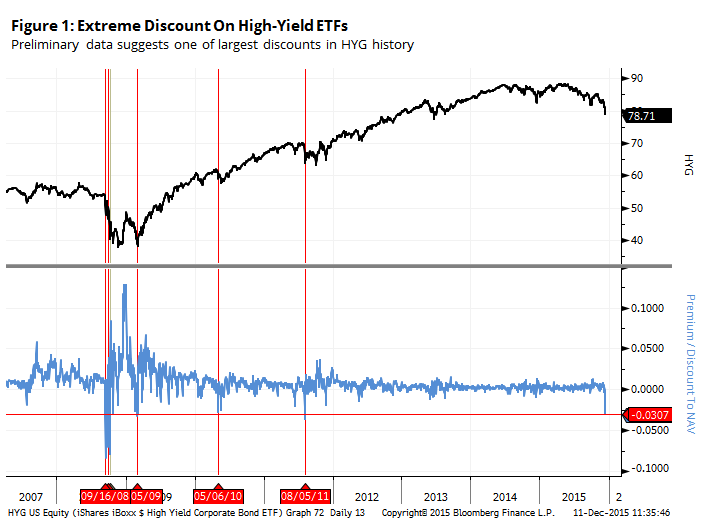

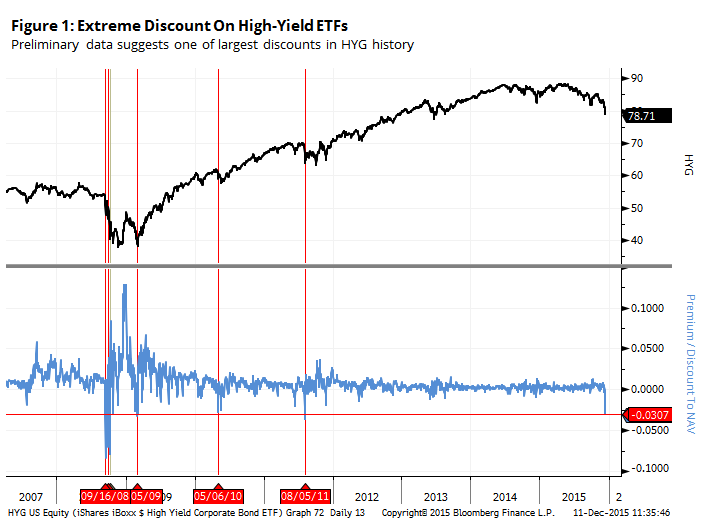

High-Yield ETF Discounts Hit Extreme Levels

In Thursday's Daily Sentiment Report we took a look at sentiment towards HYG and JNK, the two most popular funds that focus on the high-yield bond market.

As of yesterday, sentiment was showing some modest signs of "not optimism" but at prior short- and medium-term lows, traders had pushed the funds to larger discounts from their net asset value than we were seeing in recent days.

Not any longer.

They are getting slammed today, and preliminary (stress preliminary) data suggests that traders are demanding extremely large discounts today.

In both HYG and JNK, the discounts are indicated to be around 3%. The net asset values that these are based on are stale, so almost certainly the discounts will NOT be as large as indicated intraday.

Still, we're just now starting to see some panic in these funds. Such instances have usually led to a short-term bounce, but then some testing of the panic low (if there is one) in the week(s) ahead before a more reliable bottom takes hold.