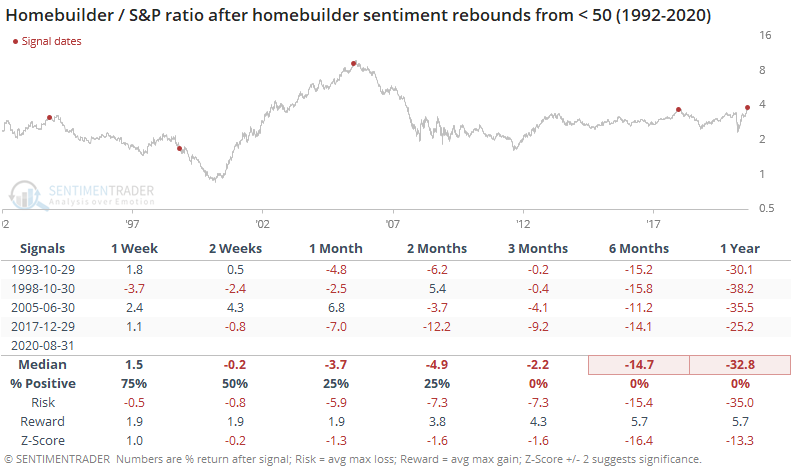

Thanks to a housing market that has held up surprisingly well despite the tumult of 2020, homebuilders have never been more optimistic. A monthly survey by the National Association of Home Builders shows that builders enjoyed the tailwind of low mortgage rates.

"Derived from a monthly survey that NAHB has been conducting for 35 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor. All the HMI indices posted gains in August."

This is quite a reversal from an index that had been at an 8-year low only a few months ago.

