Historic Volatility As Investors Flee Funds

This is an abridged version of our Daily Report.

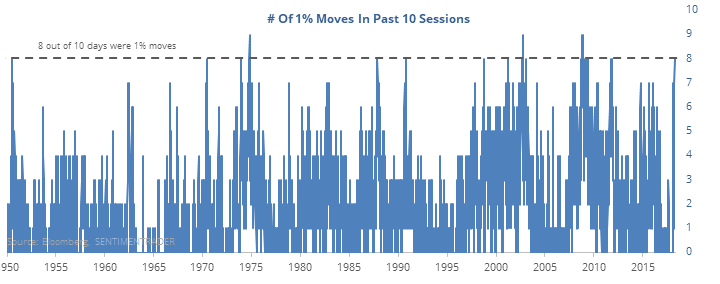

A historic couple of weeks

Stocks have swung more than 1% almost every day for the past two weeks. Even during bear markets, investors have rarely suffered through such dramatic clusters of daily swings.

Forward returns after such high volatility were excellent over the medium- to long-term.

Saved again

During the day, stock futures dropped heavily and were below the lowest close of the last 50 days. Buyers stepped in, and the upside reversal was one of the largest ever seen during a long-term uptrend.

Sell first, ask questions later

Investors yanked more than $65 billion from domestic equity mutual funds and ETFs over the past 2 months. That nears the record from 2008, but as a percentage of total assets it’s not as extreme or bullish.

A big spread

The spread between Smart Money and Dumb Money Confidence continues to widen and is at nearly +40%. The S&P 500 is also above its 200-day average again.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.