High-Yield Pessimism Hits Other Assets

This is an abridged version of our Daily Report.

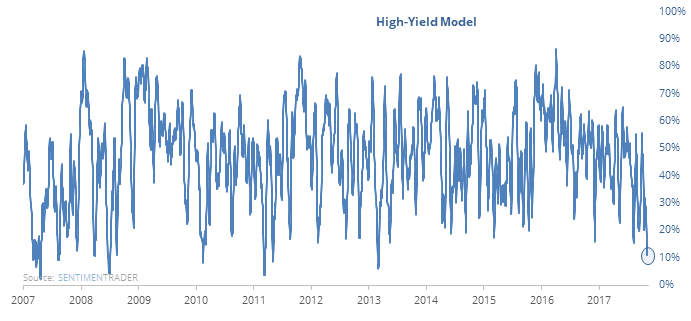

Heavy selling in high-yield

Most of the measures we track for the high-yield bond market are getting stretched. This week, there was some of the most indiscriminate selling in over a decade.

Future returns have been very positive after similar pessimism, though bear markets are a different story.

Risk vs reward

Looking at every date in the most compelling studies this week, the risk vs reward is clearly skewed positive. The vast majority of dates showed a positive return over the medium- to long-term. The probability of a bear market was small, especially in the near-term.

Miscellaneous

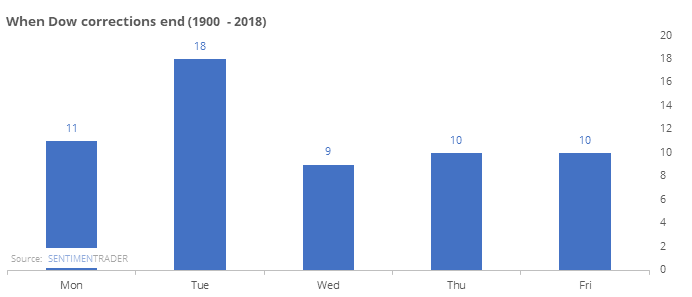

Stocks do, indeed, bottom on Friday just as often as about any other day.

The volatility this week managed to trigger a CNBC special report and a Tweet from the president.

A big spread

The spread between Smart Money and Dumb Money confidence is now +40%, a rarely-seen level when the S&P is still above its 200-day average. According to the Backtest Engine, there have been 58 days when this occurred since 1999.

Consecutive selling

The S&P 500 sold off more than 3% on back-to-back weeks yet remains above its 52-week moving average.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.