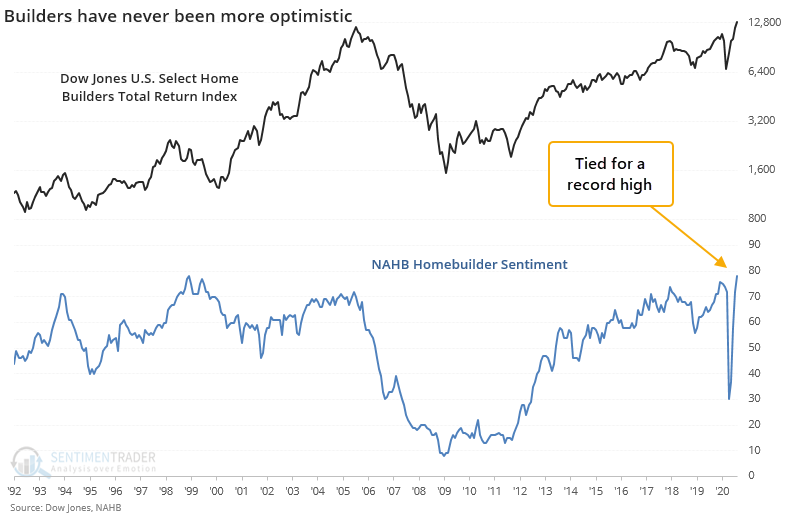

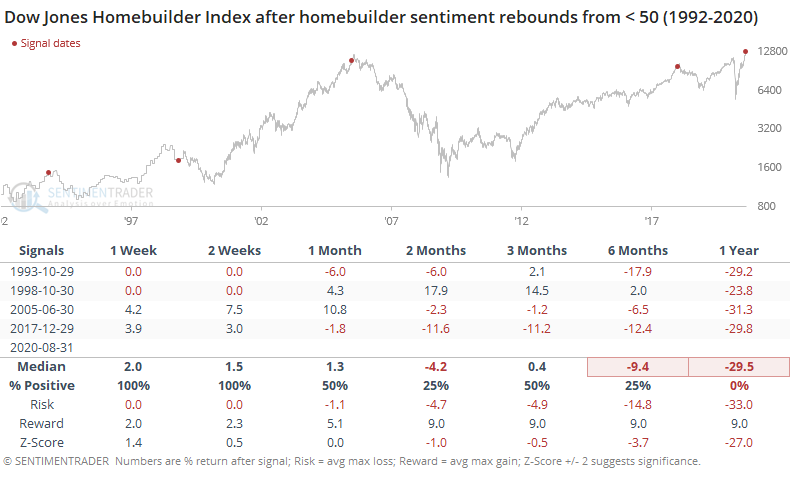

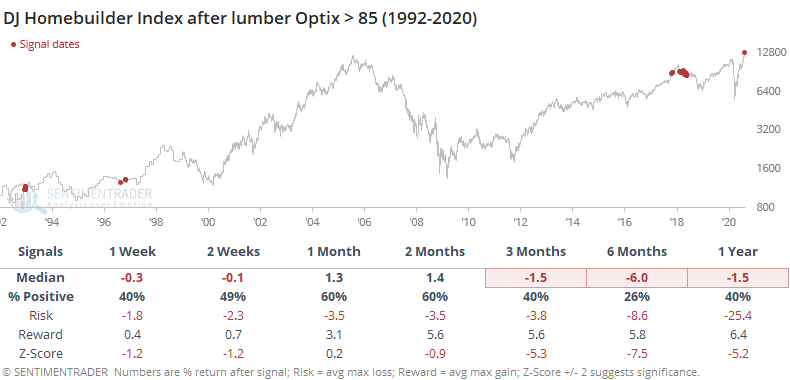

When the survey rebounds from below 50 to approach or exceed its prior multi-year high, it hasn't been a great sign for their homebuilders' stock prices going forward.

While builders managed to show large gains over the short- to medium-term in 1998 and 2005, a year later the DJ Homebuilder Index was at least 20% lower a year later.

These stocks did even worse relative to the broader market.

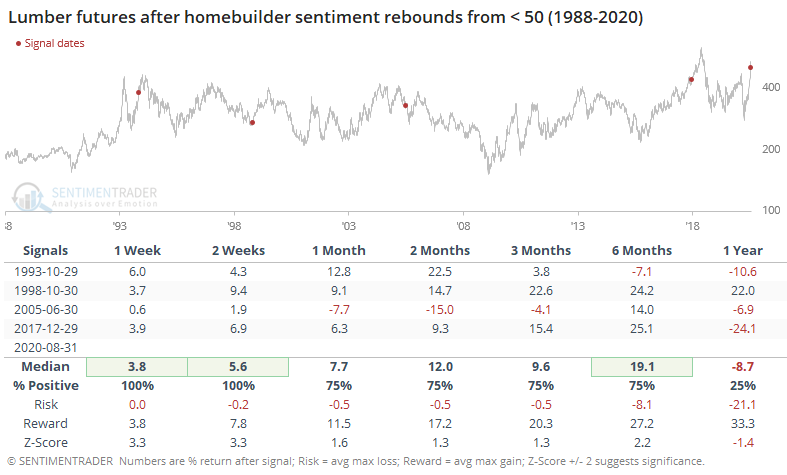

For lumber, it was mostly a good shorter-term sign, though those gains were able to persist over the next 12 months only in 1998.

