Holding The Trend; Retail Investors Are Still Active

This is an abridged version of our Daily Report.

Holding the trend

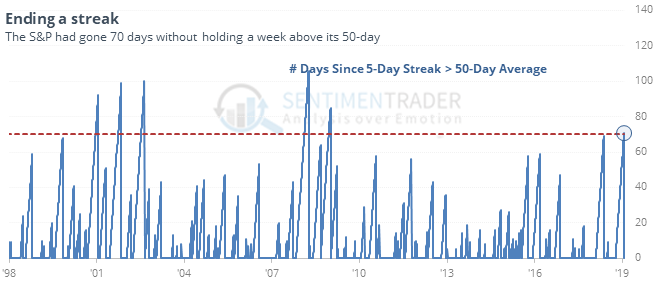

As noted by Investor’s Business Daily, the S&P 500 has managed to climb back above its widely-watched 50-day moving average and hold above it for a week straight. This ends a streak of more than 70 days without being able to do so, one of the longest since 1950.

When the longer-term trend is declining, the ends of such streaks have led to poor returns over the next few months.

Still active

Retail traders on two popular platforms have pulled back a bit on their trading activity after it surged a year ago. But they’re still relatively active, more than twice as much as during the trough in 2015-16 and thrice as much as at the end of 2008-09.

Mixed messages

Keeping with the trend of mixed signals that has been triggering frequently, and frustratingly, over the past few weeks, small options traders continue to show little interest in speculative call options. They still prefer protective put buying. The 5-week average just peaked at 25%, matched only by August and October 2002, and November/December 2008.