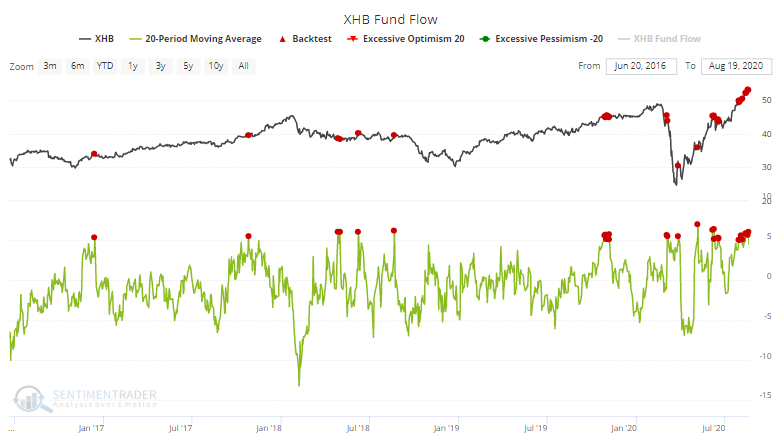

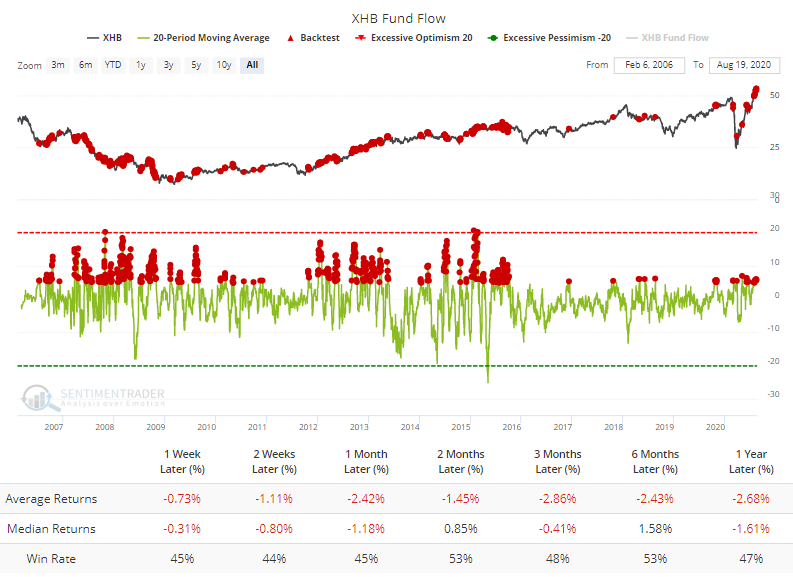

ETF investors have taken note, putting more than an average of $5 million per day into the XHB fund over the past 20 sessions.

The Backtest Engine shows that future returns were muted when flows were this high.

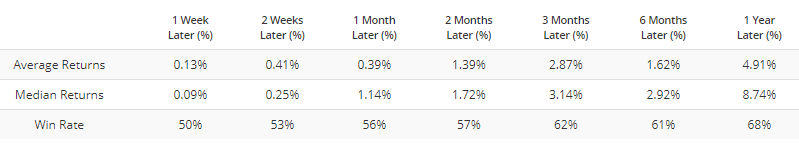

Returns were significantly better when the fund averaged a $5 million per day outflow.

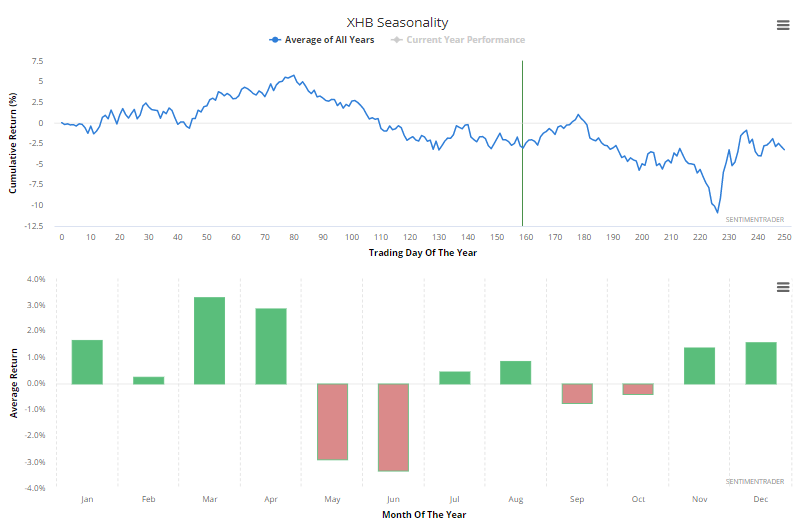

For what it's worth, the seasonal pattern isn't great right now, as homebuilding stocks have tended to show low returns into September/October.

Not only do homebuilding stocks face a potential headwind from such high optimism, as the survey release notes, high lumber prices are a potential negative as well.

"However, the V-shaped recovery for housing has produced a staggering increase for lumber prices, which have more than doubled since mid-April. Such cost increases could dampen momentum in the housing market this fall, despite historically low interest rates."

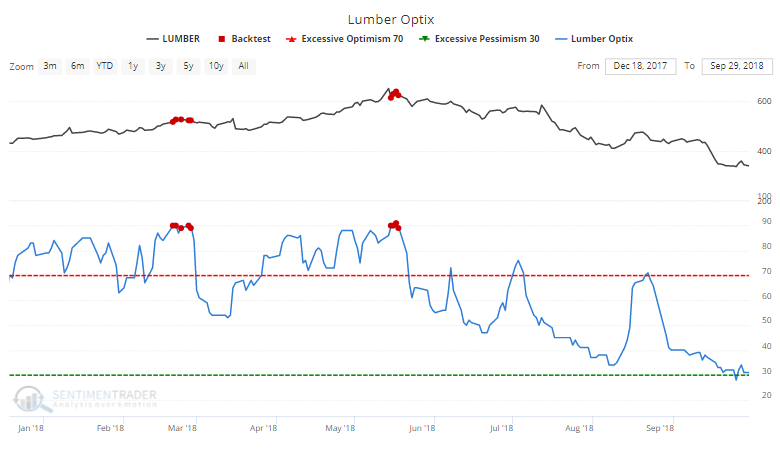

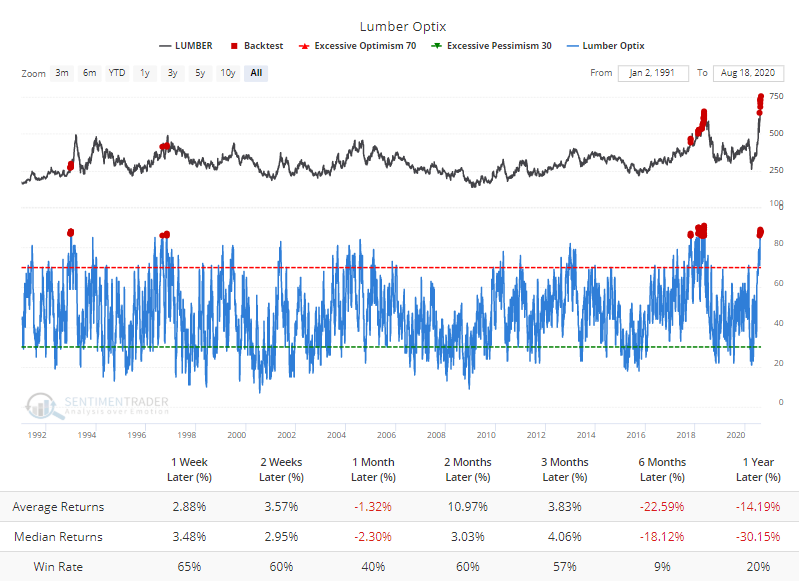

The Optimism Index for lumber just reached its 2nd-highest level in 30 years. Only a few sessions in 2018 exceeded this kind of confidence.

Looking at lesser extremes, the Backtest Engine shows that it's unusual to see it get above 85. It was way early in the spike in 1993 but otherwise triggered later in the cycles, preceding tough 6-12 month returns.

Even if lumber prices retreat from this high optimism, it hasn't necessarily been a boon to homebuilding stocks.

Overall, the run in the builders has been impressive, but the combination of high input costs and even higher optimism has traditionally been a major drag on their absolute and relative performance over a medium- to long-term time frame.